InterGlobe Aviation Ltd., IndiGo's parent company, saw an over 3% increase in its share price on Tuesday after Goldman Sachs upgraded the target price of the stock.

The company has displayed robust growth in domestic air traffic, with Nov. 2024 traffic showing a 11% year-on-year increase, said Goldman Sachs in their latest report.

They project a 12-month target price of Rs 4,800 on the stock, representing a 23.4% upside.

According to their aviation tracker, daily domestic traffic has averaged 473,000 passengers this month, following a solid 10% year-on-year growth in October. IndiGo's passenger load factor for November has also improved, reaching around 90%, compared to 85.6% in November 2023.

Despite these gains in volume, ticket fares for IndiGo's domestic flights are reportedly down 4%-5% year-on-year for November, with early December fares reflecting a similar downward trend.

The report points out a marginal rise in jet fuel costs, which averaged $89.7 per barrel so far in November, compared to $87.9 in October. IOCL revised its jet fuel price to Rs 90.6 per litre effective Nov. 1, driven by refining cracks despite a decline in global oil prices. A potential price hike on Dec. 1 could partially offset gains in PRASK, the firm said.

Fleet expansion is expected to maintain pace, supporting capacity growth as domestic demand rises, said the brokerage.

While declining yields pose a challenge, Goldman Sachs remains optimistic about IndiGo's ability to leverage strong passenger growth and operational efficiency.

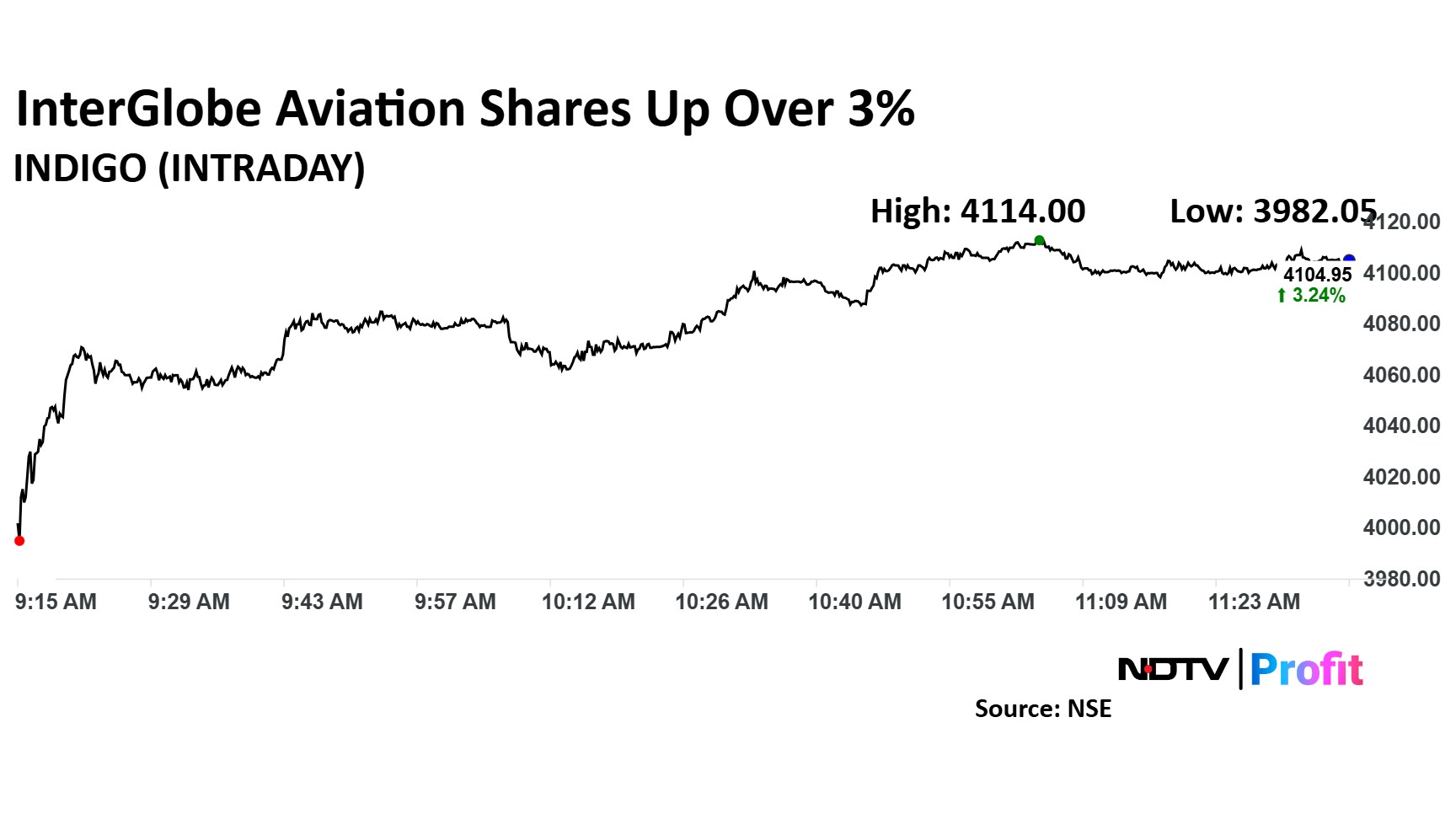

IndiGo share price rose as much as 3.46% to Rs 4,114 apiece, the highest level since Oct. 30. It pared gains to trade 3.11% higher at Rs 4,100 apiece, as of 11:25 a.m. This compares to a 1.2% advance in the NSE Nifty 50 index.

It has risen 38.23% on a year-to-date basis. Total traded volume so far in the day stood at 0.41 times its 30-day average. The relative strength index was at 45.2.

Out of 22 analysts tracking the company, 16 maintain a 'buy' rating, three recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 16.1%.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.