KPI Green Energy Ltd. saw its share price rise nearly 4% after the company announced that its subsidiary, Sun Drops Energia Pvt., received letters of award for the development of solar power projects with a total capacity of 14.9 MW. The projects will be developed under the captive power producer business segment.

The awards were granted by various clients, and the projects are scheduled to be completed in the financial year ending March 2026 in multiple phases. This development is expected to bolster KPI Green's position in the renewable energy sector and contribute to its growth trajectory.

Investors responded positively to the news, reflecting confidence in KPI Green's strategic initiatives and its ability to secure significant contracts in the competitive solar energy market.

Surat-based KPI Green specialises in the development, construction, and operation of solar and wind power projects. The company operates under two main business models: captive power producer and independent power producer. The company is known for its innovative hybrid power projects that combine solar and wind energy to maximize efficiency and output.

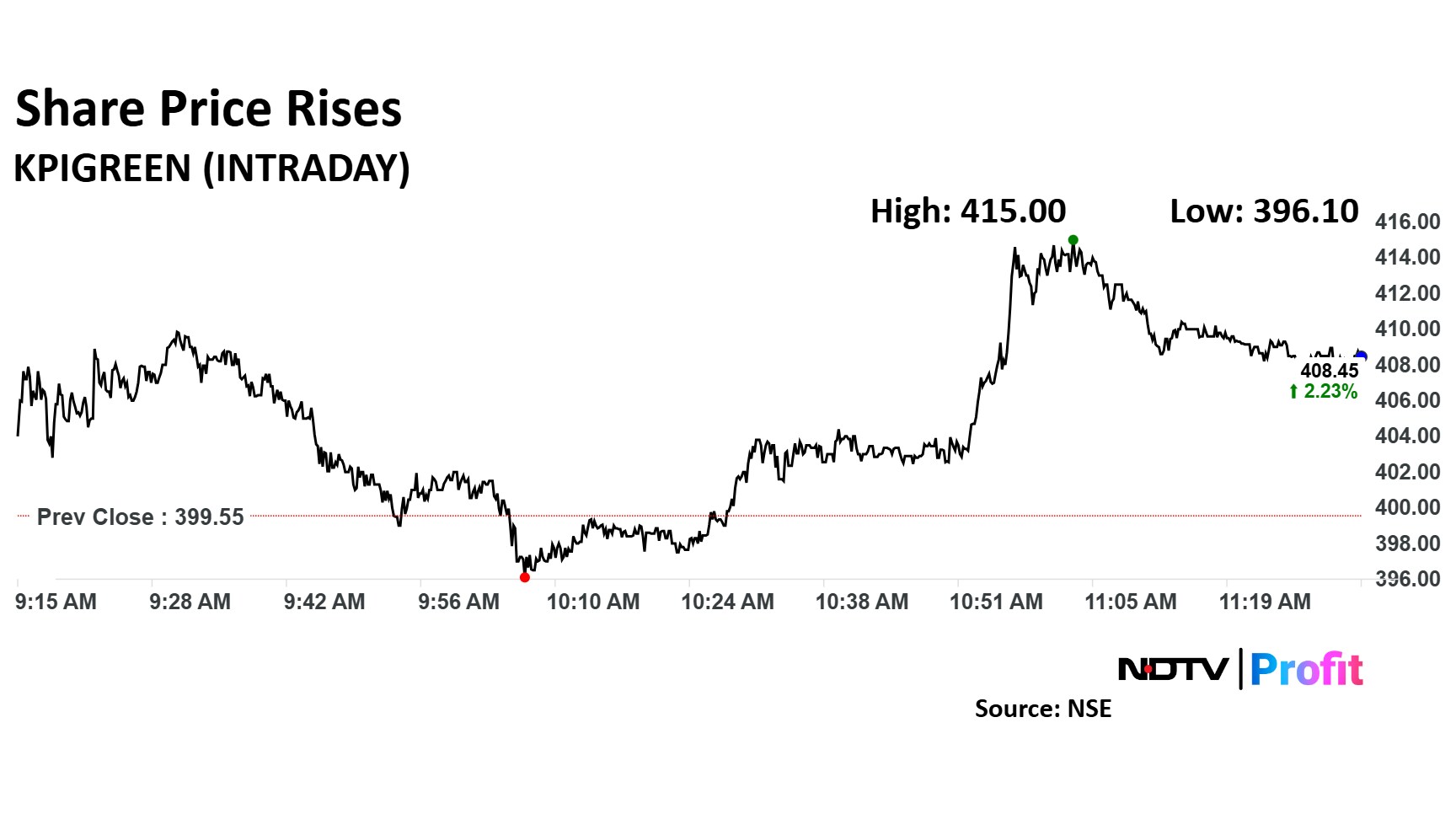

The KPI Green stock rose as much as 3.87% to Rs 415 apiece, before paring gains to trade 2.11% higher at Rs 408 apiece, as of 11:29 a.m. This compares to a 0.64% advance in the NSE Nifty 50.

It has fallen 17.7% in the last 12 months, and 25.1% year-to-date. Total traded volume so far in the day stood at 0.9 times its 30-day average. The relative strength index was at 54.

Only one analysts is tracking the company, and they maintain a 'buy' rating for the stock according to Bloomberg data. There is no average 12-month consensus price target for the stock

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.