As the Nifty 50 has corrected nearly 10% from its peak in September 2024, Goldman Sachs Equity Research highlighted several stocks that are well-positioned for strong returns, despite ongoing market volatility. Among the top stock picks are HDFC Bank Ltd., Power Grid Corp. of India, and Godrej Consumer Products Ltd.,

Adani Ports and Special Economic Zone Ltd. and Mahindra & Mahindra Ltd. were also in the list.

Cyclical Slowdown

The current slowdown in the Indian economy is cyclical rather than structural. The recent correction in stock prices reflects this temporary slowdown, which is largely driven by policy tightness, such as credit regulations, cautious monetary policy, and fiscal tightening that were in place through late 2023, the brokerage said. Although these factors have weighed on economic growth, some recent policy easing measures, including income tax relief in the union budget and RBI rate cuts, could help revive real GDP growth later in 2025.

Goldman Sachs' economists expect a growth rebound of 6.4% in the second half of calendar year 2025, bolstered by these policy actions. However, risks remain, particularly related to potential reciprocal US tariffs in India, which could dampen growth prospects.

While the brokerage acknowledges that the worst is likely behind in terms of economic growth and earnings trajectory, it anticipates higher market volatility in the near term. This is due to elevated domestic positioning in small and mid-cap stocks and global uncertainties, especially from tariffs and geopolitical factors.

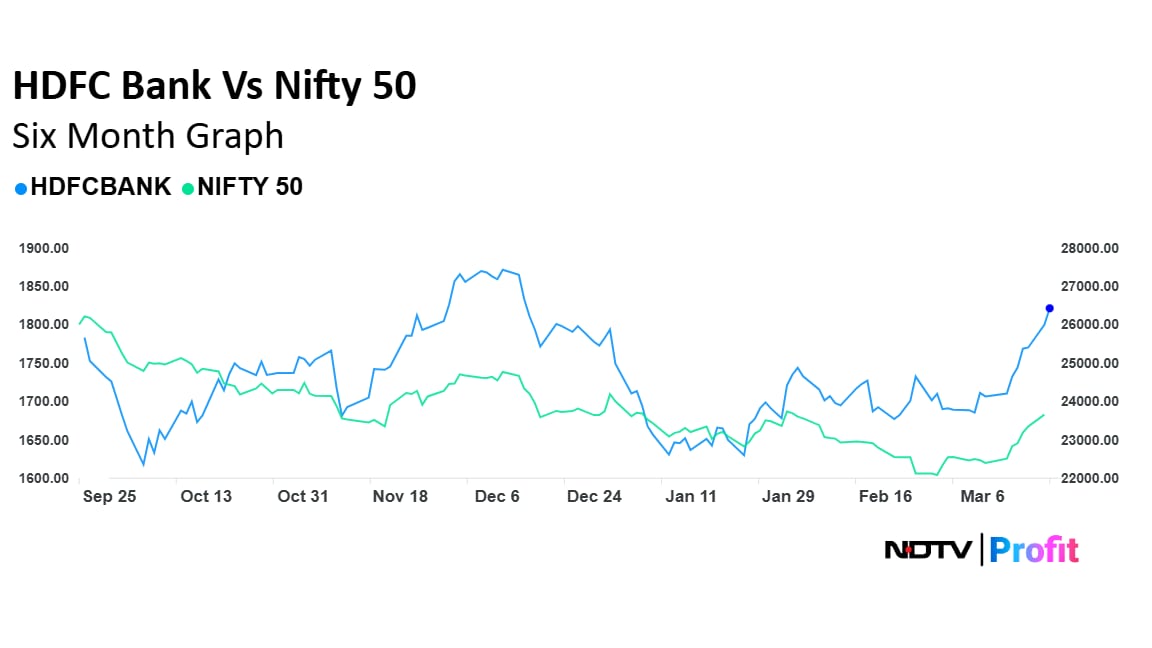

HDFC Bank

HDFC Bank has outperformed the Nifty over the last three month and six-month period, with EPS cuts bottoming out. As liquidity concerns ease, the bank is set to accelerate PPOP growth, the brokerage said in its note. Key drivers include market share gains in deposits, stable asset quality, and strong loan growth.

