HDFC Life Insurance Co.'s share price rose to the highest level in over one month, as most brokerages and analysts retained a positive view after assessing its performance during October–December.

Bernstein, Nirmal Bang Institution and Motilal Oswal Financial Services Ltd. retained their stock ratings. While, Nomura upgraded it to 'buy' as the insurance company's value of new businesses margin expanded in the third quarter, displaying surprising growth. Higher product level margin led to strong sequential margin growth, according to brokerages.

HDFC Life Q3 FY25 Result Highlights (Standalone, YoY)

Net profit up 14% at Rs 415 crore (Bloomberg estimate: Rs 417 crore).

Annualised premium equivalent grew 12% to Rs 3,569 crore vs Rs 3,191 crore.

Value of new business advanced 9% to Rs 930 crore from Rs 856 crore.

VNB margin expands to 26.1% from 24.3% (QoQ).

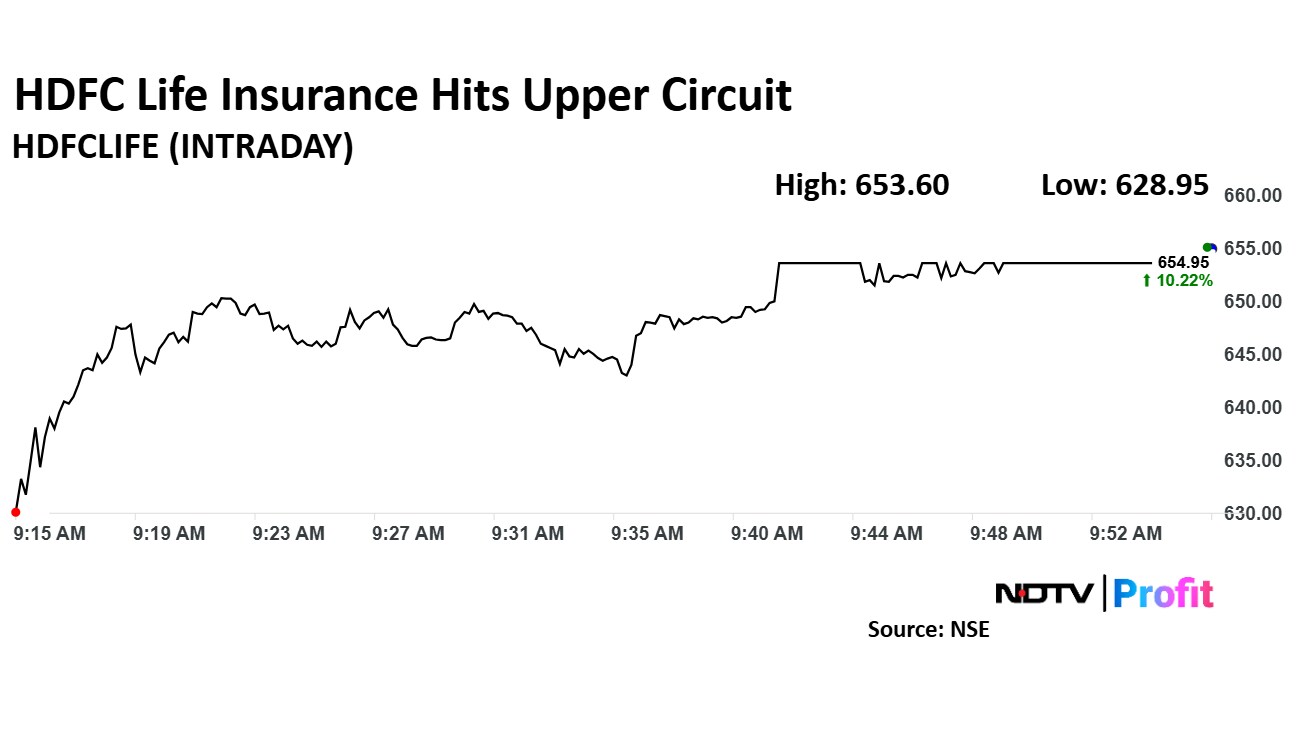

HDFC Life Insurance Share Price Today

HDFC Bank Life Insurance share price rose 11.68% to Rs 663.20 apiece, the highest level since Dec. 2, 2024. Earlier it had hit a 10% upper circuit. It pared gains and was trading 8.64% higher at Rs 645.55 apiece as of 9:25 a.m., compared to a 0.53% advance in the NSE Nifty 50.

The stock rose 5.61% in 12 months. Total traded volume so far in the day stood at 15 times its 30-day average. The relative strength index was at 60.25.

Out of 35 analysts tracking the company, 30 maintain a 'buy' rating, five recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 24.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.