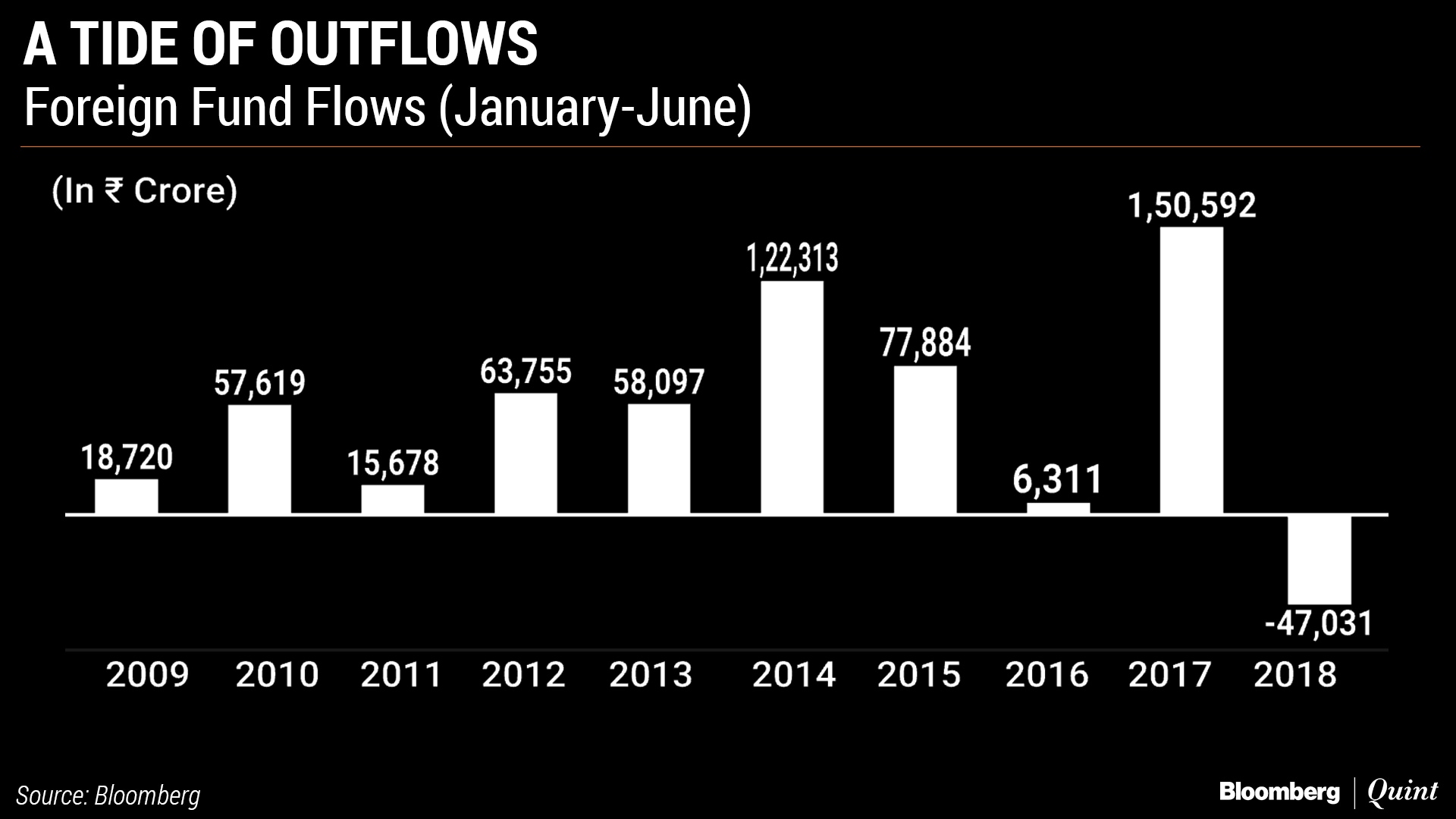

Foreign institutional investors have pulled money out of India's both debt and equity markets for the first time in a decade in the first six months of this calendar year on escalating trade tensions and macroeconomic concerns.

