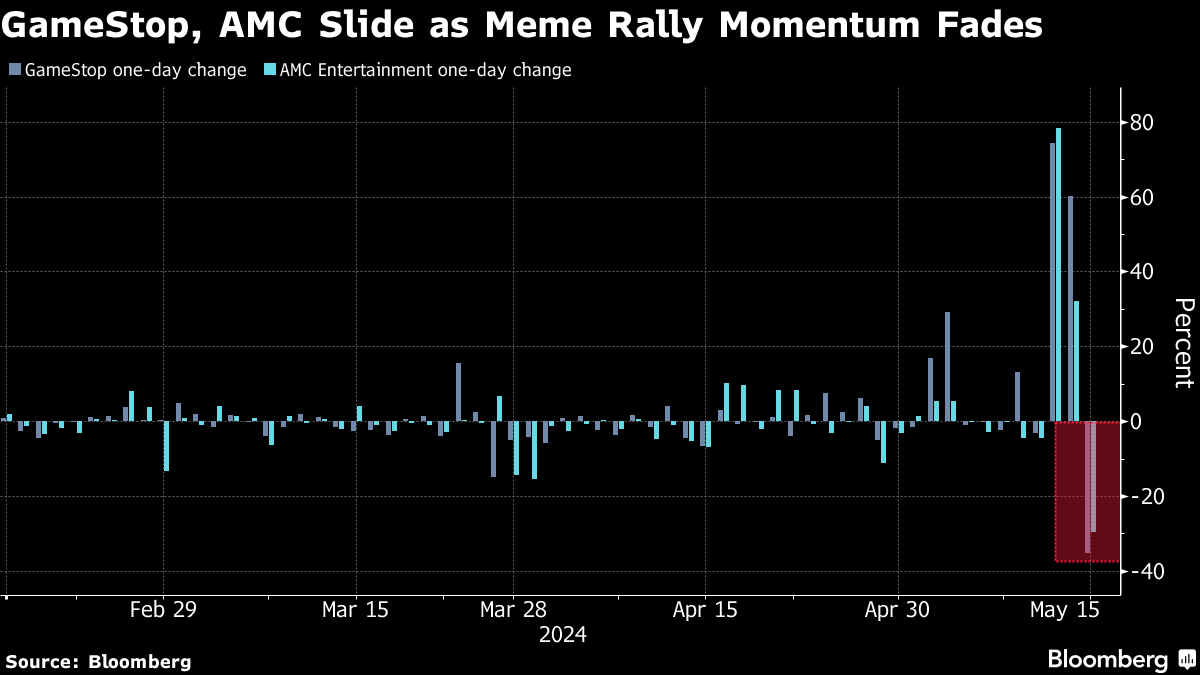

(Bloomberg) -- The meme rally that added about $11 billion in value to GameStop Corp. and AMC Entertainment Holdings Inc. faltered Wednesday, wiping out a large swath of the gains in the first minutes of trading.

GameStop fell as much as 33% on Wednesday, the most intraday since March 2021. AMC sank as much as 26% after the beleaguered movie theater chain took advantage of its equity rally through a private deal to reduce its debt. The stocks had more than doubled over the first two days of the week, before the Wednesday slide erased more than $4 billion in market value between the two.

The latest rout brings further echoes of the meme insanity that gripped markets in early 2021. Then, GameStop soared by more than 1000% in a matter of weeks before rapidly unwinding much of the gains. The stock swung for months, never fully regaining its early heights, before the retail mania finally dissipated.

The conditions that drove the surge in stock prices then are no longer present, so this time around the rally may not last as long, said Ben Laidler, global markets strategist at eToro.

“This time it is different,” he said. “The pandemic lockdown is over. Excess consumer savings are largely long spent. Short positions in these stocks are much smaller though not small. Interest rates are much higher.”

AMC said in a filing Wednesday that it would issue shares to cut about $164 million of its debt in a private deal that valued the stock, based on the principal exchanged and the accrued interest, at $7.33 per share. On Tuesday, the company said it completed an equity offering to raise about $250 million, selling 72.5 million shares at an average price of $3.45 per share. The stock ended last week at $2.91, and closed Tuesday at $6.85 following the two-day surge.

Read more: AMC Seizes on Meme Stock Momentum to Cut $164 Milllion of Debt

Social media posts this week by Keith Gill, who drove the meme-stock mania of 2021 under the moniker “Roaring Kitty,” made for effective kindling for this latest rally. Gill shot to fame that year by rallying day traders on Reddit in an effort to squeeze GameStop short sellers.

Traders betting against some of the most heavily shorted stocks are racking up big paper losses. Meanwhile, option activity on GameStop continued to surge Tuesday, with total trading volume hitting their highest level since 2022, and almost 820,000 contracts traded.

AMC and GameStop were among the top 10 securities bought by retail investors Tuesday, with respectively $51 million and $16 million daily inflows, said Giacomo Pierantoni, head of data at Vanda Research.

This week's rally also boosted other high-risk and heavily shorted stocks as traders looked to stocks beyond GameStop and AMC. Some of this week's big winners have included SunPower Corp. and Virgin Galactic Holdings Inc., both of which fell on Wednesday.

--With assistance from Bailey Lipschultz, Michael Msika and Claire Boston.

(Updates trading.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.