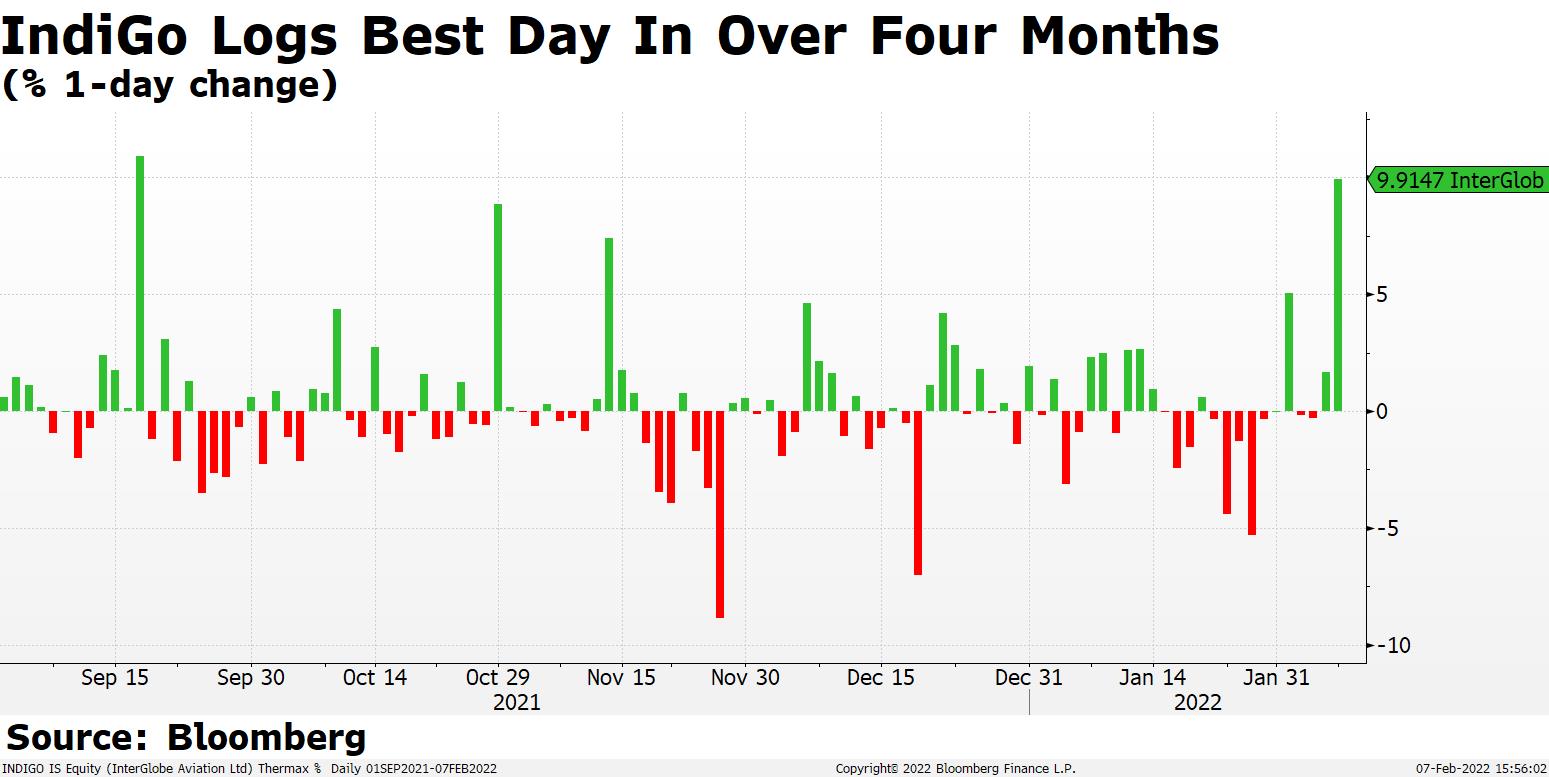

Shares of InterGlobe Aviation Ltd. logged the biggest single day gain in over four months after analysts upgraded their calls on the stock and raised target price, citing improved growth prospects as the pandemic-driven disruption eases.

The company swung to surprise profit in the quarter-ended December, ending a streak of quarterly losses. Brokerages said its yield, or average fare per passenger kilometre, was higher than expected.

Analysts pegged the company to evolve out of the pandemic stronger than before and benefit from the strong fundamentals in domestic aviation industry.

While restrictions due to the Omicron variant and sustained high prices of air turbine fuel would weigh down profitability in the near term, they see the carrier as the best proxy for reopening trade. Better yields, pent-up demand, addition of Airbus A321XLR fleet and improved cargo business are other key growth drivers in the long term.

Of the 24 analysts tracking the stock, 14 maintain 'buy', four suggest 'hold' and seven recommend 'sell'. The overall consensus price of analysts tracked by Bloomberg implied a downside of 0.9%.