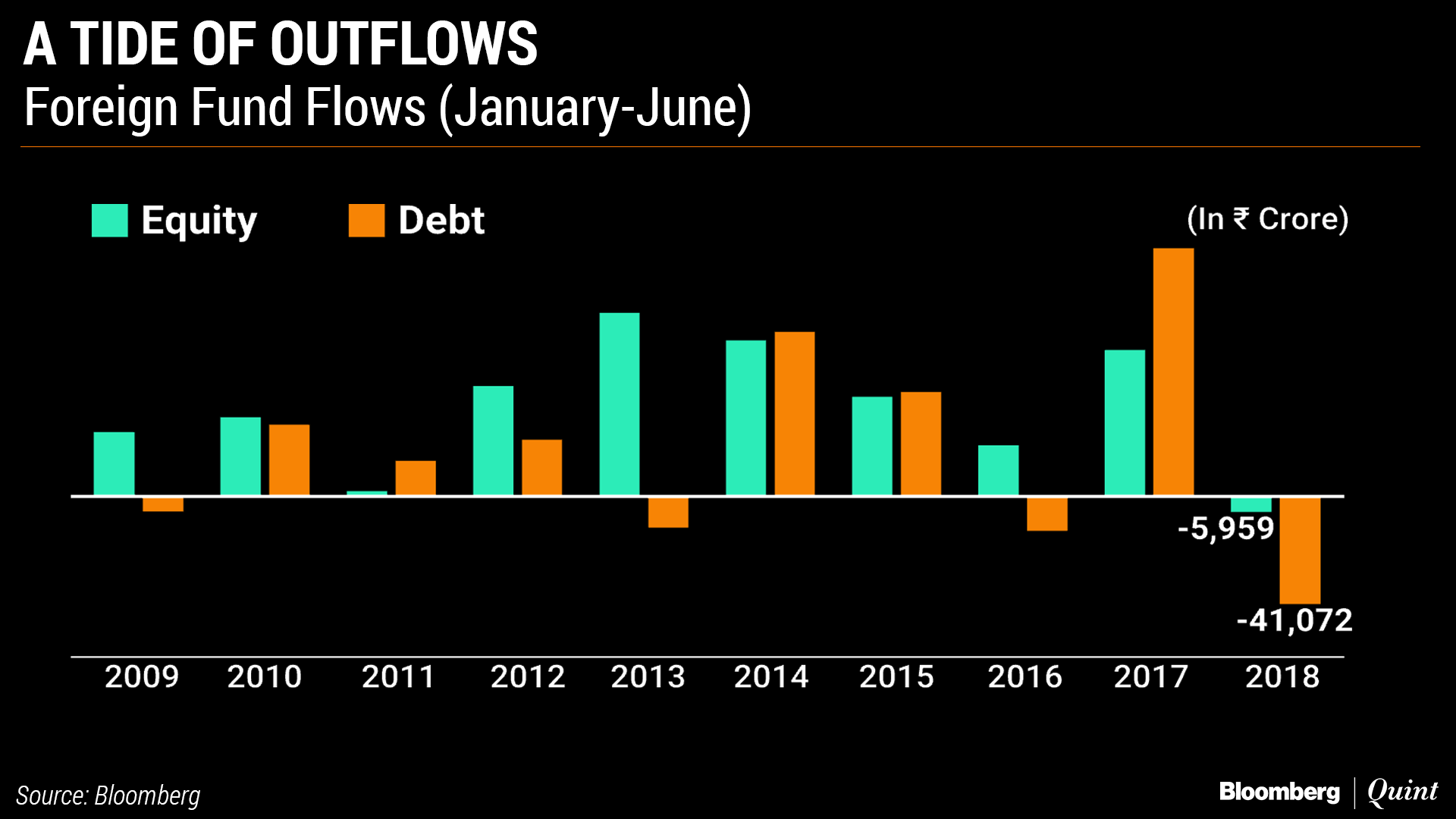

Overseas investors sold equity worth nearly Rs 6,000 crore and debt worth over Rs 41,000 crore so far in 2018, the worst outflow since 2009, according to Bloomberg data.