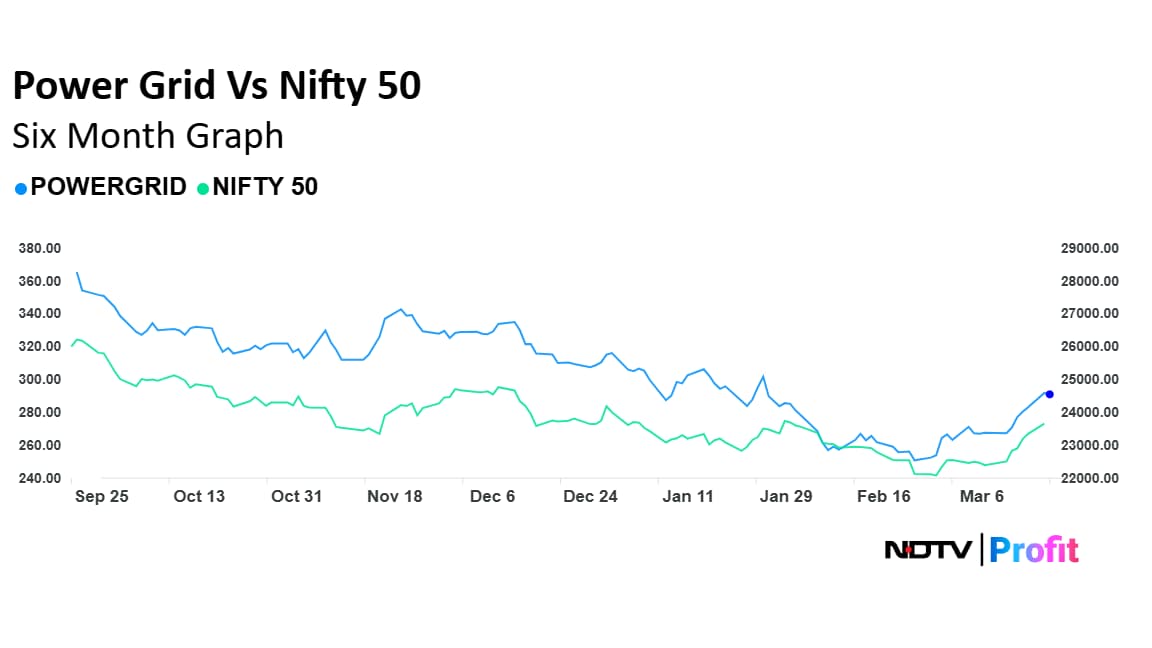

Power Grid Corporation of India

India's power transmission requires significant capex, with Power Grid well-positioned to capture a large share of this growth. Strong cash generation and a solid balance sheet support its expansion, the brokerage said in its note. Goldman Sachs maintained a 'buy' rating with a 12-month target price of Rs 375, expecting favourable risk-reward.

Godrej Consumer Products

GCPL is expected to see a turnaround, driven by growth in premium categories like liquid vaporisers, hair color, air fresheners, and liquid detergents. Despite a weak third quarter, where volume growth was flat, the company has consistently delivered strong growth over the previous six quarters. GCPL is expected to return to its growth trajectory in financial year 2026, along with a recovery in soap margins.

Adani Ports & SEZ

After an 8.5% port volume growth in financial year 2025E, Adani Ports is expected to see accelerated volume growth in fiscal 2026-2027E, driven by ramp-ups at Vizinjham, Gopalpur, Tanzania, and the commissioning of the Colombo port. Logistics revenue and Ebitda are also expected to grow faster.

Mahindra & Mahindra

M&M offers strong exposure to premiumisation and rural consumption, benefiting from the SUV market's growth. With a strong product pipeline, including the Thar Roxx and BEVs, M&M's car volume growth is set to outpace peers. Additionally, its tractor business gains market share post-El Nino, boosting earnings.

