As far as defence stocks go, Hindustan Aeronautics Ltd. has had a triumphant journey over the last five years, giving returns of 1789.15% with an upside of 20.3% year-to-date.

The defence company has been in talks with General Electric for the local production of GE414 engines. News about negotiations being halted and the company partnering with some other engine manufacturer was making the rounds on the internet, but HAL recently debunked this claim through an exchange filing on Wednesday.

The filing read, "An online article that appeared on www.idrw.org has inaccurately reported that negotiations between HAL and General Electric (GE) for the local production of ofGE414 engines have stalled, suggesting that HAL is now in talks with another engine manufacturer. HAL would like to clarify that this report is factually incorrect and misleading. HAL reiterates that negotiations with GE are on track and progressing well and that HAL is not in talks with any other company regarding engines for the LCA MK2. Any information suggesting otherwise is incorrect."

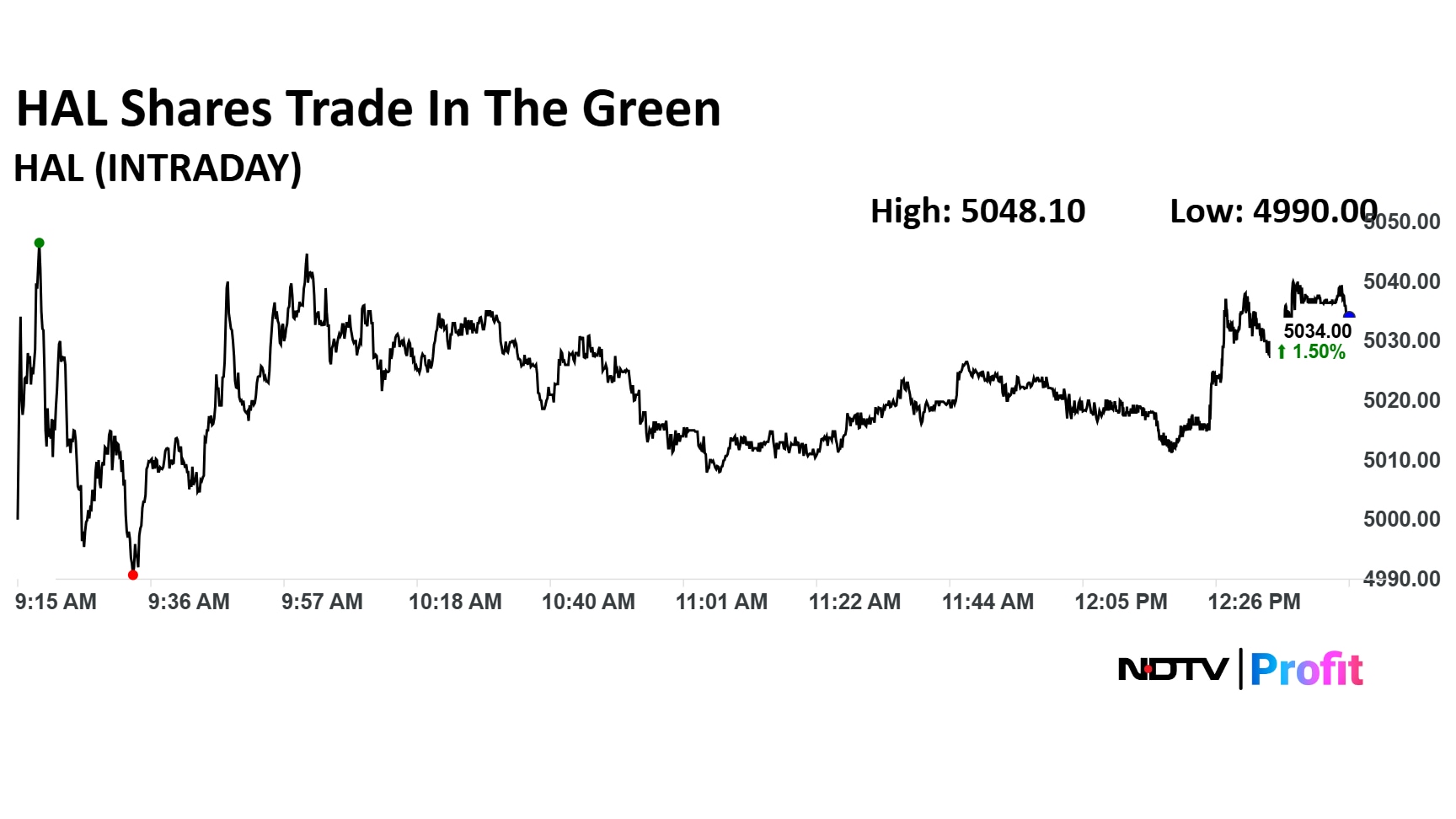

On Thursday, the share price for HAL had risen almost 2% to trade at Rs 5,048.10 apiece.

HAL Shares — Buy, Sell Or Hold?

The share price has risen 20.45% on a year-to-date basis, and is up 15.40% in the last 12 months.

Out of 20 analysts tracking the company, 15 maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 12.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.