The sell-off comes amid higher fuel prices that increase inflation risk and widen the current account deficit, putting pressure on the rupee which has depreciated over 7 percent during the same period. It also increases the import bill, hurting the government's finances. More so in an election year when it's expected to spend more to create jobs.

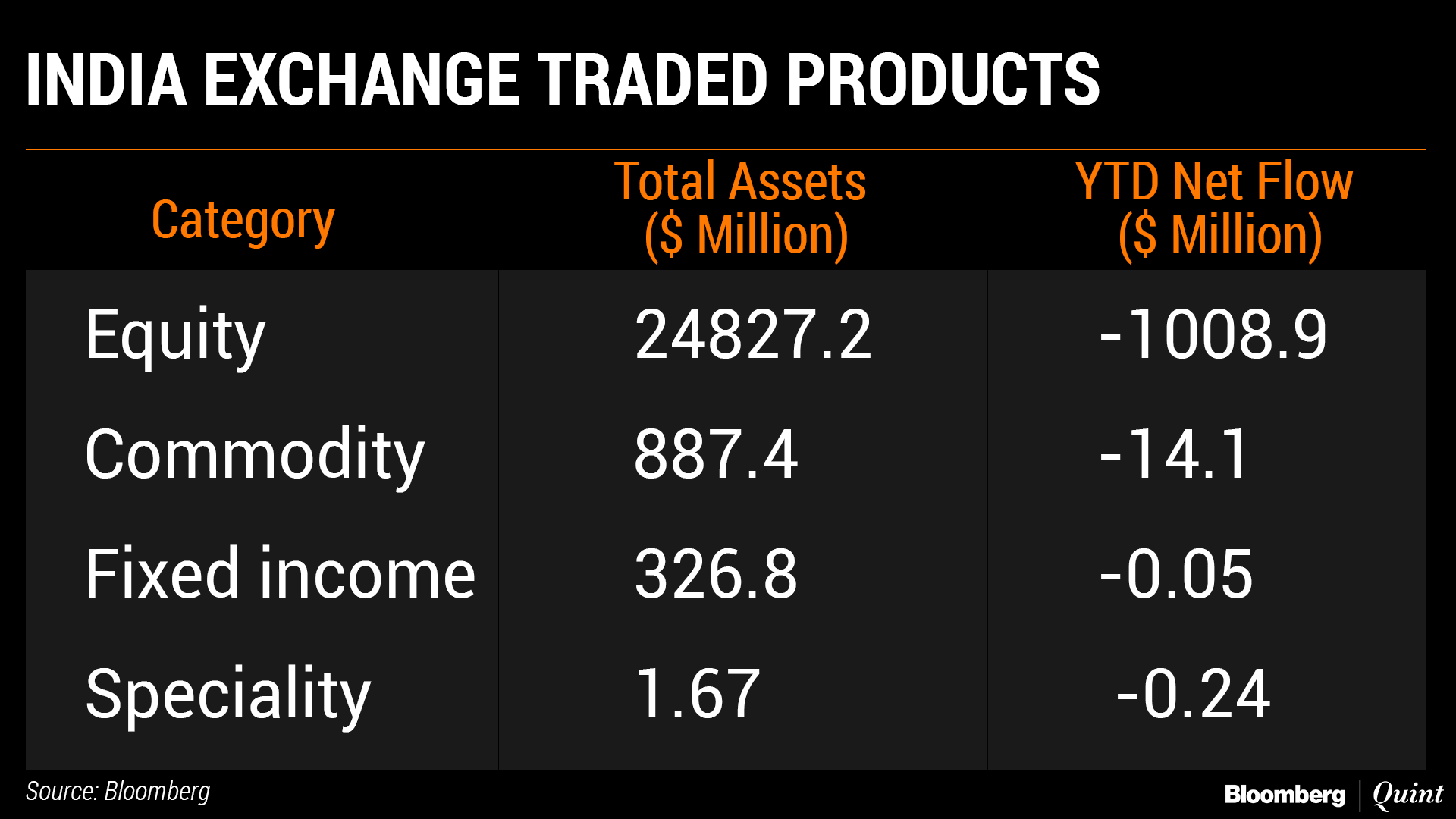

Nearly $1 billion has flown out from exchange-traded funds in India, making Asia's third-largest economy the worst performer among emerging peers. China is the best performer.

