Shares of Ircon International Ltd. fell over 9% to hit an over one-month low on Wednesday after it reported a dip in net profit for the quarter ended Dec. 31, 2024.

The 'navratna' public sector enterprise recorded a 64.89% fall in consolidated net profit at Rs 86 crore for the quarter ended December, compared to Rs 245 crore in the same quarter of the previous fiscal.

Revenue decreased 10.83% year-on-year for the three months ended December, reaching Rs 2,612 crore. Operating income, or earnings before interest, taxes, depreciation, and amortisation, fell 49.05% year-on-year to Rs 131.5 crore. The Ebitda margin contracted by 377 basis points to 5.03% from 8.81% reported in the same period last year.

In addition, the company announced an interim dividend of Rs 1.65 per share.

The company's total order book stood at Rs 21,939 crore as of December 2024. While the railways segment had the highest order of Rs 17,075 crore, the highways business received orders worth Rs 4,775 crore and other orders stood at Rs 89 crore.

Share of orders won on competitive bidding basis is about 53% of the total order book, the company said in its investor presentation.

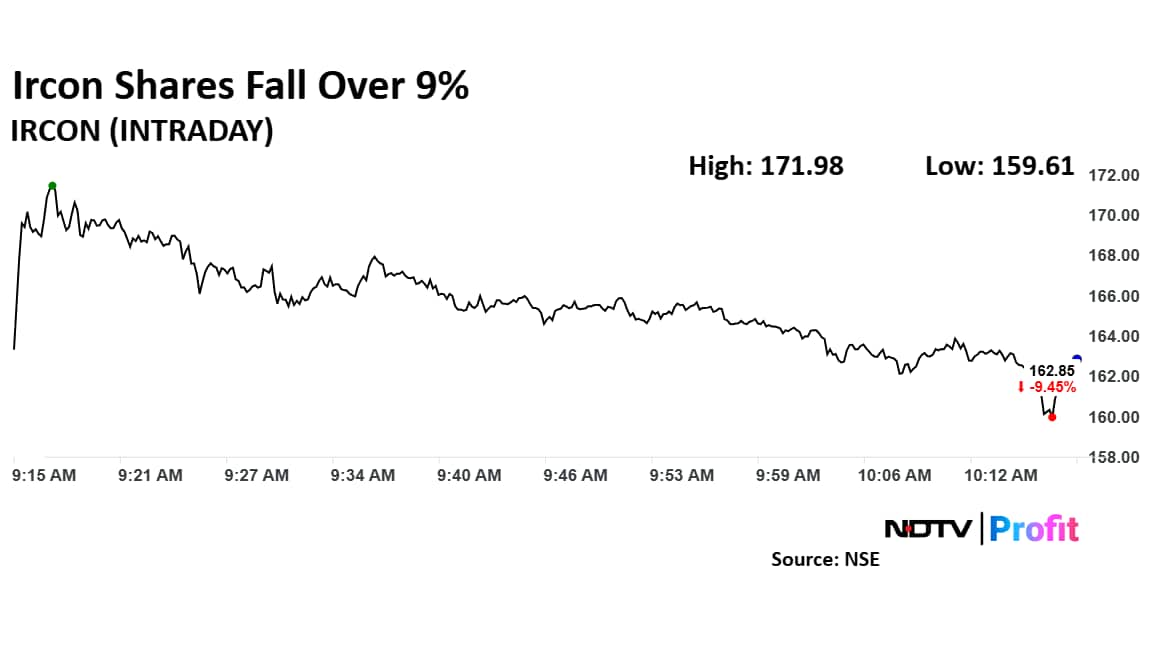

Ircon International Shares Fall

Shares of Ircon fell as much as 9.19% to Rs 163.33 apiece, the lowest level since Dec. 21, 2024. They pared losses to trade 8.43% lower at Rs 164.68 apiece, as of 10:12 a.m. This compares to a 0.98% decline in the NSE Nifty 50.

The stock has fallen 16.03% in the last 12 months. Total traded volume so far in the day stood at 3.8 times its 30-day average. Relative strength index was at 31.

Out of four analysts tracking the company, one maintains a 'buy' rating, two recommend a 'hold', and one suggests 'sell', according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.