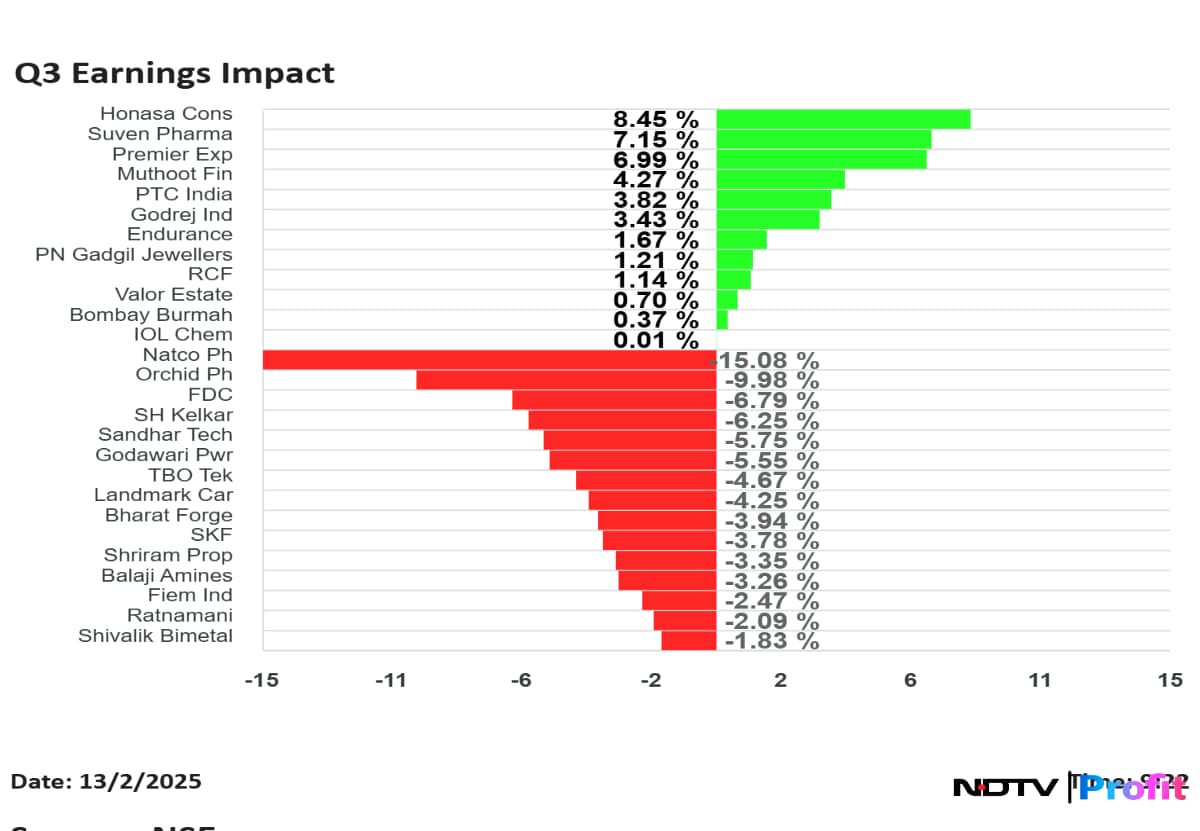

Shares of Godrej Industries Ltd., Honasa Consumers Ltd., Natco Pharma Ltd. and Bharat Forge Ltd. are in focus on Thursday after the companies announced their third quarter results.

Mamaearth's parent company's shares rose the most, while Natco Pharma fell the most, among the companies that announced their results for quarter ended Dec. 31, 2024.

Godrej Industries (Consolidated, YoY)

Shares of the company rose 4.63% to Rs 850.30.

Revenue up 34.4% to Rs 4,824.83 crore versus Rs 3,590.08 crore.

Ebitda up 113.5% to Rs 596.84 crore versus Rs 279.31 crore.

Margin at 12.4% versus 7.8%.

Net profit up 77% to Rs 188.20 crore versus Rs 106.41 crore.

Honasa Consumer (Consolidated, YoY)

Shares of the company rose 8.58% to Rs 222.28.

Revenue up 6% to Rs 517.51 crore versus Rs 488.21 crore. (Estimate Rs 515 crore)

Ebitda down 24% to Rs 26.13 crore versus Rs 34.45 crore. (Estimate Rs 19 crore)

Margin at 5% versus 7.1%. (Estimate 3.7%)

Net profit flat at Rs 26 crore. (Estimate Rs 17 crore)

Natco Pharma (Consolidated, YoY)

Shares of the company fell 18.60% to Rs 992.15.

