HDFC Bank Ltd.'s share price traded marginally higher on Friday after its first-quarter business update showed deposit growth was higher than that of loans.

Gross advances as of June 30 increased 6.7% year-on-year to Rs 26,530 crore. Period-end deposits rose 16.2% year-on-year to Rs 27,640 crore, according to business updates disclosed on Friday. Sequentially, advances were marginally up by 0.4%, while deposits rose 1.8%, respectively.

On an average deposit basis, the total deposits were up 16.4% at Rs 26,580 crore.

Current account savings account or CASA deposits jumped 8.5% to Rs 9,370 crore. CASA deposits are a crucial source of funding for banks, as they are relatively low-cost compared to other deposit types like fixed deposits.

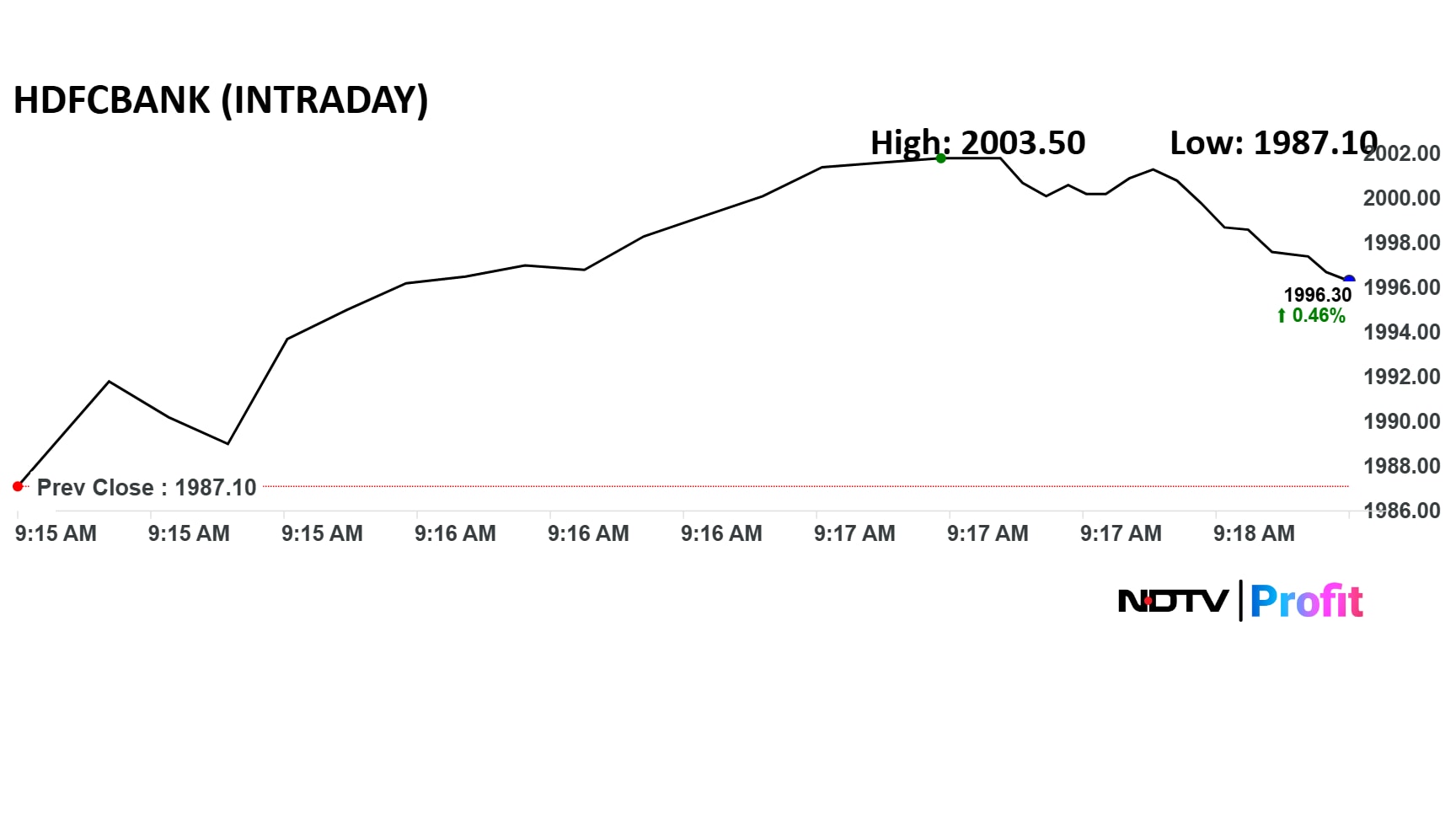

HDFC Bank Share Price Today

HDFC Bank share price gained 0.8% soon after the market opened to Rs 2,003 apiece

HDFC Bank shares gained 0.8% soon after the market opened to Rs 2,003 apiece. The stock has risen 15% in the last 12 months and 11.5% so far this year.

Over four lakh shares changed hands with the total traded value being Rs 82.44 crore as of 9:20 a.m. The company added over Rs 10,000 crore in market capitalisation.

Out of 49 analysts tracking the bank, 45 have a 'buy' rating on the stock and four recommend a 'hold', according to Bloomberg data. The average of 12-month analysts' price target of Rs 2,207 implies a potential upside of 11%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.