Shares of Epigral Ltd. jumped over 9% on Monday after the company reported robust third-quarter earnings and declared an interim dividend of Rs 2.5 per share.

Epigral reported a substantial growth in both revenue and profit for the October-December quarter. The company's consolidated net profit more than doubled to Rs 104 crore, compared to Rs 49.1 crore in the same period last year. This strong performance was supported by a 36.8% increase in revenue, which reached Rs 645 crore, up from Rs 472 crore in the corresponding quarter of the previous year.

The company also witnessed a sharp increase in Ebitda, which rose by 48.7% to Rs 183 crore, compared to Rs 123 crore in the third quarter of the last fiscal. The margin expanded to 28.3%, up from 26% in the year-ago period, reflecting improved cost efficiencies and higher sales growth.

In addition to the strong earnings, Epigral's board declared an interim dividend of Rs 2.5 per share for fiscal 2025. The record date to determine the shareholders eligible for the dividend payout has been fixed as Feb. 7, 2025, an exchange filing noted.

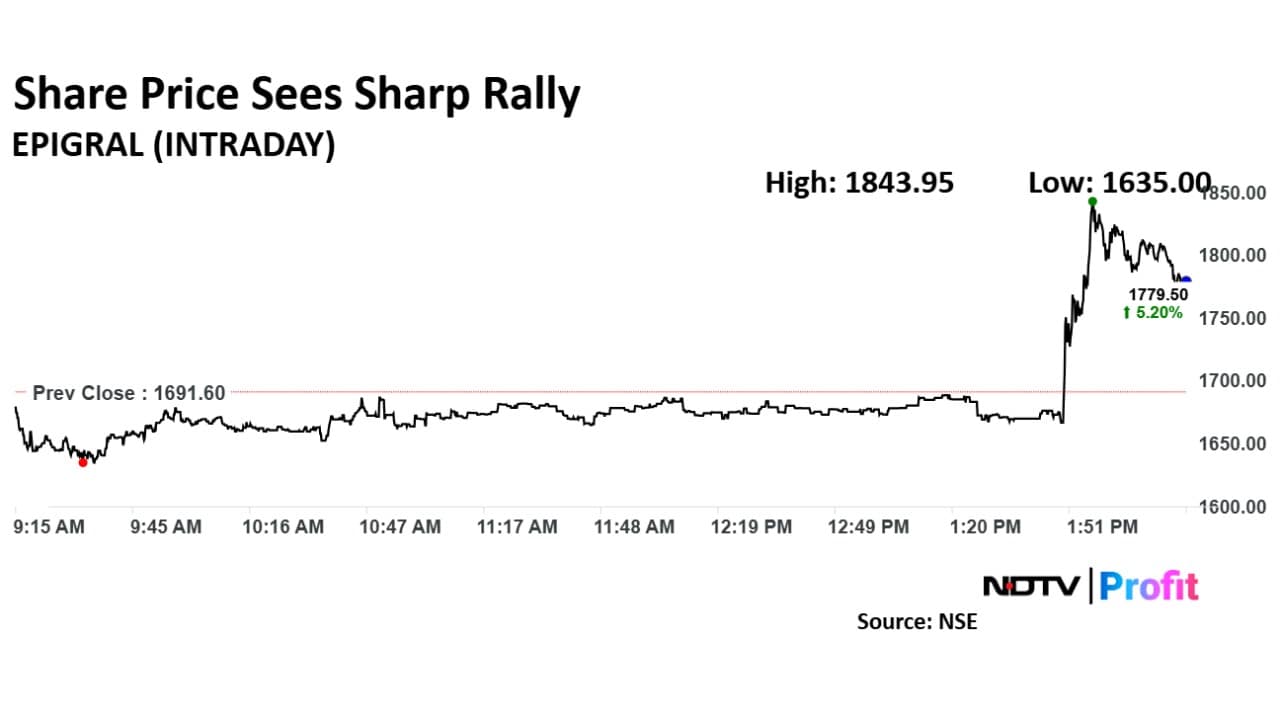

Shares of Epigral rose as much as 9.1% to Rs 1,843.95 apiece on the NSE after the quarterly results were announced. The scrip pared some of the gains to trade 7.04% higher at Rs 1,810.65 apiece, as of 2:04 p.m. This compares to a 1.1% decline in the benchmark Nifty 50 index.

The company's stock has risen by 77.3% in the last 12 months. The relative strength index was at 50.

Out of three analysts tracking the company, two maintain a 'buy' rating, and one recommends a 'hold,' according to Bloomberg data. The average of 12-month analysts' price target implies a downside of 8.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.