Revenue down 37.4% to Rs 475 crore versus Rs 759 crore. (Estimate Rs 877 crore)

Ebitda down 86% to Rs 38.8 crore versus Rs 268 crore. (Estimate Rs 303 crore)

Margin at 8.2% versus 35.3%. (Estimate 34.5%)

Net profit down 37% to Rs 133 crore versus Rs 213 crore. (Estimate Rs 247 crore)

Approved interim dividend of Rs 1.5 per share; record date set for Feb. 18.

Bharat Forge (Consolidated, YoY)

Shares of the company fell 5.43%% to Rs 1,044.70.

Revenue down 10.12% to Rs 3,475 crore versus Rs 3,866 crore (Estimate Rs 3,770 crore).

Ebitda down 10.6% to Rs 624 crore versus Rs 698 crore (Estimate Rs 687 crore).

Ebitda margin down 9 bps to 17.95% versus 18.05% (Estimate 18.2%).

Net profit down 16.14% to Rs 213 crore versus Rs 254 crore (Estimate Rs 303 crore).

Shares of the company rose 4.21% to Rs 588.15.

Revenue up 23.5% to Rs 2,435.70 crore versus Rs 1,972.15 crore.

Net profit up 49% to Rs 86.03 crore versus Rs 57.60 crore.

Ebitda up 33% to Rs 122.71 crore versus Rs 92.12 crore.

Margin at 5.0% versus 4.7%.

Muthoot Finance (Standalone, YoY)

Shares of the company rose 5.16% to Rs 2,295.45.

NII up 42.8% to Rs 2,722 crore versus Rs 1,906 crore.

Profit after tax up 32.7% to Rs 1,363 crore versus Rs 1,027 crore.

TBO TEK (Consolidated, YoY)

Shares of the company fell 5.41% to Rs 1,534.15.

Revenue up 29.2% to Rs 422 crore versus Rs 327 crore (Estimate: Rs 398 crore).

Ebitda down 1.4% to Rs 55.2 crore versus Rs 56 crore (Estimate: Rs 68 crore).

Margin at 13.1% versus 17.1% (Estimate: 17.1%).

Net profit down 2.7% to Rs 49.9 crore versus Rs 51.3 crore (Estimate: Rs 51 crore).

Landmark Cars (Consolidated, YoY)

Shares of the company fell 5.45% to Rs 483.35.

Revenue up 24.6% to Rs 1,195 crore versus Rs 959 crore.

Ebitda up 2% to Rs 67 crore versus Rs 65 crore.

Margin at 5.6% versus 6.8%.

Net profit down 38% to Rs 11 crore versus Rs 18 crore.

Shivalik Bimetal Controls (Consolidated, YoY)

Shares of the company fell 2.02% to Rs 474.

Revenue down 2.3% to Rs 123.28 crore versus Rs 126.21 crore.

Ebitda down 3% to Rs 24.55 crore versus Rs 25.18 crore.

Margin flat at 19.9%.

Net profit up 8% to Rs 18.24 crore versus Rs 16.96 crore.

The board of directors have approved an interim dividend of Rs 1.20 per share and fixed Feb. 20 as the record date for the same.

Suven Pharma (Consolidated, YoY)

Shares of the company rose 7.98% to Rs 1,131.80.

Revenue up 39.7% to Rs 307.15 crore versus Rs 219.82 crore.

Ebitda up 78% to Rs 117.70 crore versus Rs 66.08 crore.

Margin at 38.3% versus 30.1%.

Net profit up 77% to Rs 82.88 crore versus Rs 46.75 crore.

SMS Pharmaceuticals (Consolidated, YoY)

Shares of the company fell 2.15% to Rs 207.

Revenue up 7.4% to Rs 173.35 crore versus Rs 161.48 crore.

Ebitda up 15% to Rs 33.21 crore versus Rs 29 crore.

Margin at 19.2% versus 18%.

Net profit up 39% to Rs 17.08 crore versus Rs 12.29 crore.

S H Kelkar (Consolidated, YoY)

Shares of the company fell 8.01% to Rs 183.

Revenue up 15.2% to Rs 543.21 crore versus Rs 471.68 crore.

Ebitda down 15% to Rs 64.54 crore versus Rs 75.86 crore.

Margin at 11.9% versus 16.1%.

Net profit down 46% to Rs 17.52 crore versus Rs 32.21 crore.

PTC India (Consolidated, YoY)

Shares of the company rose 5.36% to Rs 139.68.

Revenue down 0.2% to Rs 3,420.81 crore versus Rs 3,428.01 crore.

Ebitda up 24% to Rs 309.59 crore versus Rs 249.72 crore.

Margin at 9.1% versus 7.3%.

Net profit up 63% to Rs 152.92 crore versus Rs 93.90 crore.

Bombay Burmah Trading (Consolidated, YoY)

Shares of the company fell 1.80% to Rs 1,977.35.

