(Bloomberg) -- Oil edged lower as the US pushed to broker a peace deal between Israel and Hamas that would reduce geopolitical tensions in the Middle East.

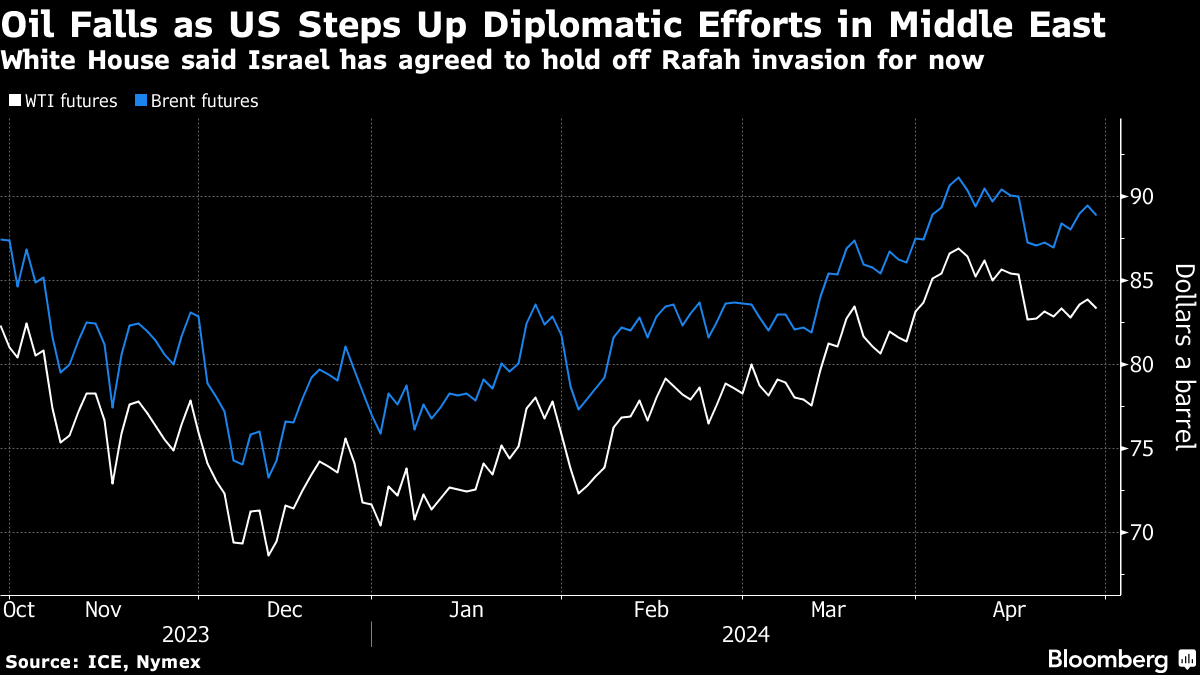

Brent crude traded below $89 a barrel while West Texas Intermediate dropped beneath $84. US Secretary of State Antony Blinken will step up efforts to secure a truce in Gaza during a visit to the region. The White House said Israel has agreed to hear out its concerns and hold off invading Rafah until meeting with the Americans.

Crude has risen this year on OPEC+ supply cuts and heightened tensions in the Middle East — the source of about a third of the world's oil. Meanwhile, shifting expectations for US monetary policy are weighing on the demand outlook, and traders will look to a Federal Reserve meeting on Wednesday to gauge the prospects for rate cuts this year.

There's also some concern about diesel and heating oil markets, where premiums over crude have fallen to the lowest level in months on concerns about oversupply.

“With little other fresh news, the possible cooling of the Gaza environment sees oil prices slip,” said John Evans, an analyst at brokerage PVM. “Heating oil remains one of our major reasons for doubting any charge in crude prices to much beyond current highs.”

Despite the uncertain outlook, timespreads continue to signal bullishness. The gap between the two nearest Brent contracts was still more than $1 a barrel in backwardation. While the figure has come off slightly from last week's highs, it's still more than double what it was a month ago.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.