The upcoming week's market sentiment will be shaped by a mix of key domestic and global events.

Indian markets will see the earnings season ramping up along with the release of consumer price index data and wholesale price index inflation data for December, which is expected to gauge price and currency stability.

Along with the release of US exports, US imports and trade balance data for December, which will also shape the domestic currency. The Reserve Bank of India will also release data on bank loan growth, deposit growth and federal exchange reserves, which will also shed light on domestic financial performance.

After a toned-down session of listing and maiden issues closing in the previous week, activities in the primary market will be slightly more active in the upcoming five days with two new issues opening and eight listings.

On the global front, the US will release the Federal Budget Balance, Producer Price Index data and core consumer price index; initial jobless claims data; and retail sales data as well as the consumer price index of December, which is expected to gauge the health of the US economy and shape global market forces.

The UK will also release its December CPI data in YoY and MoM formats. China will be releasing its gross domestic product (YoY) data for the fourth quarter of the financial year.

Some of the key companies that have some announcements lined up include Tata Consultancy Services Ltd. for the issuance of a special dividend of Rs 66 and an interim dividend of Rs 10.

Markets Last Week

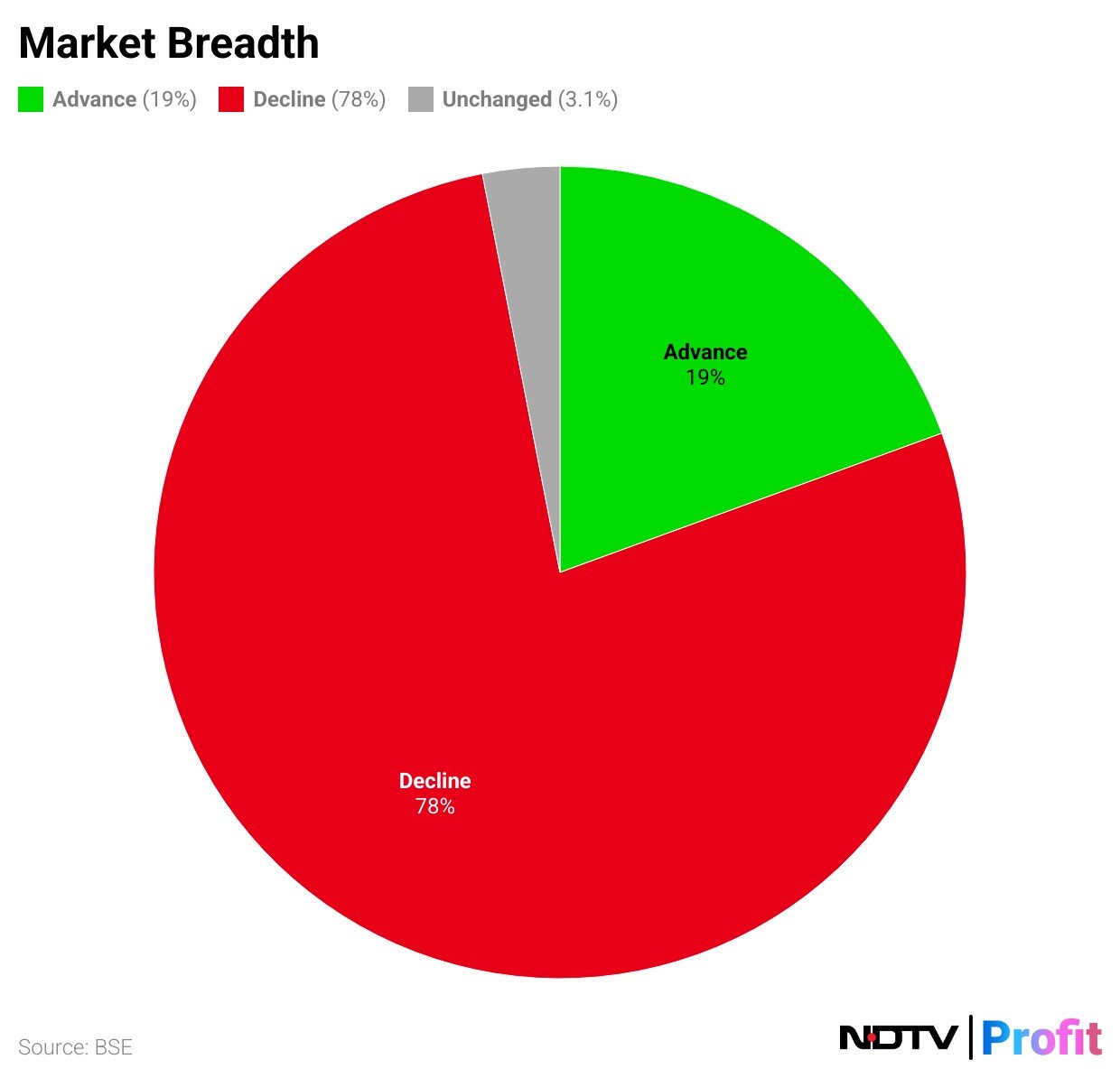

Indian equities seesawed through gains and losses but closed lower for the second consecutive day at the end of the week as financials, pharma and energy stocks weighed. Gains in information-technology stocks helped soften the decline.

The NSE Nifty 50 ended 95 points or 0.4%, lower at 23,431.5, while the BSE Sensex closed 241.3 points or 0.31%, down at 77,378.91. During the session, the Nifty declined as much as 0.77%, to an intraday low of 23,344, while the Sensex fell 0.67% to 77,099.

The Nifty entered the correction zone for the second time in two months. The index has declined over 10% from its 52-week high of 26,178 in late September. The Nifty was in correction territory in late November as well when it dipped below 23,400.

Domestic Cues

The Ministry of Statistics and Programme Implementation will release consumer price index data (year-on-year) on Monday for December, which is expected to shape price stability. Tuesday will see the Indian Ministry of Commerce and Industry releasing wholesale price index inflation data (YoY) for December, which will help gauge the relative strength or weakness of the Indian rupee. Thursday will see the release of US exports, US imports and trade balance data, all for December. And on Friday the Reserve Bank of India will release data on bank loan growth, deposit growth and federal exchange reserves.

Global Cues

The US Department of Treasury will release the Federal Budget Balance on Monday. The US is also set to release its Producer Price Index data on Tuesday.

