Le Travenues Technology Ltd., operator of online travel agency Ixigo, has received a bullish share price target from JM Financial, which initiated coverage on the stock as the company is "meaningfully outperforming market growth".

Ixigo is witnessing expansion across its key business segments — trains, flights, and buses — driven by strong tailwinds in the travel industry, particularly in lower-tier cities where it enjoys strong brand recall, the brokerage said.

Additional factors include effective cross-selling across its various apps, a strong emphasis on delivering superior customer experiences, and increasing demand for its differentiated value-added services, such as Ixigo Assured and Abhi Assured.

Ixigo is the second largest OTA in India on the basis of total reported gross transaction value, behind only MakeMyTrip. JM Financial expects the company to gain further market share on GTV rise of 26% over three year, ahead of medium term OTA market growth of 18% projected by Frost & Sullivan.

"We believe the company deserves to trade at premium valuation multiples as it is expected to meaningfully outperform the broader OTA market," JM Financial said, placing a 12-month price target of Rs 180, a potential upside of 17.3% over the previous close.

It projects Ixigo to deliver 26% growth in GTV and 23% increase in revenue over the next three years, excluding Zoop acquisition impact. Net profit could expand by 33%.

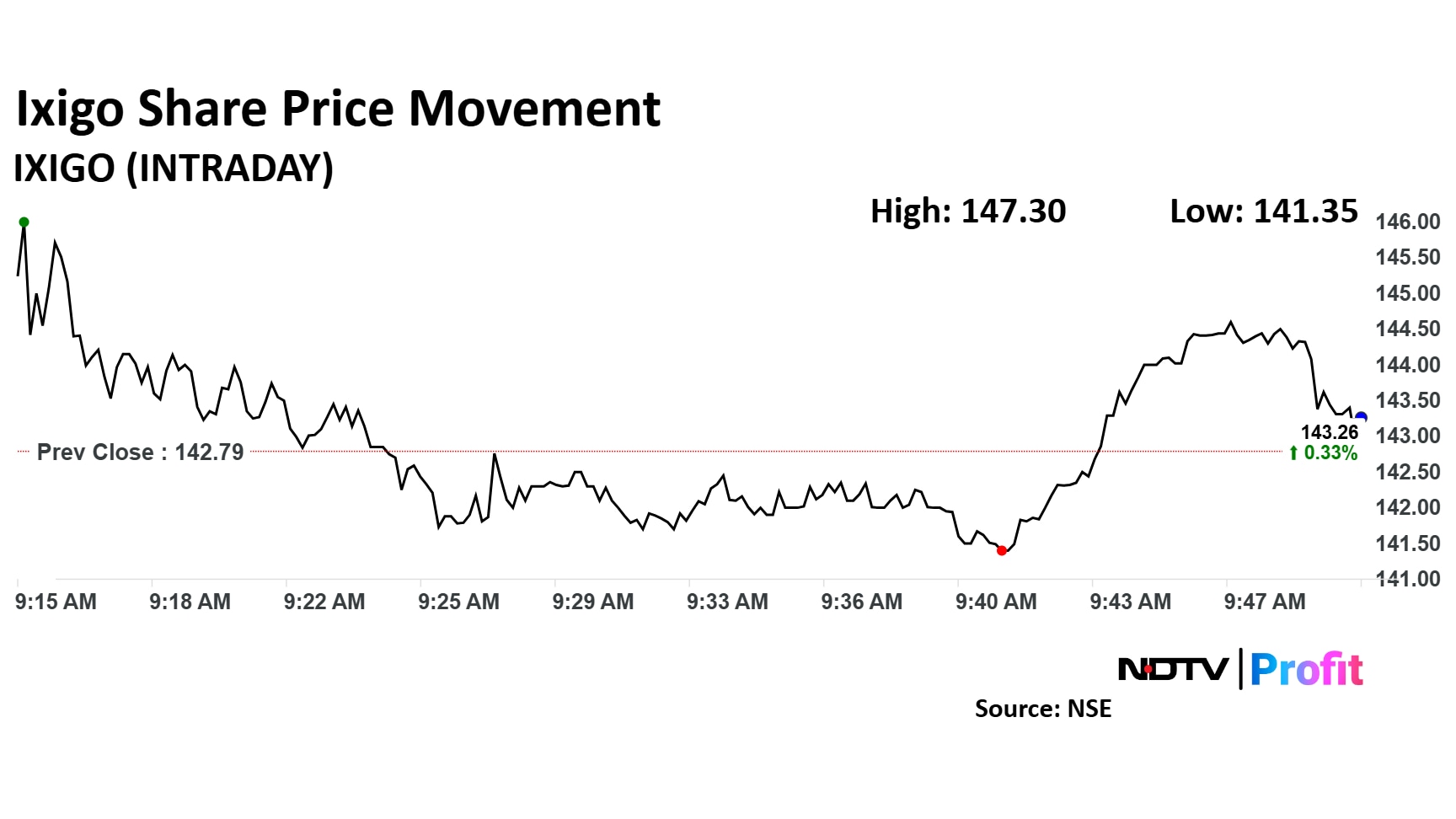

Ixigo Share Price Movement

Ixigo share price advanced over 3.16% intraday to Rs 147.3 apiece. They were trading 0.33% higher at Rs 143.26 per share by 9:52 a.m. The benchmark NSE Nifty 50 was up 0.3%.

The stock has fallen 14% since listing in June. The relative strength index was at 36.

Two analysts tracking Ixigo have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price target of Rs 175 implies a potential upside of 23%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.