Asian stocks followed Wall Street higher after US President Donald Trump dropped his tariff threat against European partners, easing trade-war concerns.

The MSCI Asia Pacific Index rose 0.9% — putting it in line to break a three-day losing streak — with most of the sub-sectors gaining. South Korean shares climbed to a new record. S&P 500 futures rose 0.2%, suggesting momentum could carry the benchmark beyond a rally that delivered its biggest advance since November.

Precious metals retreated with gold falling 1% and silver dropping 1.6% as haven demand ebbed. Bitcoin traded below $90,000 as a sweeping US crypto market bill is likely to be delayed by at least several weeks.

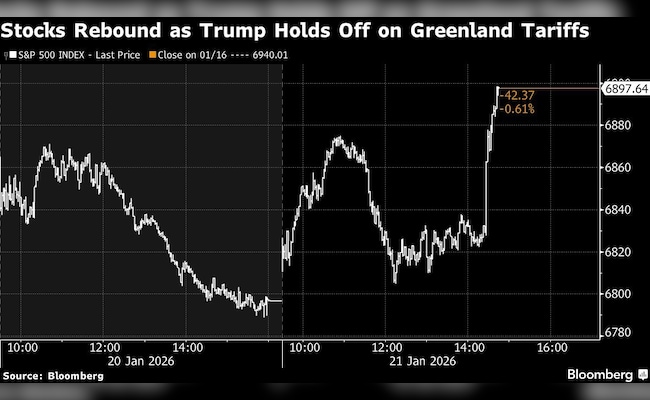

Risk appetite returned to equities after Trump ruled out military force and said he would refrain from imposing tariffs on Europe, citing a “framework” deal over Greenland. Investors interpreted the remarks at the World Economic Forum in Davos as a sign of easing geopolitical and trade tensions.

“The framework of the Greenland deal takes down the temperature a lot, given the happenings over the weekend,” said Joe Gilbert, portfolio manager at Integrity Asset Management. “Less tariffs are unequivocally a positive for markets.”

The S&P 500 climbed 1.2% Wednesday, erasing its losses for the year, while an index of Chinese companies listed in the US gained 2.2%. The Nasdaq 100 jumped 1.4%.

Small caps beat the US equity benchmark for a 13th straight session. Big tech also rose.

In other corners of the market, Australia's three-year yield rose to the highest since November 2023 after unemployment unexpectedly fell in December.

On Greenland, Trump didn't detail the parameters of the so-called “framework” and it was unclear what the agreement entails. Earlier on Wednesday, Denmark also ruled out negotiations over ceding the semi-autonomous island to the US.

Trump's decision marked a stark reversal for a president who has repeatedly attempted to coerce Europe over Greenland. It came after a meeting with North Atlantic Treaty Organization Secretary General Mark Rutte in Davos.

“Confidence in the ‘Trump Put' strengthened,” wrote Dilin Wu, a strategist at Pepperstone Group Ltd., referring to a belief that market losses of high magnitude would drive Trump to reverse course. The president's move prompted a “rapid rebuild of risk exposure that had been cut amid political noise. Dip-buying regained traction.”

What Bloomberg strategists say...

Developments on Greenland have taken equities back to their default setting: a market that wants to melt higher as optimism over a re-acceleration in growth broadens. Volatility declines show the fear premium that was built up on Tuesday has receded quickly.

— Michael Ball, Macro Strategist, Markets Live. For the full analysis, click here.

Elsewhere, global bonds found firmer footing after long-dated Japanese debt rebounded from its losses on Tuesday. Trump's comments also helped steady Treasuries, with 30-year US yields almost six basis points lower.

Treasuries were steady in early Asian trading on Thursday after a $13 billion auction of 20-year bonds in the US met solid demand. The dollar also edged higher.

“There was definitely some worry that given the recent geopolitical turmoil we might have seen a bit lower demand heading into the auction,” said Jan Nevruzi, an interest-rate strategist at TD Securities. It was mitigated by the Davos comments, higher yields and the Treasury market's ability based on its size to withstand “marginal reallocations.”

Stock Market Live Updates: GIFT Nifty Hints At Gap-Up Opening

Corporate Highlights:

- OpenAI Chief Executive Officer Sam Altman has been meeting with top investors in the Middle East to line up funding for a new investment round that could total at least $50 billion, according to people familiar with the matter.

- Apple Inc. plans to revamp Siri later this year by turning the digital assistant into the company's first artificial intelligence chatbot, thrusting the iPhone maker into a generative AI race dominated by OpenAI and Google.

- Renault SA plans to reintegrate its Ampere electric vehicle and software operations as Chief Executive Officer Francois Provost reverses a strategy that sputtered due to lower-than-expected EV demand.

Stocks

- S&P 500 futures rose 0.2% as of 10:05 a.m. Tokyo time

- Hang Seng futures rose 0.2%

- Nikkei 225 futures (OSE) rose 1%

- Japan's Topix rose 0.8%

- Australia's S&P/ASX 200 rose 0.6%

- Euro Stoxx 50 futures rose 1.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1684

- The Japanese yen was little changed at 158.28 per dollar

- The offshore yuan was little changed at 6.9575 per dollar

- The Australian dollar rose 0.4% to $0.6788

Cryptocurrencies

- Bitcoin fell 0.3% to $89,898.95

- Ether fell 0.5% to $3,013.69

Bonds

- The yield on 10-year Treasuries was little changed at 4.24%

- Japan's 10-year yield was little changed at 2.285%

- Australia's 10-year yield advanced one basis point to 4.79%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold fell 1% to $4,782 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.