Mid and small cap stocks rose on Wednesday after data from Association of Mutual Funds of India showed that inflows in the segments increased in January. This was despite a challenging stock market environment.

AMFI data revealed that equity mutual fund inflows marginally fell by 3.6% over the last month to Rs 39,687.78 crore in January. This follows a 14.5% jump in December to Rs 41,155.91 crore.

However, mid-cap category saw an inflow of Rs 5,147.8 crore, slightly higher than the Rs 5,093.2 crore recorded in the previous month. While, small-cap funds recorded a net inflow of Rs 5,721 crore, compared to Rs 4,667.7 crore in December.

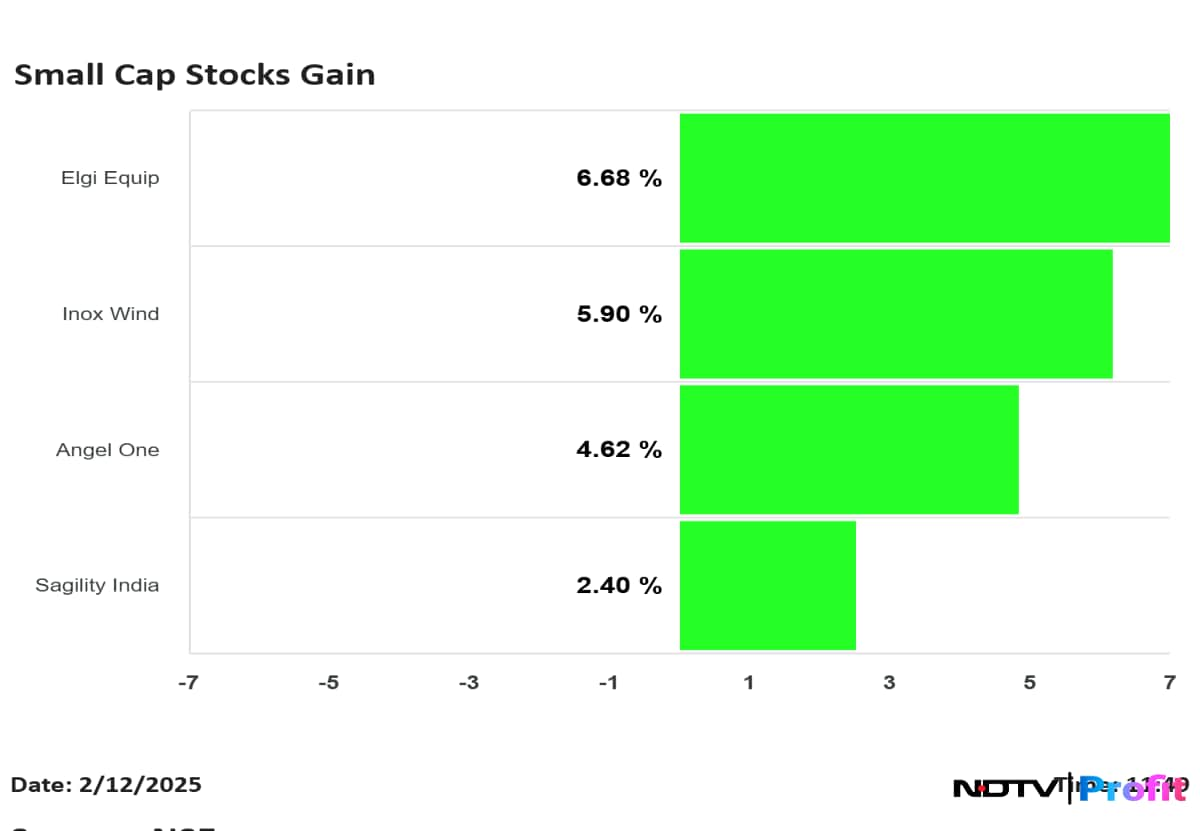

Among small cap stocks, Elgi Equipment, Inox Wind, Angel One, and Sagility India gained as much as 7.23%, 6.74%, 5.07% and 3.75%, respectively. These stocks have shown resilience and significant growth, reflecting investor confidence in the small cap segment.