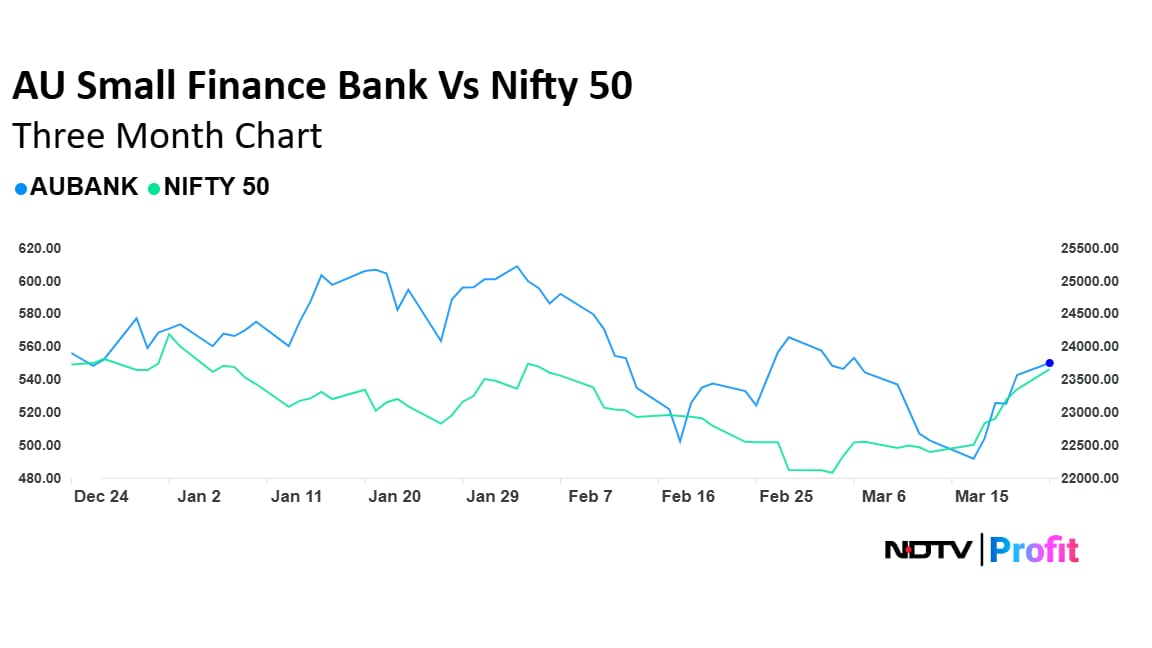

AU Small Finance Bank

AU Small Finance Bank has underperformed due to profitability concerns and macro challenges. However, its stock is now trading at a significant discount, offering an opportunity for growth. The bank is expected to deliver 31% earnings growth over financial year 2025-2027, driven by strong loan growth and healthy returns. Goldman Sachs reiterated its 'buy' rating with a target price of Rs 796.

MakeMyTrip

MakeMyTrip has consistently delivered 20%+ year-on-year revenue growth, driven by strong travel demand and a diversified revenue mix. The company's market leadership and scale should improve margins and profitability, with 200-300bps annual margin growth expected. MMYT is forecasted to deliver 30%+ Ebitda growth, with a target price of $124.

InterGlobe Aviation

Goldman Sachs maintains a 'buy' rating on IndiGo citing sustainable market share gains, cost leadership, and strong international growth. With a target price of Rs 5,050, the airline is expected to grow Ebitda at 17% CAGR from financial year 2024-2027. Risks include rising oil prices, rupee depreciation, and capacity delays.

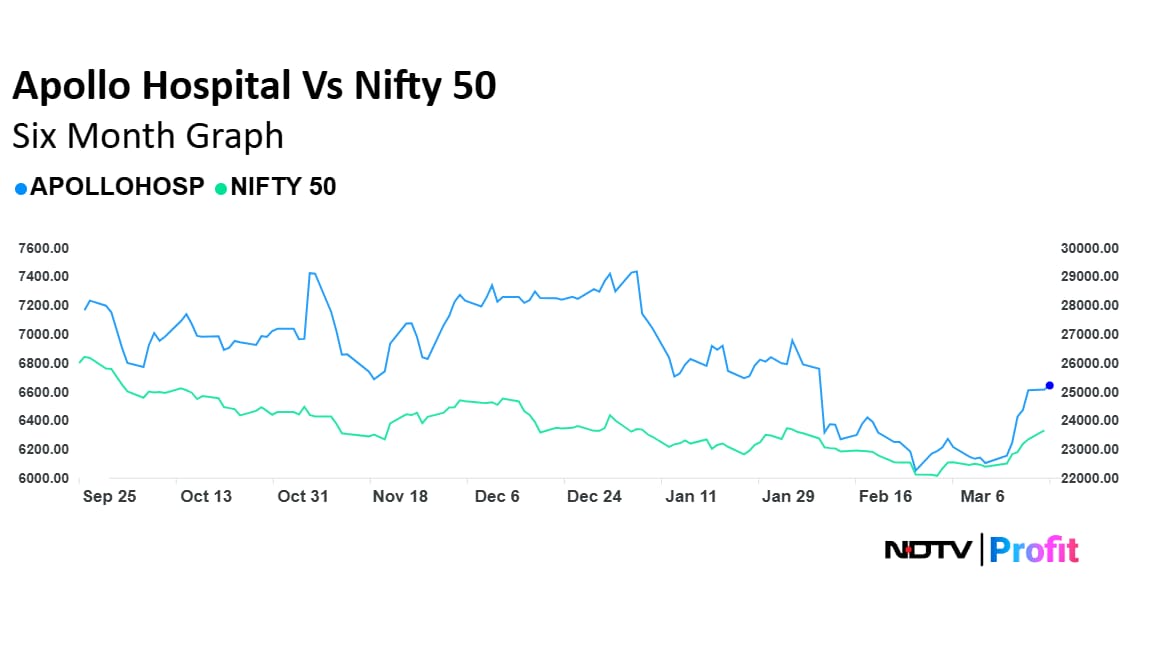

Apollo Hospitals

Apollo Hospitals is well-positioned for growth, with improved hospital occupancy, operating leverage, and breakeven for Apollo 24x7. The company is also expanding its diagnostics business. Goldman Sachs expects 26% Ebitda growth over financial year 2024-2027E, making the stock attractive at current valuations. The brokerage maintains a 'buy' rating with a target price of Rs 8,025.

Titan

Titan has seen strong revenue growth driven by market share gains from unorganised jewellers to branded chains. Despite a recent moderation in jewellery EBIT margins, Titan is taking steps to address this, such as lowering gold price premiums and re-engineering designs. The brokerage expects EBIT growth to align with revenue growth over financial year 2025-2027, with an 18% CAGR in standalone EBIT margins, a significant improvement from the previous period's 6.2% CAGR.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.