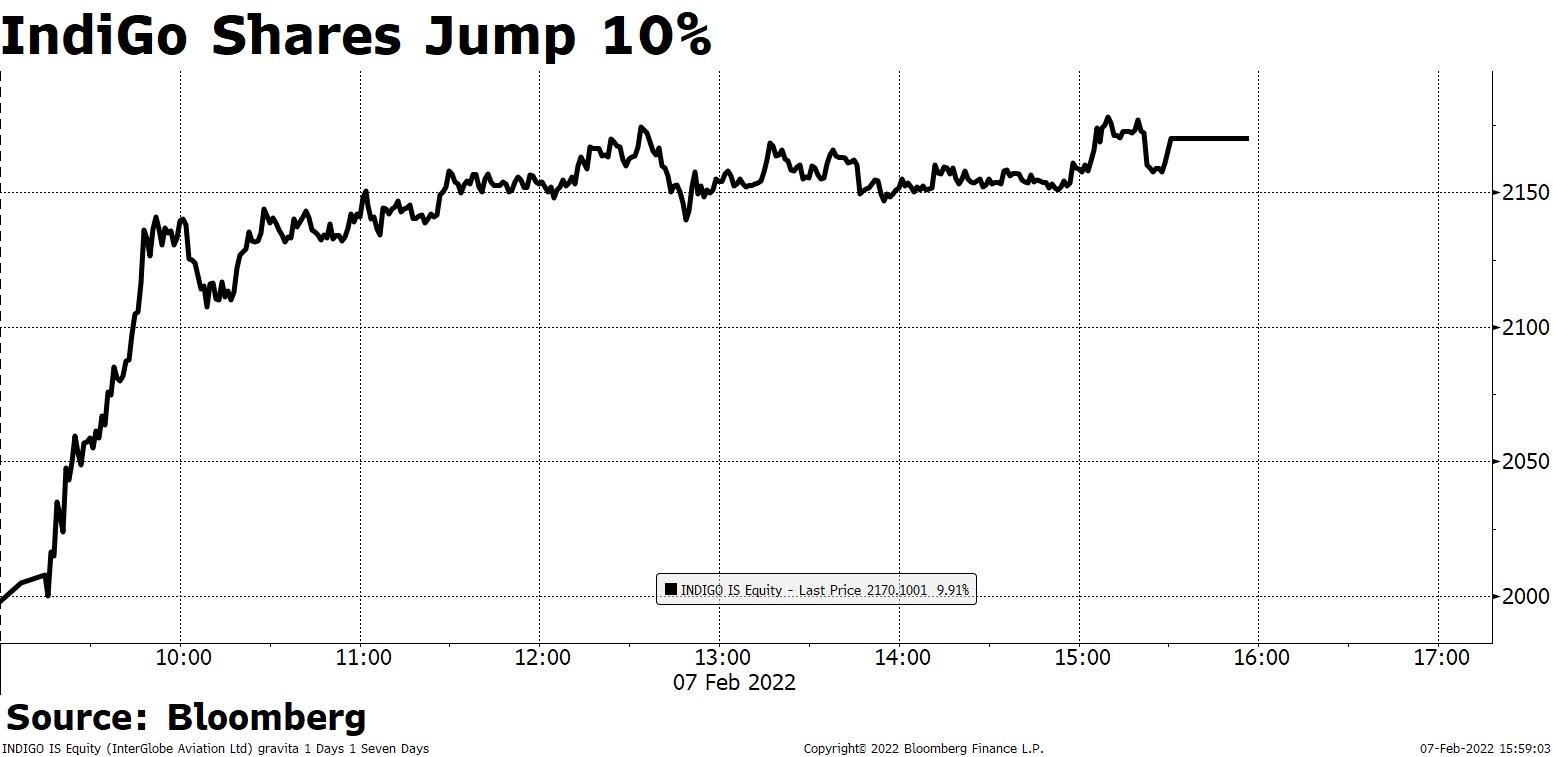

Shares of InterGlobe Aviation rose 10.77% to an intraday high of Rs 2,187.05 apiece. Trading volume on the stock was over five times the 30-day average volume at the times, when market closed Monday.

Motilal Oswal

Reiterates 'neutral' on the stock, raises the target price to Rs 2,200 from Rs 2,100; an implied return of 11.43%.

Strong Q3 performance was driven by higher-than-estimated yield because of pent-up demand.

Traffic for January 2022 was down 43% month-on-month owing to the Omicron wave, but is seen improving once again since late January 2022.

The company will evolve out of the pandemic stronger than before with various pre-emptive steps undertaken already.

Values the stock at 8x FY24E EV/Ebitdar to arrive at the target price.

Fundamentals of aviation in India remains strong, aiding the company to return to profitable growth.

International revenue continues to be robust.

ICICI Securities

Upgrades stock from 'sell' to 'hold'; raised target price to Rs 1,871 from Rs 1,650 earlier; still an implied downside of 12.32%.

Better yields in Q3 a surprise.

Uncertainty of repeat Covid waves and high crude prices remain significant overhangs.

Beyond-metro markets have better fares and could benefit IndiGo as some of its low-cost peers are forced to spread thin across their network.

Prabhudas Lilladher

Reiterates 'hold' on the stock and raises target price to Rs 2,050 from Rs 1,950; an implied upside of 3.83%.

Increases FY23/FY24 earnings by 3.9%/4.7% on expectations of swift recovery in demand as Covid cases subside.

Higher capacity deployment, strong yield environment across geographies, robust load factors augur well.

Expects the company to end FY22 on a sour note due to the third Covid wave and sustained inflationary ATF trends.

Company's focus on fortifying its domestic network, widening international network and freighter operations are positive factors.

Rising crude prices remains a cause of concern.

IndiGo continues to remain better placed than its peers and is likely to emerge stronger post-Covid given superior balance sheet, industry-leading cost structure and strong management team.

Edelweiss Securities

Upgrades to 'buy' from 'hold' with the target price raised to Rs 2,380 from Rs 1,896.

Upgrade due to improved growth prospects.

In the near-term, the company is a proxy for re-opening trade led by better yields and pent-up demand.

Addition of XLR fleet and improved cargo business are likely to enhance competitiveness in the long term.

High ATF prices remain a concern.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.