Revenue up 8% to Rs 4,684.91 crore versus Rs 4,336.73 crore.

Ebitda up 9% to Rs 874.44 crore versus Rs 799.08 crore.

Margin at 18.7% versus 18.4%.

Net profit down 12% to Rs 338.98 crore versus Rs 386.57 crore.

Approved dividend of Rs 13 per share with record date as Feb. 21.

IIFL Finance (Consolidated, QoQ)

Shares of the company fell 1.80% to Rs 1,977.35.

Total income down 4.4% to Rs 2,442.58 crore versus Rs 2,556.04 crore.

Net profit down 92% to Rs 40.70 crore versus Rs 490.44 crore.

Premier Explosives (Consolidated, YoY)

Shares of the company rose 12.36% to Rs 416.85.

Revenue more than triples to Rs 165.92 crore versus Rs 44.56 crore.

Ebitda at Rs 15.44 crore versus Rs 4.88 crore.

Margin at 9.3% versus 11%.

Net profit up over five times to Rs 9.22 crore versus Rs 1.71 crore.

FDC (Consolidated, YoY)

Shares of the company rose 6.98% to Rs 410.30.

Revenue up 1.3% to Rs 464.11 crore versus Rs 458.12 crore.

Ebitda down 44% to Rs 46.65 crore versus Rs 83.74 crore.

Margin at 10.1% versus 18.3%.

Net profit down 53% to Rs 37.04 crore versus Rs 79.18 crore.

Fineotex Chemical (Consolidated, YoY)

Shares of the company rose 3.75% to Rs 269.80.

Revenue down 9.1% to Rs 125.92 crore versus Rs 138.45 crore.

Ebitda down 15% to Rs 34.29 crore versus Rs 40.35 crore.

Margin at 27.2% versus 29.1%.

Net profit down 16% to Rs 27.58 crore versus Rs 32.67 crore.

Jindal Worldwide (Consolidated, YoY)

Shares of the company fell 2.28% to Rs 381.05.

Revenue up 42.6% to Rs 624 crore versus Rs 438 crore.

Ebitda up 0.1% to Rs 50.7 crore versus Rs 50.6 crore.

Margin at 8.1% versus 11.6%.

Net profit down 12.3% to Rs 18.4 crore versus Rs 21 crore.

Orchid Pharma (Consolidated, YoY)

Shares of the company fell 17.86% to Rs 1,013.65.

Revenue down 1.37% to Rs 217 crore versus Rs 220 crore.

Ebitda down 24.05% to Rs 26.4 crore versus Rs 34.76 crore.

Ebitda margin down 363 bps to 12.16% versus 15.8%.

Net profit down 25.63% to Rs 22.45 crore versus Rs 30.19 crore.

Shares of the company fell 3.29% to Rs 1,326.

Revenue up 21.7% to Rs 593.09 crore versus Rs 487.28 crore.

Ebitda up 20% to Rs 77.56 crore versus Rs 64.88 crore.

Margin at 13.1% versus 13.3%.

Net profit up 16% to Rs 47.02 crore versus Rs 40.50 crore.

Shares of the company rose 2.67% to Rs 141.52.

Net profit down 99% to Rs 4.6 crore versus Rs 464 crore.

Revenue up 131.5% to Rs 330 crore versus Rs 143 crore.

Ebitda down 77.7% to Rs 17.9 crore versus Rs 80.6 crore.

Margin at 5.4% versus 56.4%.

Shares of the company fell 8.69% to Rs 371.05.

Revenue up 9.5% to Rs 974 crore versus Rs 890 crore.

Ebitda up 7.2% to Rs 95 crore versus Rs 89 crore.

Ebitda margin at 9.7% versus 10%.

Net profit up 18.7% to Rs 30 crore versus Rs 25 crore.

Shares of the company fell 4.22% to Rs 76.11.

Revenue down 45.2% to Rs 121 crore versus Rs 221 crore.

Ebitda loss at Rs 15 crore versus profit of Rs 19 crore.

Net profit down 29.8% to Rs 13 crore versus Rs 19 crore.

Ratnamani Metals (Consolidated, YoY)

Shares of the company fell 2.50% to Rs 2,483.55.

Net profit down 1.2% to Rs 131 crore versus Rs 133 crore.

Revenue up 4.7% to Rs 1,316 crore versus Rs 1,257 crore.

Ebitda up 1.7% to Rs 204 crore versus Rs 200 crore.

Margin at 15.5% versus 15.9%.

Precision Wires (Consolidated, YoY)

Shares of the company fell 4.33% to Rs 138.50.

Net profit up 5% to Rs 19 crore versus Rs 18 crore.

Revenue up 22.5% to Rs 979 crore versus Rs 799 crore.

