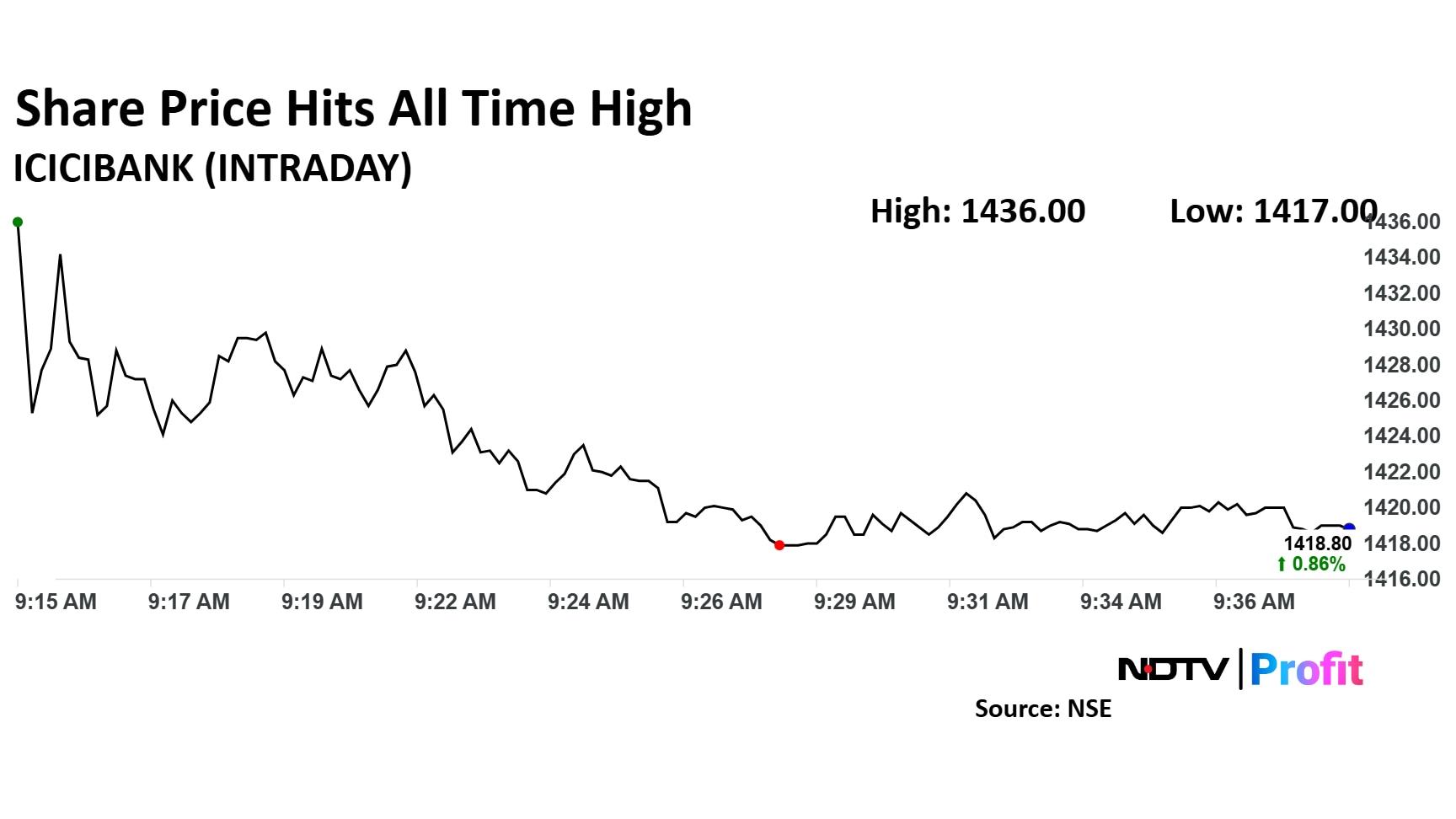

ICICI Bank's share price surged by 2.08% on Monday, reaching an all-time high of Rs 1,436 following the announcement of its fourth quarter earnings.

The bank reported a net profit increase of 18% year-on-year to Rs 12,630 crore, driven by higher net interest income and operating profit. The net non-performing assets ratio improved to 0.39% from 0.42% quarter-on-quarter, indicating better asset quality management.

Gross NPA also showed improvement, decreasing to 1.67% from 1.96% quarter-on-quarter. Net interest income grew by 11% year-on-year to Rs 21,193 crore, supported by an increase in net interest margin. Operating profit rose by 17.5% year-on-year to Rs 17,664 crore. Provisions increased by 24% year-on-year to Rs 891 crore.

ICICI Bank Ltd's fourth quarter earnings have received positive reviews from brokerages CLSA and Jefferies. Both brokerages highlighted the bank's strong performance, with CLSA noting that ICICI Bank's pre-provision operating profit and profit after tax exceeded their estimates. Jefferies maintained a bullish outlook on the bank, citing a profit growth of 18% year-on-year and a 13% growth in current account and savings account deposits.

The scrip rose as much as 2.08% to Rs 1,436 apiece, hitting an all time high. It pared gains to trade 0.98% higher at Rs 1,420 apiece, as of 09:37 a.m. This compares to a 0.59% advance in the NSE Nifty 50 Index.

It has risen 30.72% in the last 12 months. Total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 73.

Out of 52 analysts tracking the company, 49 maintain a 'buy' rating, three recommend a 'hold', and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.