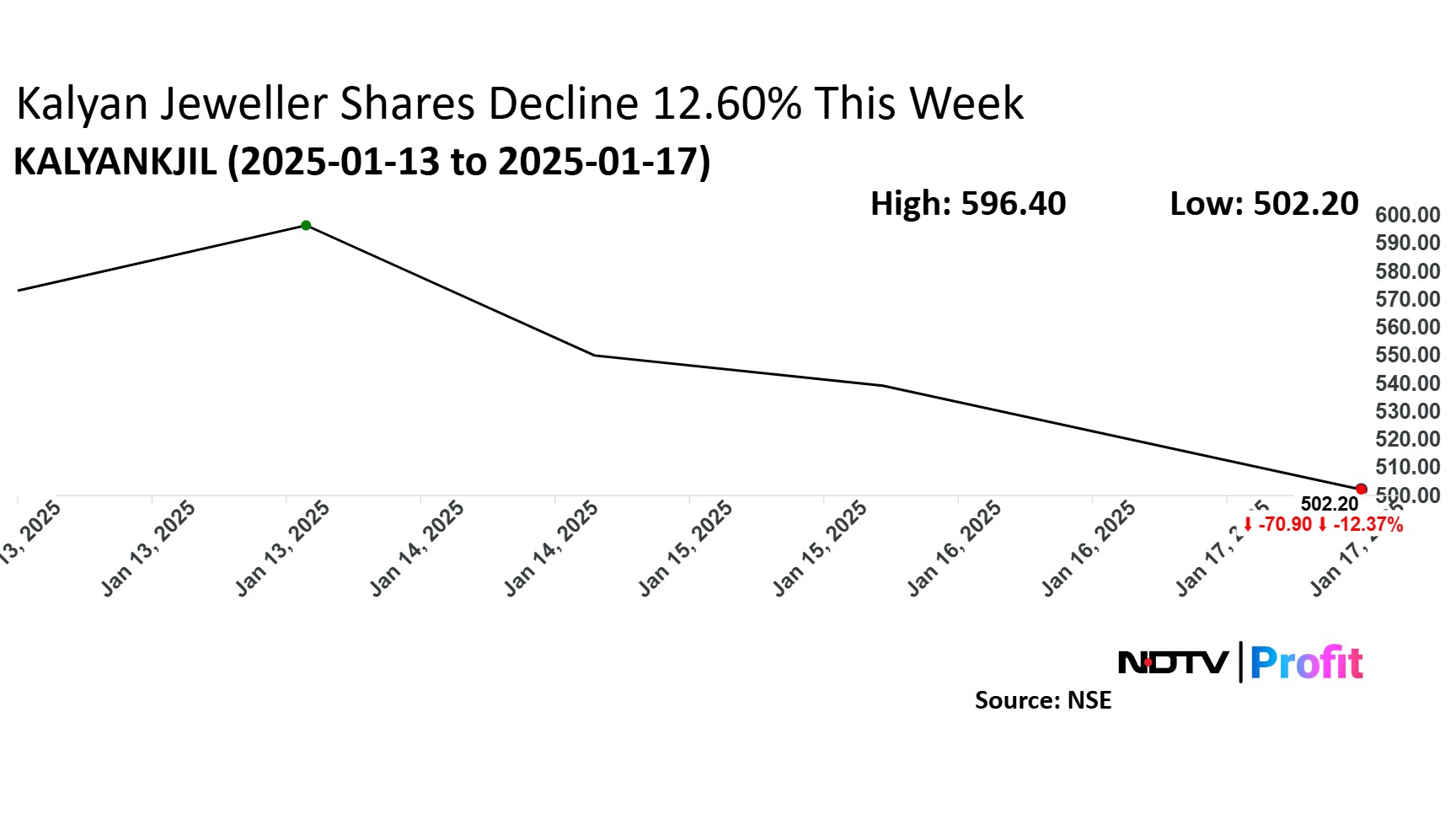

Kalyan Jewellers India Ltd.'s share price has plunged 12.6% this week as the stock continued its rout on Friday. It dipped as low as 6.63% intraday today, hitting a day's low of Rs 503.25 per share and closed 6.86% lower at Rs 502.2. This compares to a 0.47% decline at the NSE Nifty 50. This is a 36.66% drop from its record high of Rs 794.60.

The stock has fallen in four of the five trading sessions this week, following a five-session losing streak last week. It had already declined 19% in the previous week, making it nine losses of the last 10 trading sessions.

Kalyan Jewellers started 2025 on a strong note, reaching an all-time high on Jan. 2. However, the stock has been on a downward trend since then, falling in 10 of the 13 sessions this year.

At the close of trading on Jan. 2, the company had a market capitalisation of over Rs 82,000 crore, which has now plunged to Rs 51,742 crore.

This marks the longest sell-off for the stock since February 2022. Despite the recent correction, Kalyan Jewellers' stock remains up five-fold over the past two years and 8.5 times over the last three years.

Eight out of the nine analysts tracking the company have a 'buy' rating on the stock, and one suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 38.8%.

Kalyan Jewellers faces mounting pressure on margins, with return ratios among the lowest in the industry. The company's second-quarter profit and EPS for fiscal 2025 were the lowest in the past six quarters. Furthermore, its valuations remain expensive compared to peers.

Additionally, the stock continues to be under the Futures & Options ban, preventing the creation of new positions.

Attempts by the management to address investor concerns regarding corporate governance and inventory overvaluation have largely failed to reassure stakeholders. In an investor call, the management dismissed concerns over corporate governance issues, but doubts persist.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.