- Kotak Mahindra Bank’s share price dropped nearly 3% after Q2 profit decline due to higher provisions

- Provisions rose 43.5% year-on-year to Rs 947 crore, impacting net profit which fell 2.7% to Rs 3,253 crore

- Analysts remain cautiously optimistic with 28 out of 43 recommending buy and average target price of Rs 2,377

Kotak Mahindra Bank Ltd. share price fell nearly 3% during early trade on Monday after higher provisions dragged profit in the second quarter. The earnings report came on Saturday.

The private sector bank's provisions saw a sharp increase, jumping by 43.5% year-on-year to Rs 947 crore from Rs 660 crore. Consequently, net profit fell 2.7% to Rs 3,253 crore, compared to Rs 3,344 crore in the year-ago quarter.

Further, Kotak Bank's Net Interest Margin or NIM for the period was 4.54%, a slight contraction from 4.65% recorded in the previous quarter, amid a decline in yields and asset mix.

Kotak Mahindra Bank Q2 Highlights (YoY)

Net Interest Income up 4% to Rs 7,311 crore versus Rs 7,020 crore.

Operating Profit up 3.3% to Rs 5,268 crore versus Rs 5,099 crore.

Provisions up 43.5% to Rs 947 crore versus Rs 660 crore.

Analysts remain cautiously optimistic about the lender following its Q2 earnings, highlighting improving core trends and healthy loan growth, but flagging concerns over NIM compression and elevated valuations.

The management said NIM is likely to expand over the next two quarters, helped by deposits repricing and the benefit from the cash reserve ratio (CRR) cut. Credit cost for the second half of the year is expected to be better than the first half.

In terms of asset quality, the bank showed improvement quarter-over-quarter. The bank's reported Gross NPA decreased to 1.39% from 1.48%, and the Net NPA improved to 0.32% from 0.34% during the second quarter.

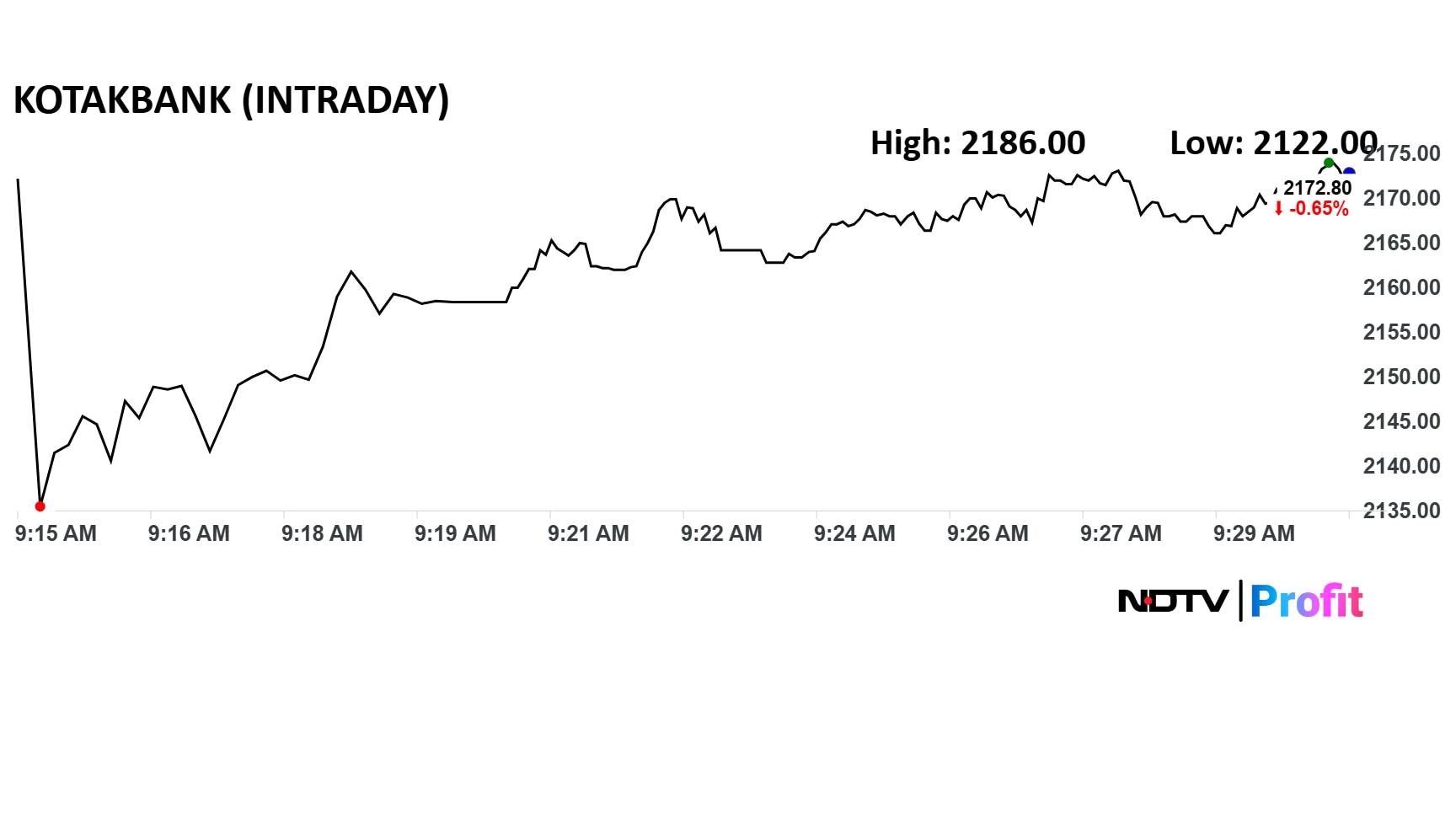

Kotak Mahindra Bank Stock Movement

Kotak Mahindra Bank's share price fell 2.7% intraday to Rs 2,122 apiece, before recovering some losses. The benchmark Nifty 50 was up 0.3%. The relative strength index was at 37.

The stock has risen 22% in the last 12 months.

Out of the 43 analysts tracking Kotak Mahindra Bank, 28 have a 'buy' rating on the stock, 11 recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets is Rs 2,377, which implies a potential upside of 10%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.