Shares of Info Edge (India), the parent company of Naukri.com, witnessed a notable movement on Tuesday after the company reported a solid business update for the third quarter of financial year 2025. For the quarter ending December 31, 2024, the company posted standalone billings of Rs 668.3 crore, marking a significant 15.8% year-on-year (YoY) increase from Rs 578 crore in the same period last year.

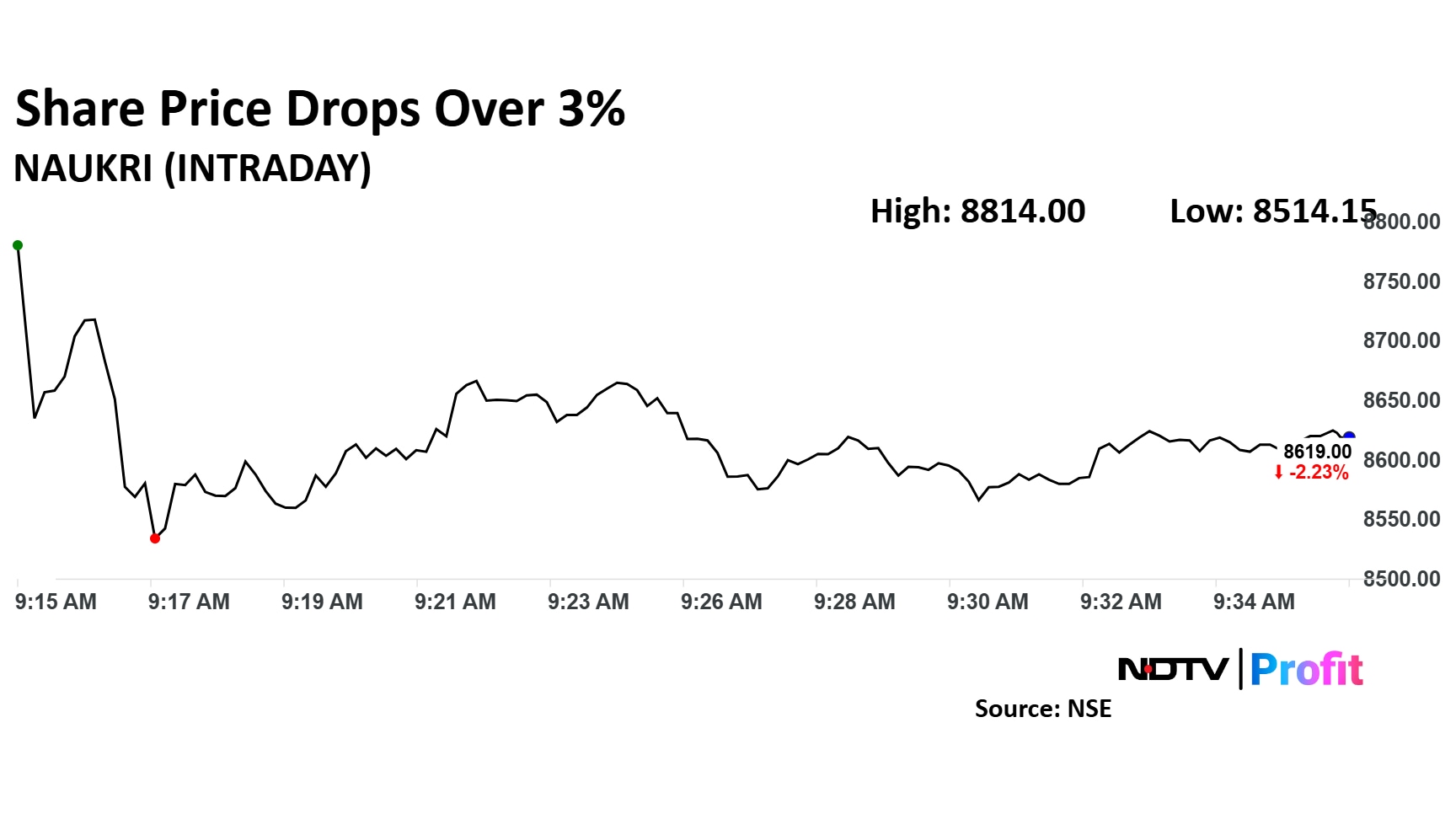

However, despite this positive financial performance, Info Edge's shares declined by over 3% in initial trade, possibly due to profit booking.

In addition to the strong quarterly growth, the company also highlighted robust performance over the nine months ending December 31, 2024. Standalone billings reached Rs 1,897.9 crore, up from Rs 1,669 crore during the same period last year, reflecting a 13.7% growth.

Breaking down the segment performance, the Recruitment Solutions division, which remains Info Edge's core business, saw steady growth with billings rising to Rs 494 crore in third quarter of financial year 2025, up from Rs 428.9 crore in third quarter of financial year 2024. The real estate platform 99acres also contributed positively, with its billings growing to Rs 102.6 crore from Rs 88.4 crore. The other segments of the company showed consistent growth as well, with billings rising to Rs 71.7 crore compared to Rs 59.6 crore in the previous year.

Despite the strong business update, the market's reaction was subdued, possibly due to investors capitalising on recent gains after a sharp rally in the company's stock.

The scrip fell as much as 3.42% to Rs 8,514.15 apiece. It pared losses to trade 2.15% higher at Rs 8,626.29 apiece, as of 09:41 a.m. This compares to a 0.72% advance in the NSE Nifty 50 Index.

It has risen 67.66% in the last 12 months. Total traded volume so far in the day stood at 4.1 times its 30-day average. The relative strength index was at 51.

Out of 20 analysts tracking the company, 15 maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 2.6%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.