Shares of KPIT Technologies Ltd. rose over 1% on Wednesday even as Goldman Sachs cut its 12-month target price to Rs 1,230 from Rs 1,280.

The brokerage expects negative other income this quarter, due to hedging losses that are likely from the sudden appreciation of currencies. Auto R&D spending and deal closures remain subdued in the ongoing uncertain tariff environment, it further added.

An EU-US trade deal could act as a positive catalyst for auto OEMs to increase R&D spending, it said. "We do not see any major deal closure in the near term and expect KPIT's revenue growth to be modest in first half of the year 2026, with a pickup expected in second half of the year 2026, pending some of the larger deal closure that are currently in the pipeline," it said.

The brokerage further expects the tech company's Q1 revenue to decline 2% in constant currency terms quarter-on-quarter, while Ebitda is expected to fall 0.3% and profit after tax to decline 12.4%.

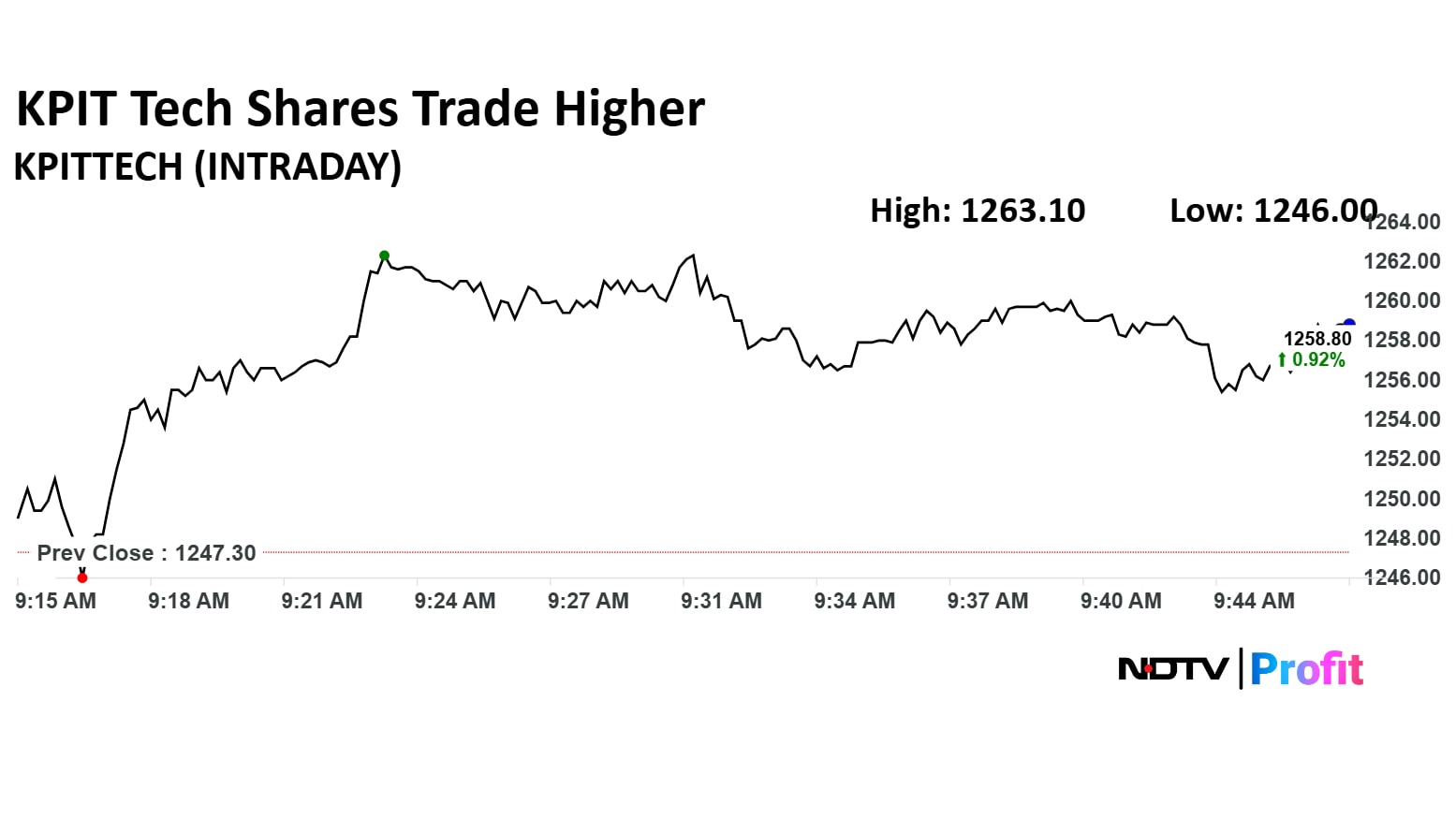

KPIT Tech Share Price

Shares of KPIT Tech rose as much as 1.27% to Rs 1,263.10 apiece. They pared gains to trade 0.92% higher at Rs 1,258.80 apiece, as of 9:45 a.m. This compares to a 0.02% decline in the NSE Nifty 50.

The stock has fallen 24.39% in the last 12 months and 14.12% year-to-date. Total traded volume so far in the day stood at 0.19 times its 30-day average. The relative strength index was at 56.94.

Out of 21 analysts tracking the company, 14 maintain a 'buy' rating, five recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.