011123-2.jpg?downsize=773:435)

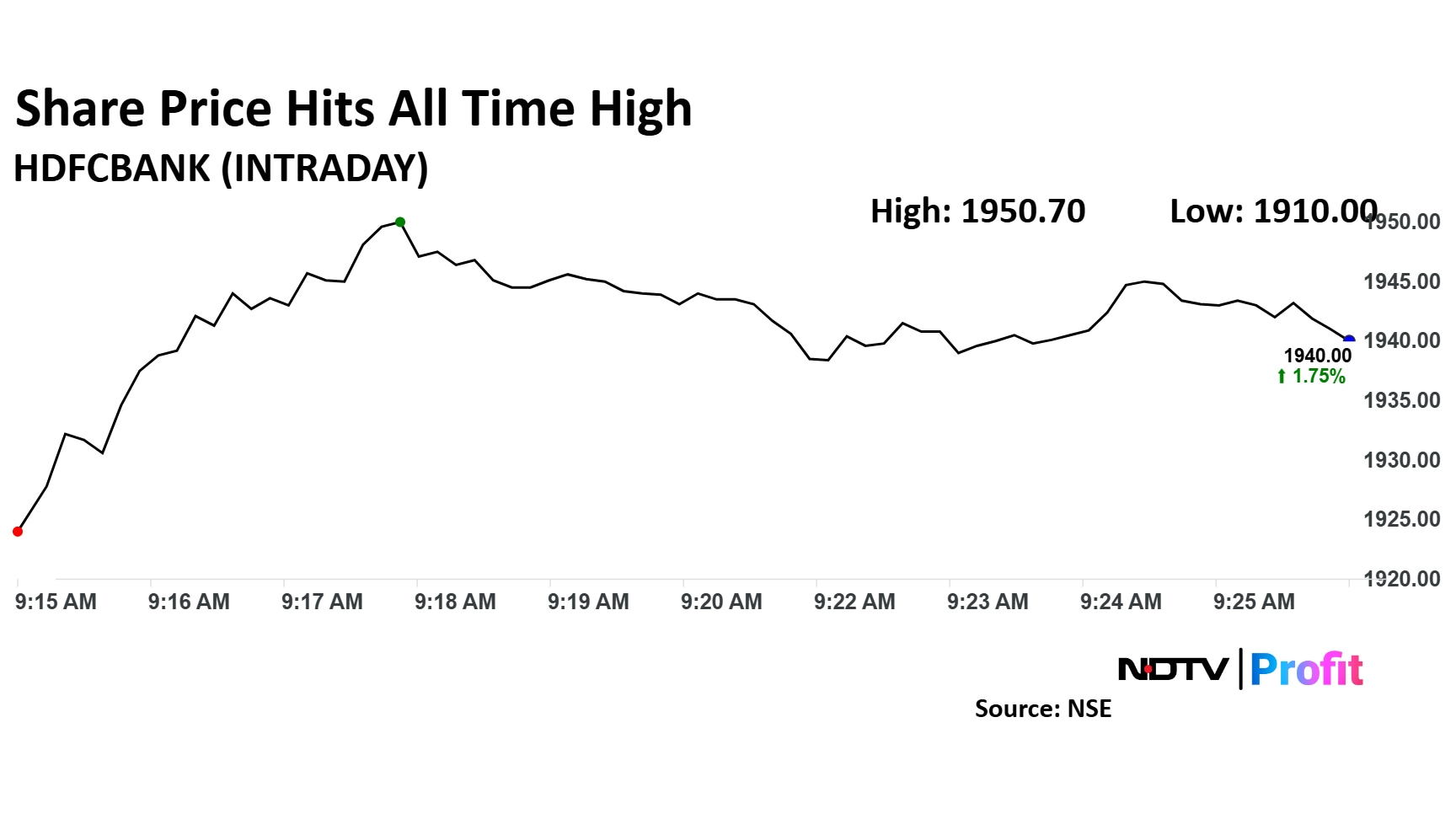

HDFC Bank Ltd.'s share price rose over 2% on Monday, reaching an all-time high of Rs 1,950 following the announcement of its fourth quarter earnings.

The bank reported a net profit increase of 6.7% year-on-year to Rs 17,616 crore, alongside a 10.3% rise in net interest income to Rs 32,066 crore. Additionally, the net non-performing assets ratio stood at 0.43%, down from 0.46% quarter-on-quarter, while gross NPA improved to 1.33% from 1.42% quarter-on-quarter.

The bank's financial results also garnered positive outlook from brokerages. Jefferies has retained HDFC Bank as one of its top picks, while Macquarie has maintained an 'outperform' rating, citing stable credit costs and improved margins.

Ahead of its earnings announcement on Thursday, the bank's share price had previously reached an all-time high, surging 2.22% to trade at Rs 1,919.

HDFC Bank Share Price Today

Shares of the lender rose as much as 2.31% to Rs 1,950.70 apiece, reaching an all time high. They pared gains to trade 1.69% higher at Rs 1,939 apiece, as of 09:24 a.m. This compares to a 0.37% advance in the NSE Nifty 50.

The stock has risen 28.22% in the last 12 months. Total traded volume so far in the day stood at 0.31 times its 30-day average. The relative strength index was at 73.

Out of 48 analysts tracking the company, 44 maintain a 'buy' rating, four recommend a 'hold' and none suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 9.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.