Shares of Hitachi Energy Ltd. rose nearly 8% as Goldman Sachs is bullish on the firm, given strong order inflows and growing demand. The brokerage has a 'buy' rating with a target price of Rs 13,350, implying a 10% upside.

This bullish stance is also backed by other key factors like robust growth and market dominance.

Order Inflow Surge

Hitachi Energy's order inflow has exceeded the expected figures, signalling a strong market demand. Paired with a pipeline of potential future orders, the company's growth trajectory appears secure, according to the brokerage. The rising demand is also sustained by the capacity expansion in the company.

To capitalise on this rising demand, Hitachi Energy is actively expanding its production capacity. This strategic move ensures the company can efficiently deliver according to the strong order inflow.

Indigenous HVDC Manufacturing

A crucial element of Hitachi Energy's strategy is its domestic manufacturing. The company's plan to indigenously produce 80-90% of High-Voltage Direct Current project components aligns with the 'Make in India' initiative. This alignment further strengthens its supply chain and reducing reliance on imports, the brokerage said.

Growth And Market Share

Hitachi has a notable 50% share of the domestic market, which displays its dominant position. This also shows the company's ability to tap into market trend based opportunities.

Goldman Sachs has revised its order inflow and margin estimates to show increased confidence in Hitachi Energy's ability to keep pace with its strong order inflows.

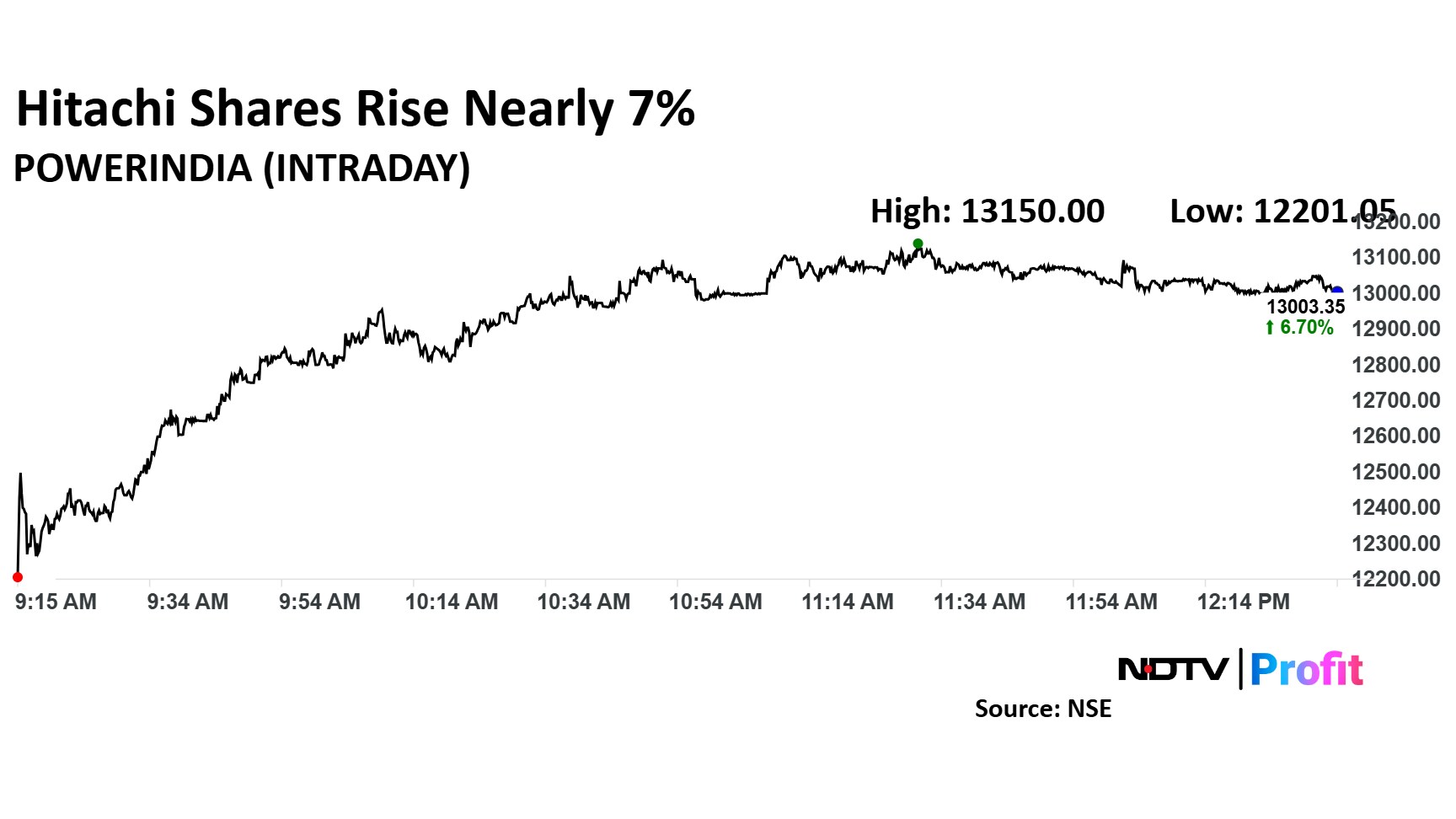

Hitachi Share Price

Hitachi Energy stock rose as much as 7.9% during the day to Rs 13,150 apiece on the NSE. It was trading 6.81% higher at Rs 13,017.3 apiece, compared to a 1.39% advance in the benchmark Nifty 50 as of 12:33 p.m.

It has risen 106.01% in the last 12 months. Total traded volume so far in the day stood at 1.2 times its 30-day average. The relative strength index was at 61.6.

Five out of seven analysts tracking the company have a 'buy' rating on the stock and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 14,266, implying an upside of 9.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.