Landmark Cars' share price declined over 5% in Thursday's session as the company reported a decrease in its net profit during the October–December 2024 quarter. Its consolidated net profit fell 38% on the year to Rs 11 crore from Rs 18 crore in the previous quarter.

Depreciation costs due to addition of new outlets, and grant of ESOPs weighed on the net profit during the quarter, the company said in an exchange filing. Landmark Cars added 23 new outlets in the first nine months of financial year 2025.

New outlets and workshops are yet to reach full capacity, which affected gross profit margin, and overall workshop realisation, the company said.

Landmark Cars reported its topline rose 24.6% on the year to Rs 1,195 crore from Rs 959 crore. Its operating profit rose only 2% to Rs 67 crore from Rs 65 crore. Margin fell 120 basis points year-on-year to 5.6% from 6.8%.

Landmark Cars is initiating cost rationalisation to improve profitability and focus on operational efficiencies, such as co-locating of select outlets, it said in the exchange filing.

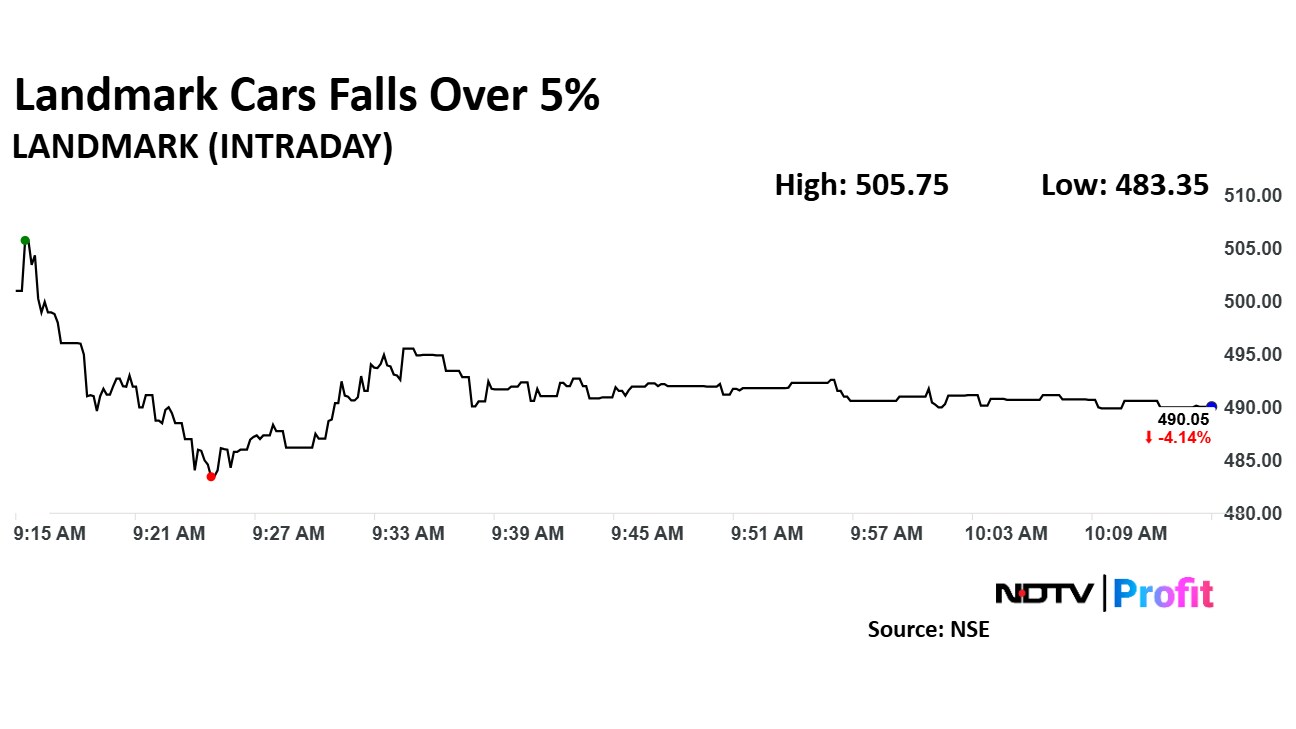

Landmark Cars Share Price Today

Landmark Cars share price declined 5.45% to Rs 483.35 apiece. It was trading 4.15% down at Rs 490 apiece as of 10:15 a.m., as compared to a 0.58% advance in the NSE Nifty 50.

The share price hit a nearly two-year low of Rs 458 apiece on Wednesday. The stock declined 31.53% in 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 34.72.

Three analysts tracking the company maintain a 'buy' rating, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.