India's IT sector is seeing a sharp divergence in performance. While stock prices have risen recently, analysts and market participants are advising caution and suggesting it may be time to reduce exposure to the sector.

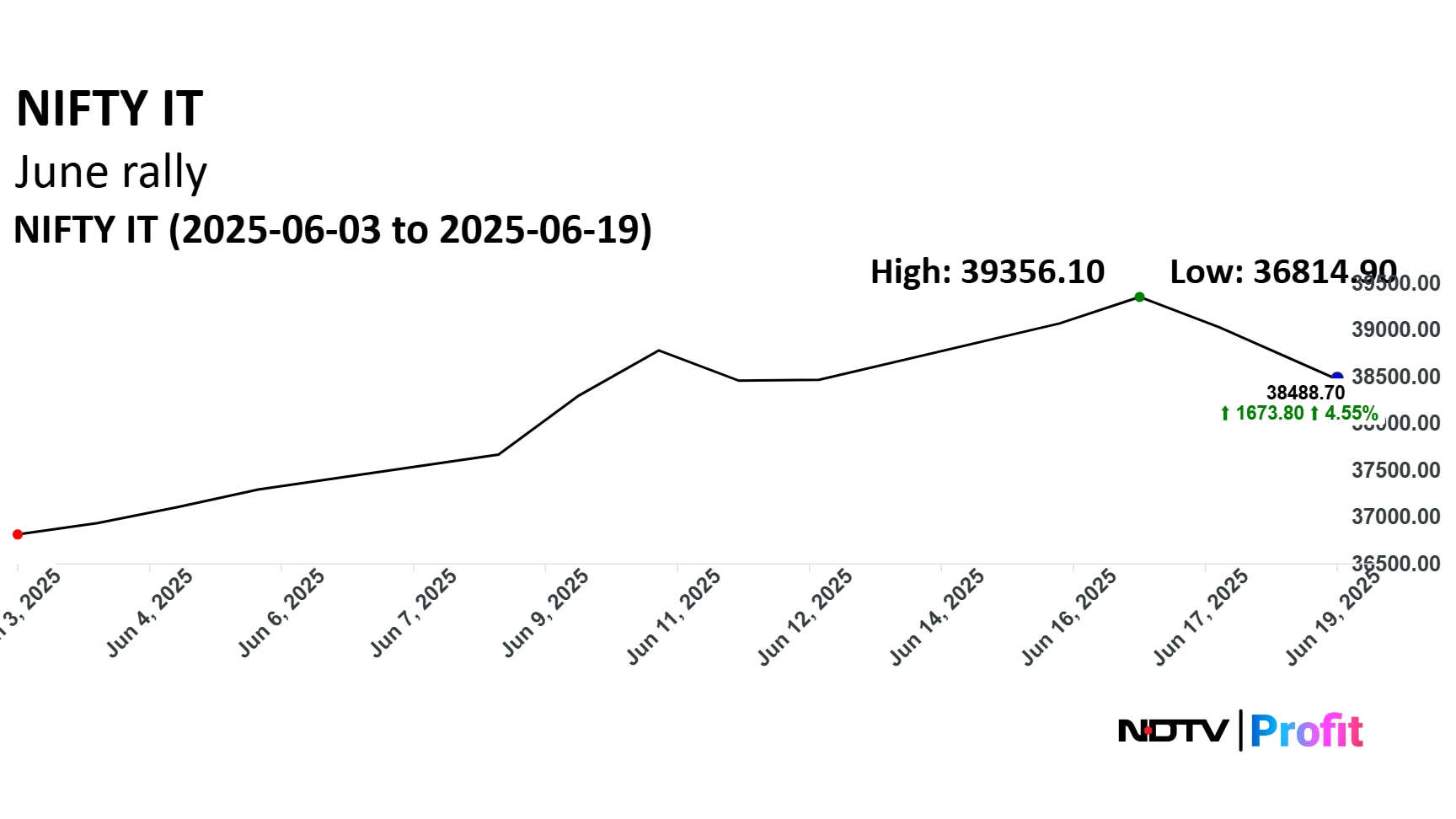

The Nifty IT index has climbed nearly 6% over the last 11 sessions, with Oracle Financial Services, Tech Mahindra, and Persistent Systems leading the gains. Despite the rally, valuations remain high and analysts are warning against overexposure.

Morgan Stanley remains cautious, though it sees the growth outlook as slightly better than feared.

“Rally should be used as a good opportunity to trim,” the firm said. It believes the recent gains already reflect improved sentiment and sees no fresh triggers for a further re-rating.

Citi, in its latest coverage, has raised target prices across IT stocks based on changes in the exchange rate and revised operational parameters. However, the firm has not changed its view on the sector's business outlook.

“Target price hike incorporates changes in the exchange rate and operational parameters,” Citi said in its note.

CLSA noted that demand in the BFSI segment, a major contributor to global IT services spending, remains strong.

“BFSI, the mainstay of global IT services spending, continues to see strong demand,” CLSA said, adding that the current quarter could show strong order bookings and improved commentary on deal pipelines.

Speaking to NDTV Profit, Sandip Agarwal, Fund Manager and Co-founder of Sowilo Investment Manager LLP, said, “Growth rates are not justifying valuations. We've exited nearly 80-90% of our portfolio in this space.”

OUTLOOK

The recent rise in IT stocks may offer a sell-on-rally opportunity rather than a new entry point. Some individual names could continue to perform, but broad-based sector outperformance looks unlikely unless earnings momentum improves significantly in Q1FY26.

Analyst Recommendations

Tata Consultancy Services Ltd.: Thirty-six analsysts tracked by Bloomberg have a "Buy" rating, while 11 have a "hold" rating and three have a "sell" call. The analysts consensus price target tracked by Bloomberg showed a potential upside of 7.40% from the current market price.

Infosys Ltd. has 35 “Buy” calls, with only 2 “Sell” and 12 “Hold” recommendations. The projected return potential stands at 0.10%, according to Bloomberg consensus.

Tech Mahindra Ltd. has a more mixed outlook, with 26 “Buy” ratings, along with 12 “Sell” and 8 “Hold” calls and a potential downside of 10.40%, as per Bloomberg data.

Coforge Limited has 28 “Buy” recommendations, 6 “Sell” and 4 “Hold” ratings, with a return potential of -9.50%, based on Bloomberg consensus estimates.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.