JB Chemicals And Pharmaceuticals Ltd.'s shares fell nearly 8% on Thursday as 9 million or 5.78% of shares changed hands in a block deal.

Tau Investments Holdings Pte., the promoter of JB Chemicals & Pharmaceuticals, had plans to sell up to 15.9 million shares in a block deal valued at Rs 2,576 crore, NDTV Profit had reported on Wednesday.

Sources earlier said that 10.2% equity would be sold by the promoter at a price of Rs 1,625 apiece, reflecting a 5% discount in comparison to the current market price.

The company's market cap at the end of Wednesday's trading session was at Rs 26,518 crore.

JB Chemicals And Pharmaceuticals Q3 Performance

JB Chemicals And Pharmaceuticals' consolidated net profit jumped 22% to Rs 163 crore for the third quarter of the current financial year. The pharma firm's revenue grew 14% to Rs 963 crore for the three months ended Dec. 31, 2024, as against Rs 845 crore for the year-ago period.

The earnings before interest, tax, depreciation and amortisation surged to Rs 255 crore, denoting a 14% rise from Rs 223 crore for the same quarter of the corresponding year. The margin remained flat at 26.4% for the quarter under review of the current fiscal.

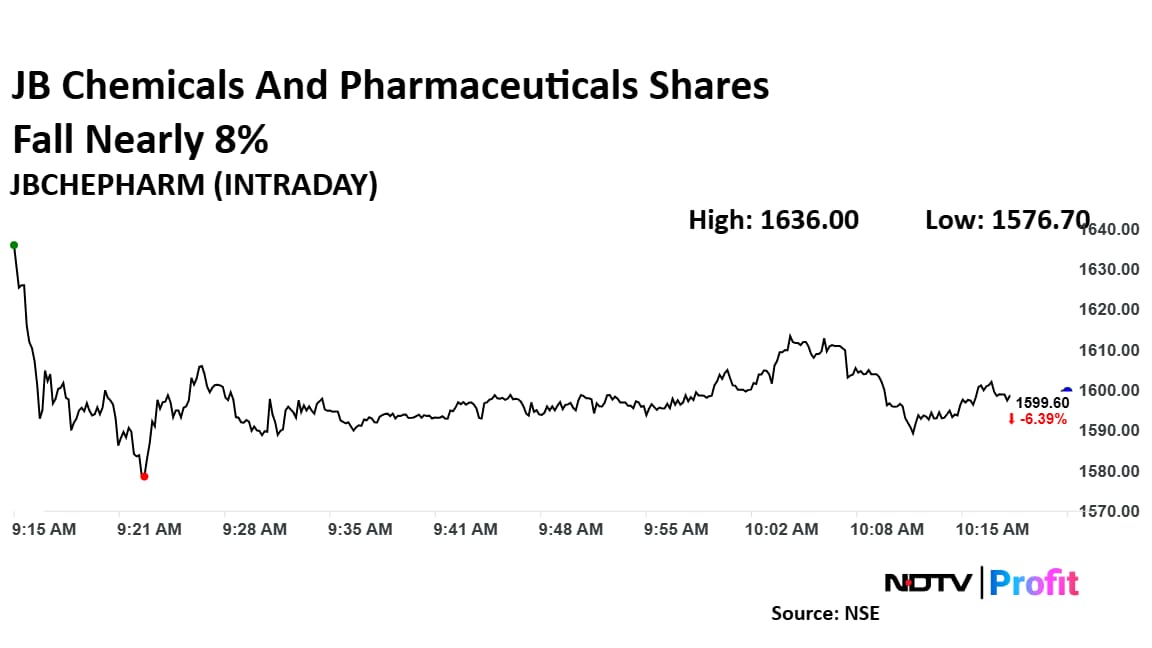

JB Chemicals And Pharmaceuticals Share Price Falls

The shares of JB Chemicals And Pharmaceuticals fell as much as 7.73% to Rs 1,576.70 apiece, the lowest level since March 19. It pared losses to trade 6.81% lower at Rs 1,592.40 apiece, as of 10:15 a.m. This compares to a 0.49% advance in the NSE Nifty 50 Index.

It has risen 3.07% in the last 12 months and 15.34% year-to-date. Total traded volume so far in the day stood at 482 times its 30-day average. The relative strength index was at 46.

Out of 15 analysts tracking the company, 13 maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 34.5%.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.