- Lalit Keshre became India's newest billionaire after Groww's stock surged post-IPO

- Keshre owns 9.06% stake in Billionbrains Garage Ventures, valued at $1.2 billion

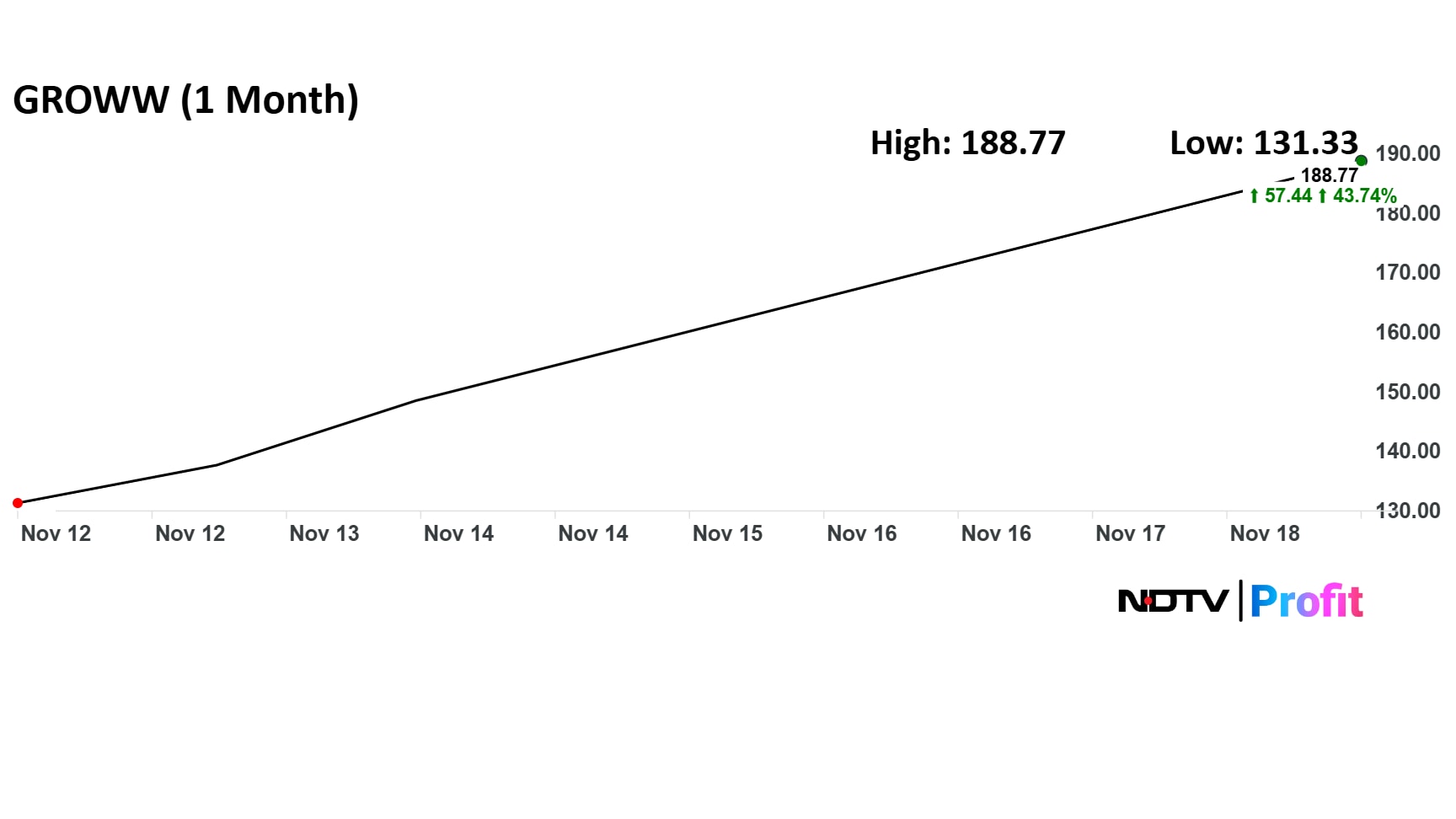

- Groww's market cap crossed Rs 1 lakh crore within a week of its stock market debut

Lalit Keshre, co-founder and CEO of Groww, has become India's newest billionaire following the stock's prolific rally since listing last week.

Keshre owns 55.9 crore equity shares, representing 9.06% stake in Billionbrains Garage Ventures Ltd. The current market value stands at Rs 10,556 crore or $1.2 billion.

Groww listed at a premium on Nov. 12. The stock has jumped more than 89% over its IPO price in five sessions, with its market capitalization crossing Rs 1 lakh crore — one of the strongest debuts in recent times.

The company was founded in 2017 by four ex-Flipkart employees – Keshre, Harsh Jain, Ishan Bansal and Neeraj Singh.

If the stock rally continues, promoters and co-founders Harsh Jain and Neeraj Singh, who own 6.67% and 6.21% respectively, will also join the billionaires' club. Jain is the chief operating officer and Singh is the chief technical officer of the company.

The current value of Harsh Jain's stake is around Rs 7,800 crore, while that of Neeraj Singh is Rs 7,300 crore. This means, they both are around Rs 1,000 crore away from the billionaire status.

On the other hand, chief financial officer Ishan Bansal's holding value is around Rs 5,200 crore.

Groww's IPO generated solid demand from institutional, non-institutional and retail investors this month. In the offer for sale, the founders did not offload equity.

Billionbrains Garage Ventures, backed by Microsoft Chief Executive Officer Satya Nadella, will use funds raised in the IPO fresh issue to expand margin trading, unsecured lending, wealth management, and possibly inorganic growth, as per offer documents.

The company started as a mutual fund investment platform but later expanded into stocks, futures and options, foreign equities and other products, attracting lakhs of first-time investors.

Keshre, 44, grew up in the Lepa village in Madhya Pradesh. He was raised in modest surroundings by his grandparents, and he studied in the only English-medium school in the Khargone district.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.