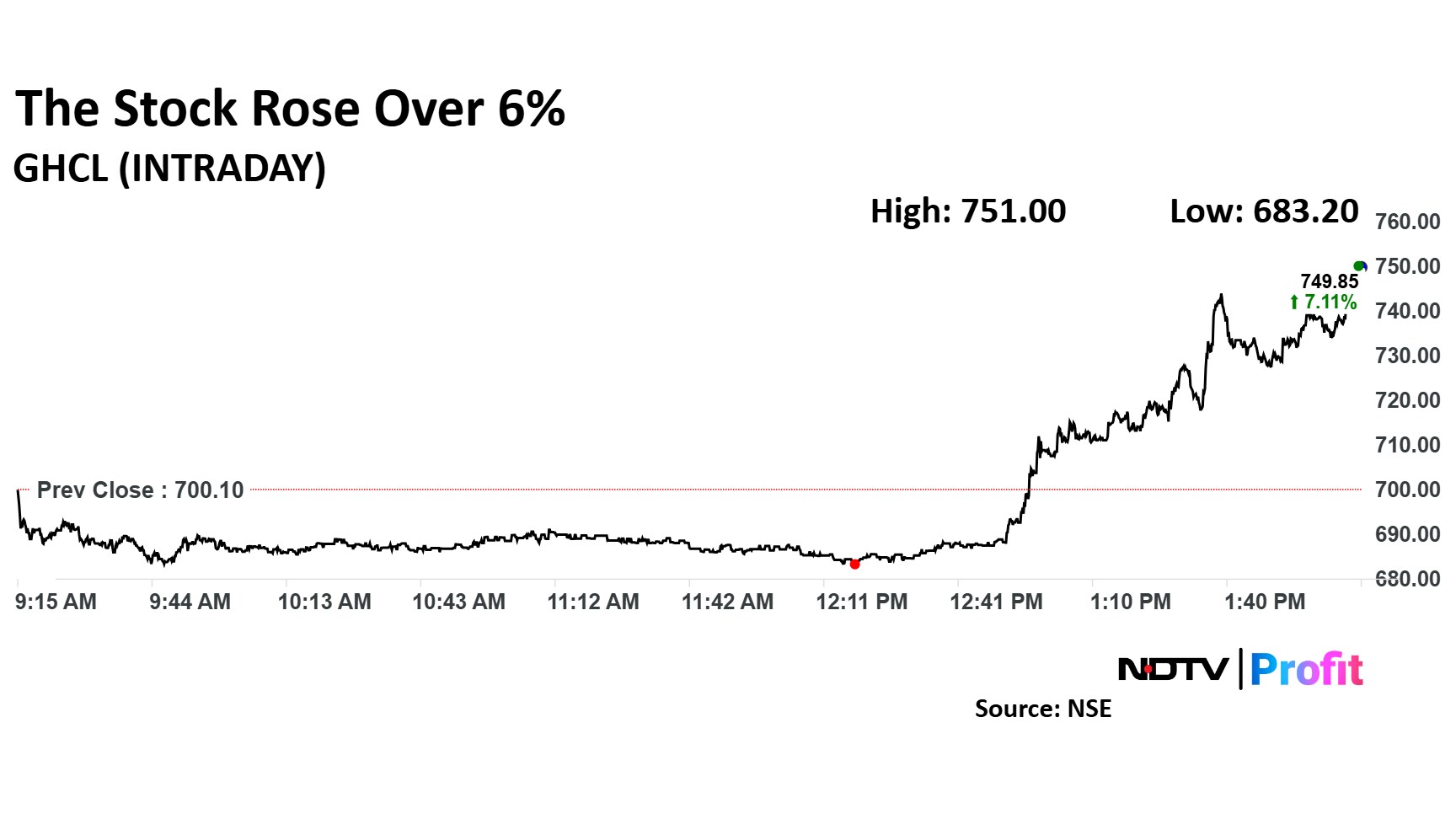

Shares of GHCL Ltd. surged over 6% to an all-time high on December 12, 2024, after the company announced that it had received environment clearance for its Soda Ash Greenfield Project in Kutch, Gujarat. The approval from the Ministry of Environment, Forest and Climate Change, Government of India, marks a significant milestone for the company, which plans to expand its operations in the region.

The environment clearance is a crucial step in the development of the new project, which will contribute to GHCL's growing presence in the soda ash market. The company's decision to invest in the Kutch Greenfield project is seen as a strategic move to meet increasing demand for soda ash, a key raw material in industries like glass manufacturing, chemicals, and detergents. GHCL's stock saw a strong uptick following the announcement, reaching its highest-ever value.

Founded in 1983, GHCL Ltd. is a players in the chemicals and textiles sectors. The company operates a diverse business portfolio, with a significant presence in the soda ash industry. GHCL is one of the largest producers of soda ash in India, and its manufacturing facilities are equipped with state-of-the-art technology to cater to both domestic and international markets.

GHCL also has a strong footprint in the textile sector, with its home textile division supplying products to major international retailers.

With the new project in Kutch, GHCL aims to enhance its production capacity, further consolidating its position as a leading soda ash manufacturer.

GHCL share price rose as much as 6.27% to Rs 744 apiece. It pared gains to trade 5.10% higher at Rs 735.80 apiece, as of 02:06 p.m. This compares to a 0.35% decline in the NSE Nifty 50 index.

It has risen 30.89% in the last 12 months. Total traded volume so far in the day stood at 6.2 times its 30-day average. The relative strength index was at 75.

Out of three analysts tracking the company, one maintains a 'buy' rating, two recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.