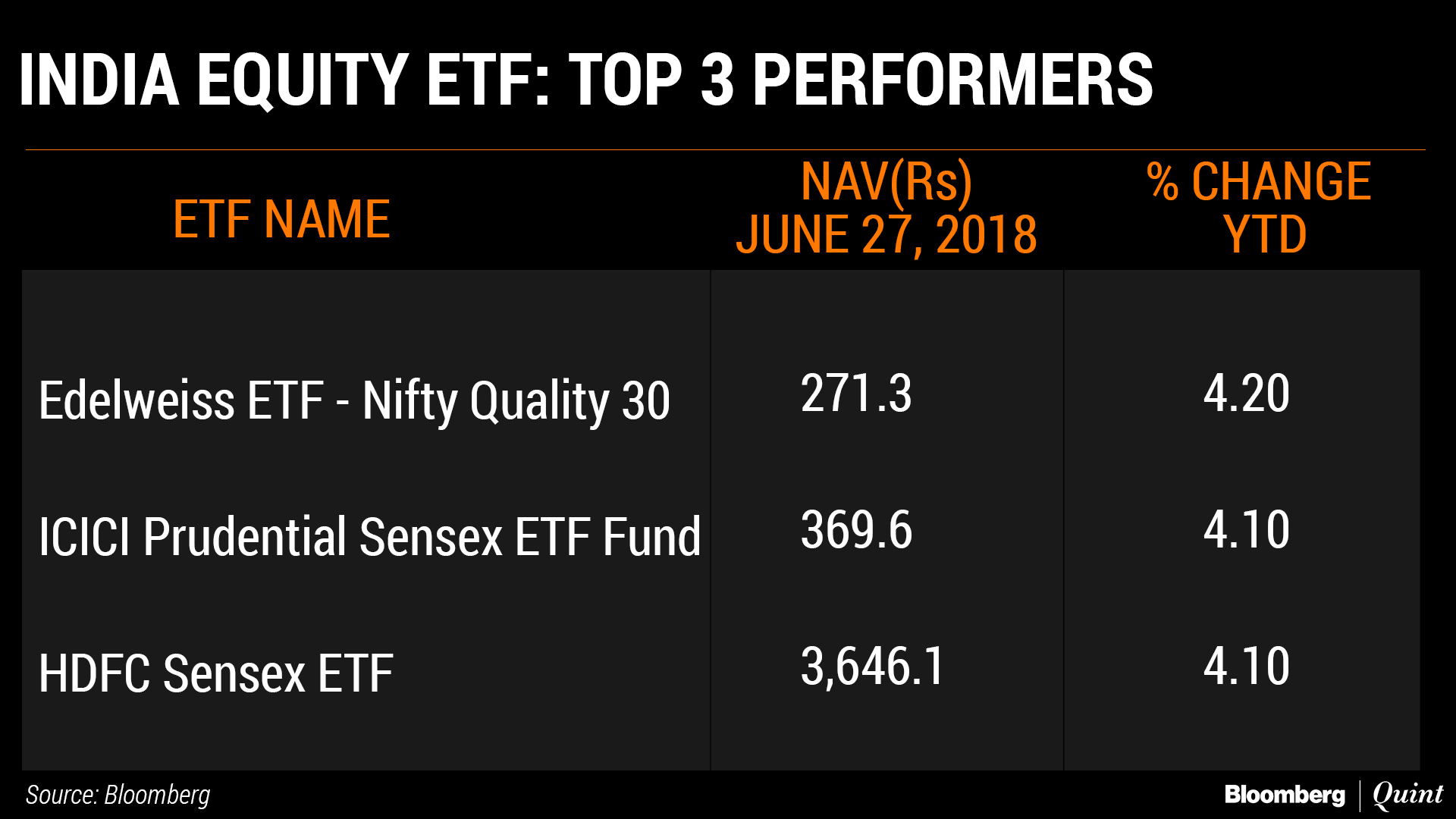

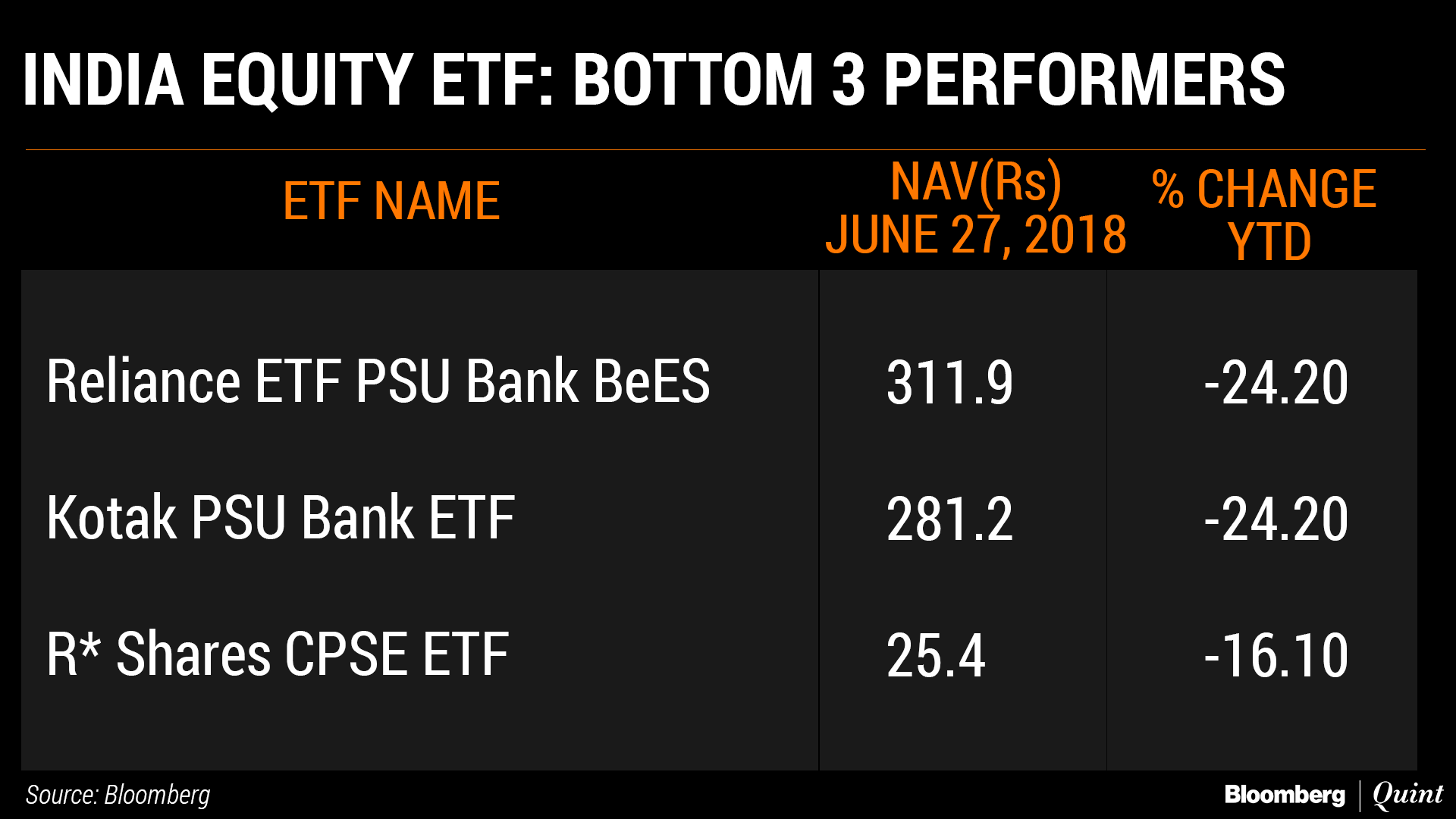

Amid volatility in the market, large caps have managed to stem the slide. Indian ETF's tracking large-cap stocks and indices have outperformed mid caps and specific sectors so far in 2018.