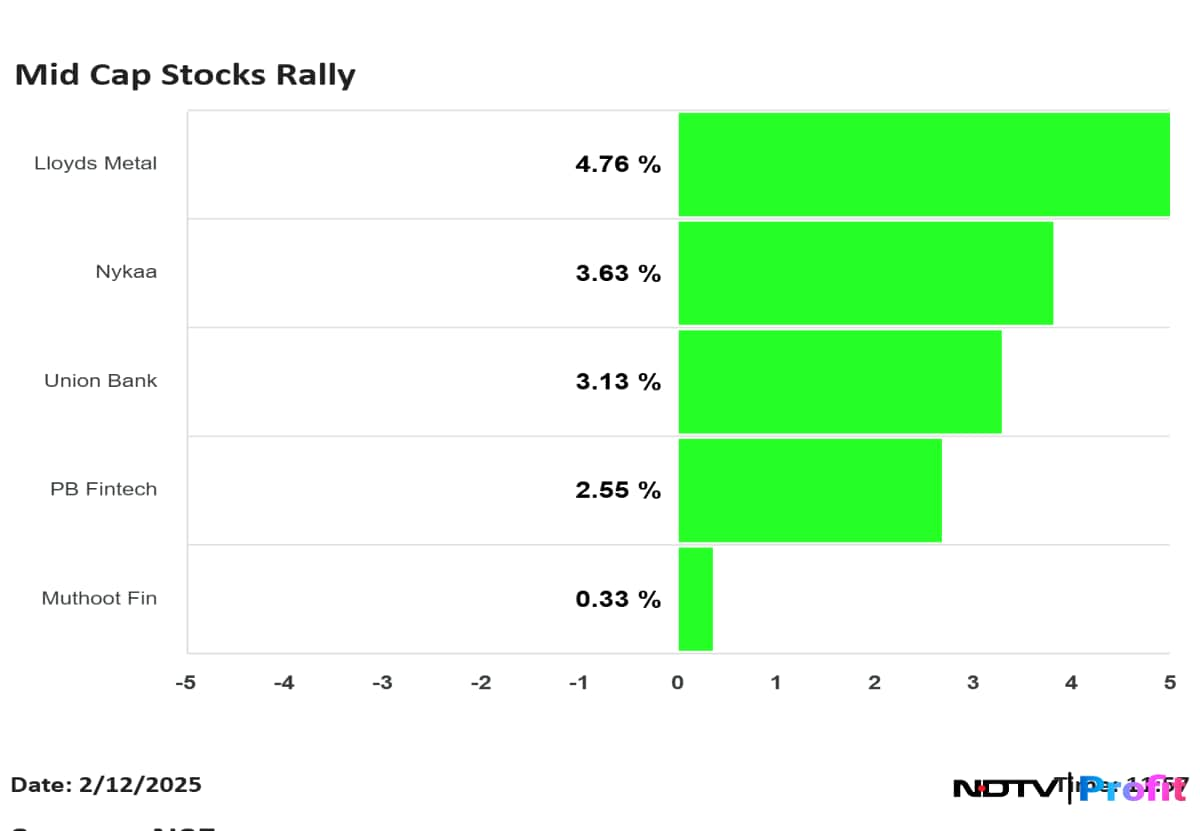

In the mid cap category, Lloyds Metals gained 4.93% to trade at Rs 1,193 apiece, Nykaa owner FSN E-Commerce Ventures Ltd.'s share price gained 4.08% to trade at Rs 173.63 apiece, and Union Bank stock gained 3.35% to Rs 1,14.31 apiece.

Large-cap funds recorded an inflow of Rs 3,063.3 crore, up from Rs 2,010.9 crore in December.

Flexi-cap funds saw an inflow of Rs 5,697.5 crore, while inflows into the sectoral and thematic category rose to Rs 9,016.5 crore.

Despite the slight decline in overall equity mutual fund inflows, January marked the 47th consecutive month of positive net inflows into open-ended equity funds. This resilience comes against the backdrop of a muted equity market, with the BSE Sensex falling 1.28% and the NSE Nifty 50 slumping 0.99% during January.

While the broader market, including large cap indices, is fairly valued, no one is claiming that small and mid cap indices are cheap, said Radhika Gupta, managing director and chief executive officer of Edelweiss Mutual Fund.

However, she remains confident in the potential of these funds, encouraging investors to maintain a long-term perspective.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.