Shares of Garden Reach Shipbuilder & Engineers Ltd. rose on Tuesday to hit a three-month high, after the company signed a contract for construction and delivery of two ships with a company in Germany.

In a bid to expand its global footprint, the shipbuilder signed a contract with Carsten Rehder Schiffsmakler and Reederei GmbH & Co. KG Germany, the company said in an exchange filing on Monday. The order is for the construction and delivery of two ships from the series of the additional four 7,500 DWT Multi-Purpose Vessels.

Each ship will be 120 metres long and 17 metres wide, with a maximum draft of 6.75 metres. It can carry 7,500 metric tonnes of cargo.

These ships have been specifically designed to carry multiple large windmill blades on deck. It will also have a single cargo hold to accommodate bulk, general and project cargoes and containers will be carried on the hatch covers.

This is in line with the 'Option Agreement' signed between both the companies for the procurement of four additional multi-purpose vessels. "The shipyard will build a total of eight vessels at an approximate order value of 108 MUSD," according to the agreement.

Garden Reach Shipbuilders Shares Rise

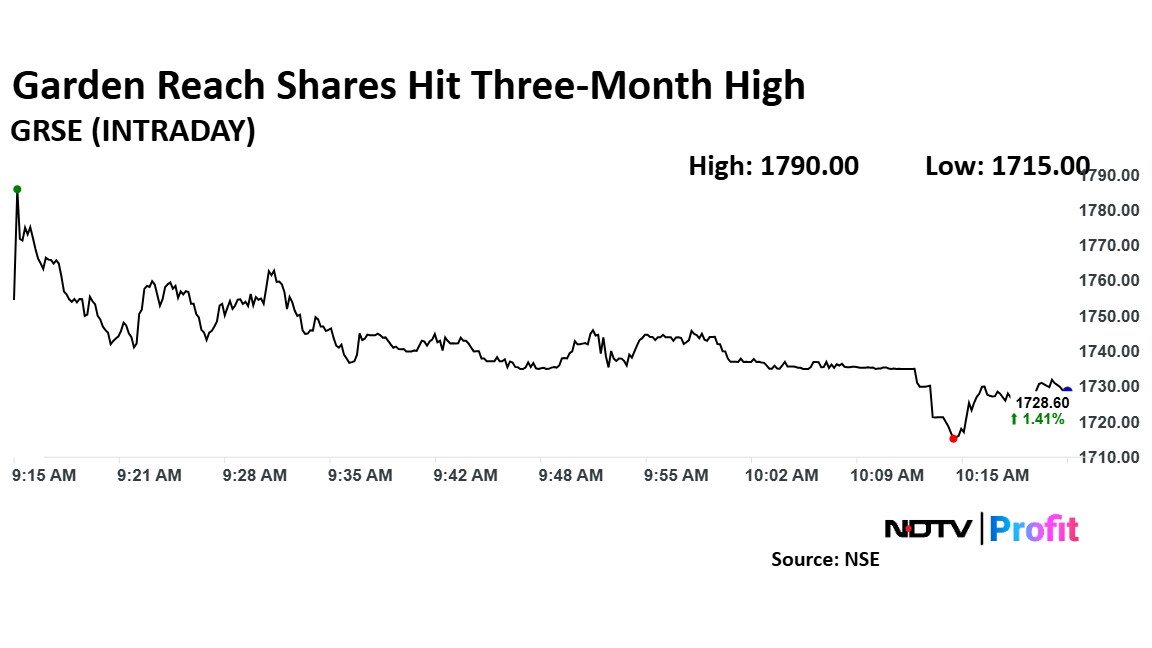

Shares of Garden Reach Shipbuilders & Engineers rose as much as 5.1% to Rs 1,790 apiece, the highest level since Dec. 17, 2024. They pared gains to trade 2.97% higher at Rs 1,755.15 apiece, as of 10:14 a.m. This compares to a 0.52% advance in the NSE Nifty 50.

The stock has risen 118.71% in the last 12 months and 4.61% year-to-date. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 72, indicating it was overbought.

Out of four analysts tracking the company, three maintain a 'buy' rating and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 24.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.