Ebitda up 10.6% to Rs 36.9 crore versus Rs 33.3 crore.

Margin at 3.8% versus 4.2%.

Dollar Industries (Consolidated, YoY)

Shares of the company fell 3.30% to Rs 417.

Revenue up 14.8% to Rs 381 crore versus Rs 332 crore.

Ebitda up 27.6% to Rs 41.6 crore versus Rs 32.6 crore.

Margin at 10.9% versus 9.8%.

Net profit up 12.8% to Rs 20 crore versus Rs 17.7 crore.

Entero Healthcare (Consolidated, YoY)

Shares of the company rose 3.59% to Rs 1,349.40.

Revenue up 36.9% to Rs 1,359 crore versus Rs 993 crore.

Ebitda up 74.7% to Rs 49.8 crore versus Rs 28.5 crore.

Margin at 3.7% versus 2.9%.

Net profit up to Rs 25.4 crore versus Rs 6.7 crore.

Balaji Amines (Consolidated, YoY)

Shares of the company fell 5.28% to Rs 1,489.75.

Revenue down 18.4% to Rs 312.73 crore versus Rs 383.36 crore.

Ebitda down 38% to Rs 45.71 crore versus Rs 74.20 crore.

Margin at 14.6% versus 19.4%.

Net profit down 33% to Rs 33.19 crore versus Rs 49.37 crore.

IOL Chemicals & Pharmaceuticals (Consolidated, YoY)

Shares of the company fell 1.21% to Rs 352.40.

Revenue up 0.6% to Rs 523.30 crore versus Rs 520.39 crore.

Ebitda up 6% to Rs 46.87 crore versus Rs 44.35 crore.

Margin at 9% versus 8.5%.

Net profit down 11% to Rs 20.53 crore versus Rs 23.08 crore.

Board declares interim dividend of Rs 4 per share; record date set for Feb. 18.

SKF India (Consolidated, YoY)

Shares of the company fell 4.08% to Rs 3,643.10.

Revenue up 15% to Rs 1,256 crore versus Rs 1,091 crore. (Estimate: Rs 1,266 crore)

Ebitda down 30% to Rs 121 crore versus Rs 172 crore. (Estimate: Rs 208 crore)

Margin at 9.7% versus 15.8%. (Estimate: 16.4%)

Net profit down 17% to Rs 109 crore versus Rs 132 crore. (Estimate: Rs 154 crore)

Endurance Tech (Consolidated, YoY)

Shares of the company rose 3.70% to Rs 1,938.80.

Revenue up 11.6% to Rs 2,859 crore versus Rs 2,561 crore. (Estimate: Rs 2,905 crore)

Ebitda up 24.5% to Rs 372 crore versus Rs 299 crore. (Estimate: Rs 383 crore)

Margin at 13% versus 11.7%. (Estimate: 13.2%)

Net profit up 21% to Rs 184 crore versus Rs 152 crore. (Estimate: Rs 198 crore)

Crompton Greaves Consumer Electricals (Consolidated, YoY)

Shares of the company rose 2.90% to Rs 349.85.

Revenue up 4.5% to Rs 1,769.21 crore versus Rs 1,692.69 crore. (Estimate: Rs 1,804 crore)

Ebitda up 25% to Rs 187.93 crore versus Rs 149.80 crore. (Estimate: Rs 180 crore)

Margin at 10.6% versus 8.8%. (Estimate: 10%)

Net profit up 28% to Rs 109.84 crore versus Rs 85.99 crore. (Estimate: Rs 109 crore)

Godawari Power (Consolidated, YoY)

Shares of the company fell 6.80% to Rs 163.65.

Revenue down 0.9% to Rs 1,297.60 crore versus Rs 1,308.92 crore.

Ebitda down 33% to Rs 221.15 crore versus Rs 330.91 crore.

Margin at 17% versus 25.3%.

Net profit down 37% to Rs 144.78 crore versus Rs 229.26 crore.

ITD Cementation (Consolidated, YoY)

Shares of the company fell 1.17% to Rs 525.

Revenue up 11.3% to Rs 2,244.86 crore versus Rs 2,017.16 crore.

Ebitda up 1% to Rs 206.06 crore versus Rs 204.80 crore.

Net profit up 11% to Rs 87.02 crore versus Rs 78.39 crore.

Rashtriya Chemicals Fertilizers (Consolidated, YoY)

Shares of the company rose 3.29% to Rs 144.68.

Revenue down 7.86% to Rs 4,518 crore versus Rs 4,903 crore.

Ebitda up 115.66% to Rs 179 crore versus Rs 83 crore.

Ebitda margin up 226 bps to 3.96% versus 1.69%.

Net profit up 627.27% to Rs 80 crore versus Rs 11 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.