Kaynes Technology India Ltd. stock plunged over 9% during early trade on Wednesday after market regulator SEBI issued a show-cause notice to Managing Director Ramesh Kunhikannan alleging violations of insider trading rules.

The notice, issued on Monday, alleged suspected violations in the maintenance of Structured Digital Database (SDD) pertaining to financial results for the period ended March 31, 2023, as per Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015, according to an exchange filing.

Kaynes Tech said it is currently reviewing the content of the SEBI notice and will take all appropriate legal and procedural steps, including providing a timely response to the regulator.

"The company, noticee and all concerned remain committed to fully cooperating with SEBI to resolve this matter in accordance with the applicable legal and regulatory framework," the filing said.

Kaynes Tech Share Price Down

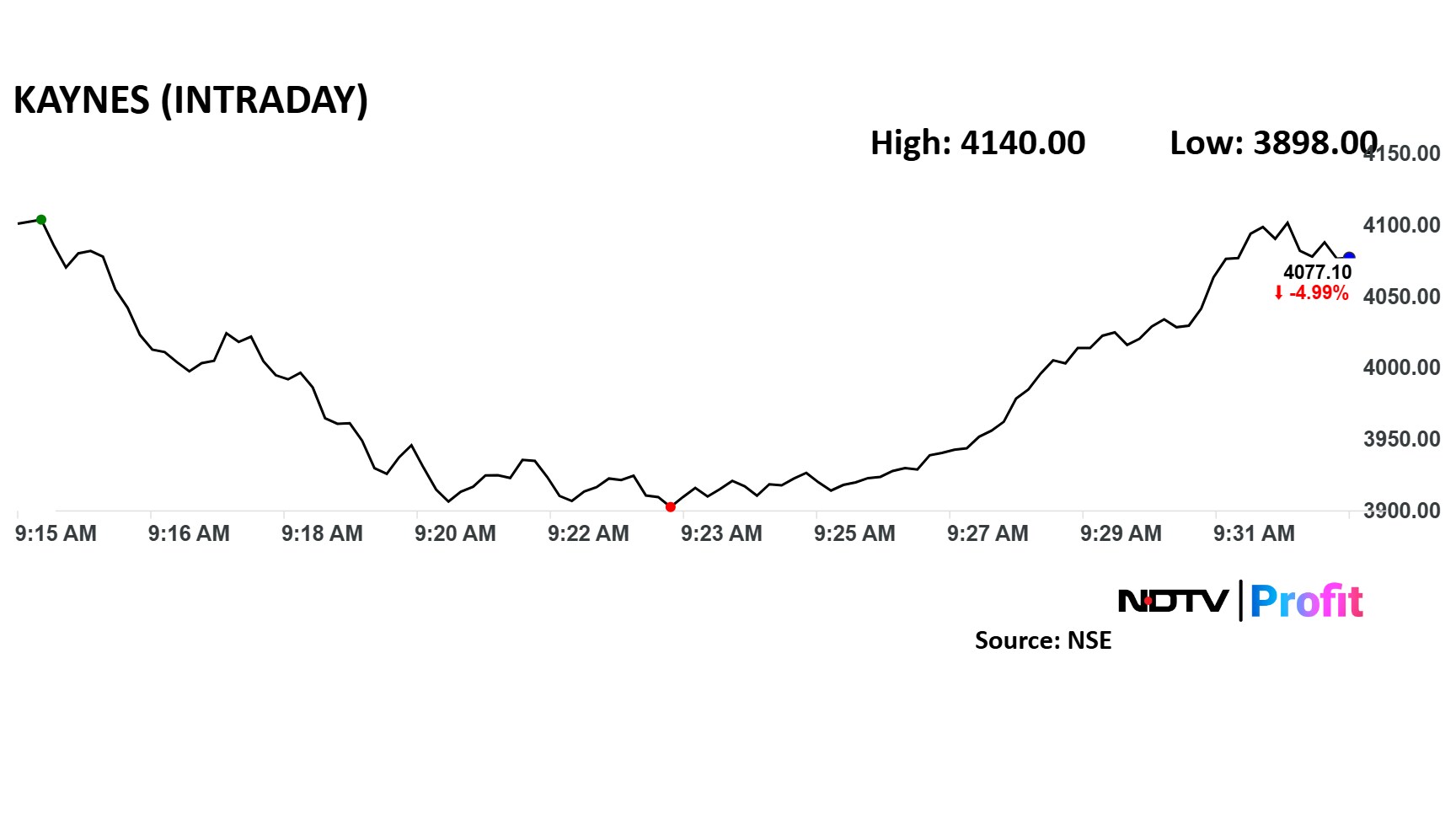

Kaynes Tech share price fell as much as 9.17% to Rs 3,898 apiece in early trade.

Kaynes Tech share price fell as much as 9.17% to Rs 3,898 apiece in early trade. The scrip was trading 5% lower by 9:30 a.m. The benchmark NSE Nifty 50 was down 0.14%.

The stock has fallen 45% in the last 12 months and 44% on a year-to-date basis. The relative strength index was at 39.

Seventeen out of the 23 analysts tracking Kaynes Tech have a 'buy' rating on the stock, five recommend a 'hold' and one suggests a 'sell', according to Bloomberg data. The average of 12-month analysts' price target of Rs 5,512 implies a potential upside of 40%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.