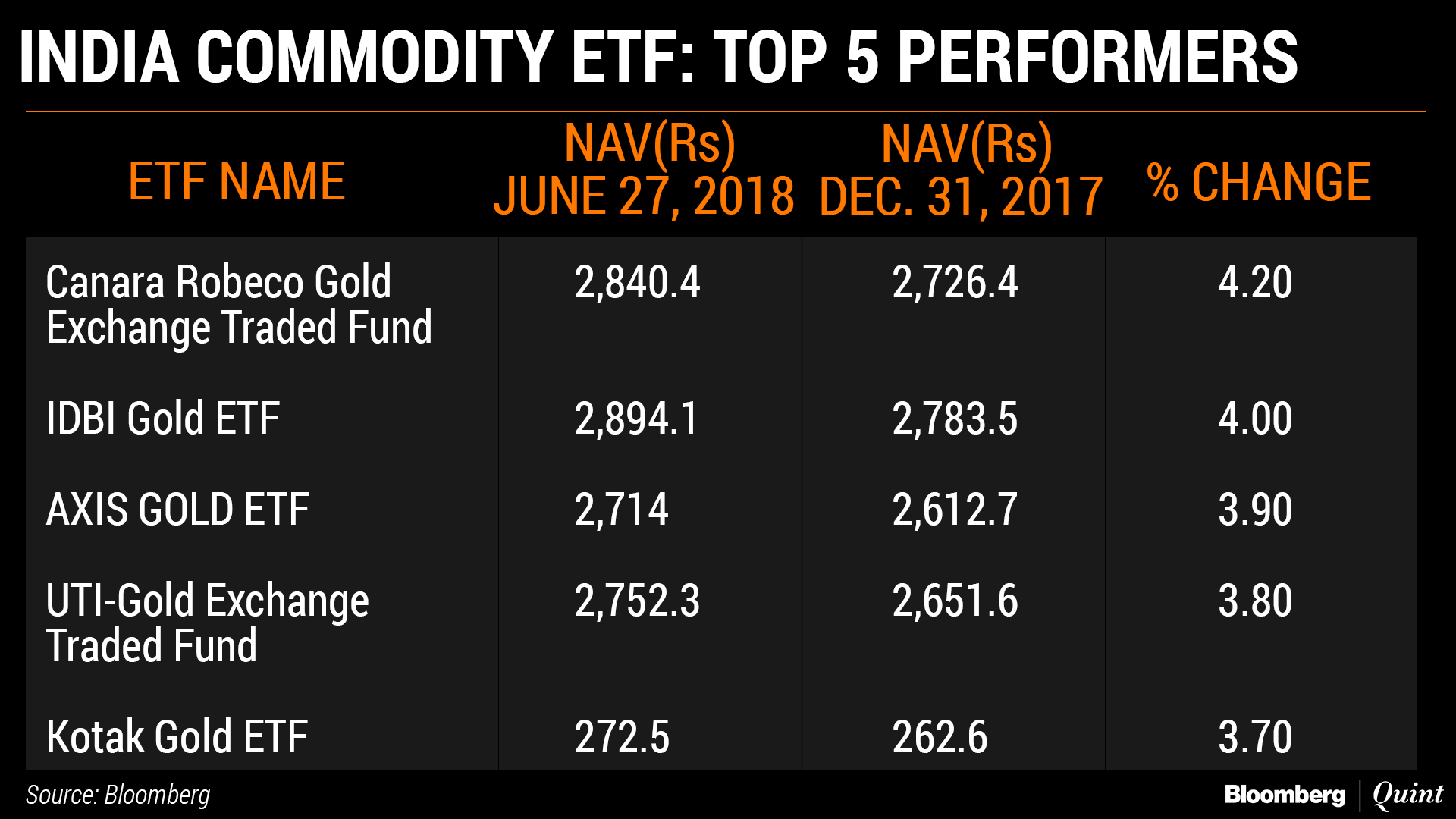

Expectedly, ETFs tracking gold—a safe haven for investors—beat equity ETFs.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.