On Wednesday, the US will release its core consumer price index and the year-on-year and month-on-month data for the consumer price index of December. The UK will also release its December CPI data in YoY and MoM formats.

The UK will release its Gross Domestic Product (MoM) data for November on Thursday. This day will be very significant for US markets that week as core retail sales data (MoM) and initial jobless claims data are released. It will also release the Philadelphia Federal Reserve Manufacturing Index, which measures the relative level of business conditions amongst manufacturers in the Federal Reserve district.

China will also release its GDP (YoY) data for the fourth quarter of the financial year.

The Eurozone will release its core consumer price index and the year-on-year and month-on-month data for the consumer price index of December on Saturday.

Primary Market Action

After a toned-down session of listing and maiden issues closing in the previous week, activities in the primary market will be slightly more active in the upcoming five days with two new issues opening and eight listings.

In the initial public offering space, the maiden issue of Laxmi Dental Ltd. will open for subscription on Monday. The integrated dental products will have their issue price in the range of Rs 407.00 to 428.00.

The mainboard offering includes a fresh issue of 32 lakh shares valued at Rs 138 crore, along with an offer for sale comprising 1.31 lakh shares, amounting to Rs 560.06 crore. The two-day issue will close on Jan 15.

On Wednesday the issue of Kabra Jewels Ltd. will open in the small and medium enterprises space. The IPO aims to raise Rs 40 crore at an issue price of Rs 121 to 128 per share. The two-day issue will close on Jan. 17.

The maiden offerings of Barflex Polychem Ltd. and Sat Kartar Shopping Ltd. in the SME space that began for bidding in the previous week will end on Jan. 15 and Jan. 14, respectively, in the upcoming sessions.

The offerings of Sat Kartar Shopping will list on Friday. Standard Glass Lining Technology Ltd. and Indobell Insulation Ltd., whose offerings opened in the previous week, will have their shares listed on Monday.

Tuesday will be a very busy day for IPOs, with Avax Apparels and Ornaments Ltd., Quadrant Future Tek Ltd., Delta Autocorp Ltd., Capital Infra Trust Invit, and B.R. Goyal Infrastructure Ltd. listing on that day.

Corporate Actions Ahead

Some of the key companies that have some announcements lined up include the issuance of a special dividend of Rs 66 and an interim dividend of Rs 10 for Tata Consultancy Services Ltd. on Friday, during the week. Ultracab (India) Ltd. is having its right issue of equity shares on Thursday. And CESC Ltd. having its interim dividend of Rs. 4.5, and PCBL Ltd. having an interim dividend of Rs. 5.5 on that day. Regis Industries Ltd. will also have its stock split from Rs.10 to Rs.1 on that day.

The table below shows the full list of corporate actions for the upcoming week.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.