IDBI Bank Ltd.'s shares surged nearly 5% on Monday to trade close to its all-time high, after NDTV Profit reported that the central government's disinvestment plan is in the final phase.

The government is confident about the timeline of IDBI Bank's sale and the recent market volatility won't impact the schedule, people in the know said.

The share purchase agreement has been cleared by an inter-ministerial group and financial bids are likely to be invited in September. The government is eyeing Rs 40,000–Rs 50,000 crore from IDBI Bank disinvestment, they said.

A core group of secretaries will soon review the plans.

Three bidders are said to be in the race to acquire the majorly LIC-owned IDBI Bank. A confidential reserve price will be set for the sale.

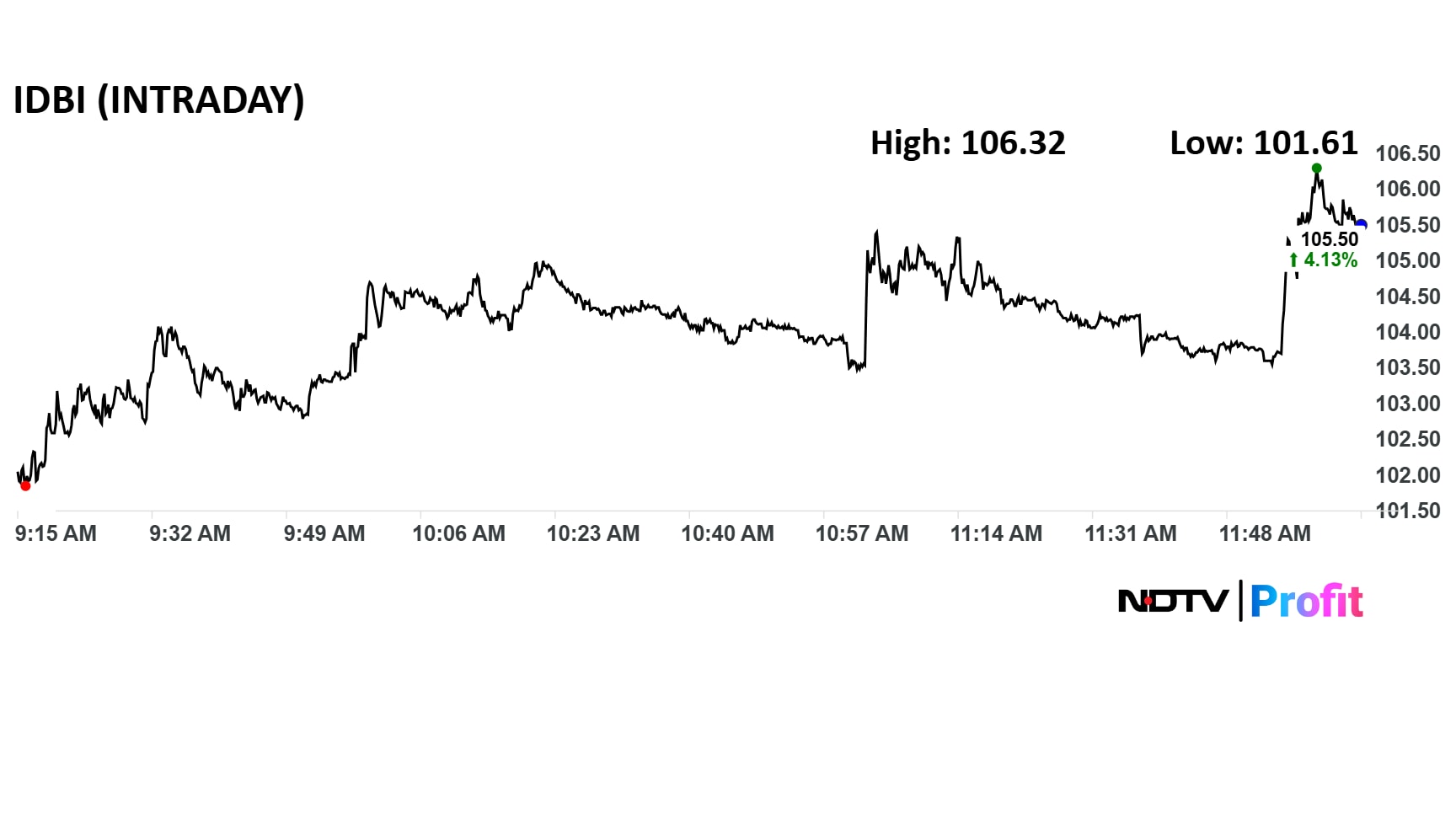

IDBI Bank Stock Movement

IDBI Bank share price advanced 4.9% intraday to Rs 106.32 apiece and traded close to that level as of 12:10 p.m.

IDBI Bank share price advanced 4.9% intraday to Rs 106.32 apiece and traded close to that level as of 12:10 p.m. The benchmark NSE Nifty 50 was down 0.2%.

The stock has risen 25% in the last 12 months and 37% on a year-to-date basis. The total traded volume so far in the day stood at 3.3 times its 30-day average. The relative strength index was at 71, indicating the stock is overbought.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.