(Bloomberg) -- Foreign buyers swooped in to purchase Chinese stocks on Friday as Xi Jinping's government announced a slew of measures to bolster the housing market.

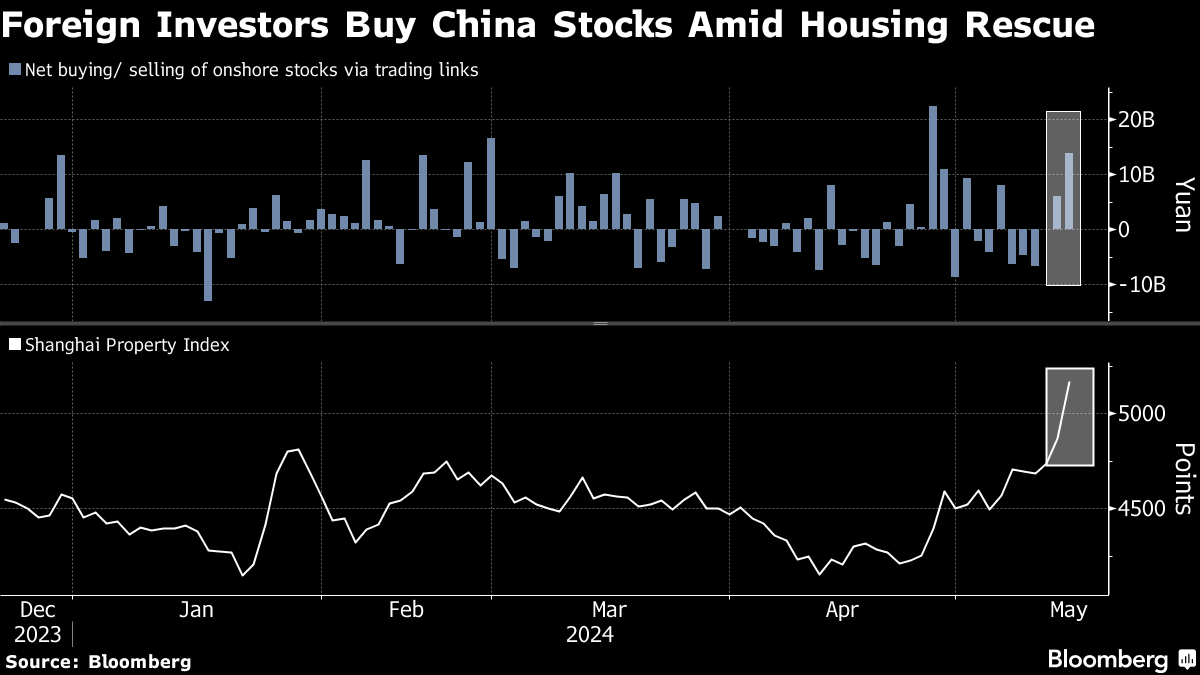

Traders purchased 14 billion yuan ($1.9 billion) of A-shares on Friday via the links with Hong Kong, the most since a record day in late April. That came as Beijing announced its most forceful attempt yet to rescue the beleaguered Chinese property market, including relaxing mortgage rules.

Equity investors had cheered the news on Friday, sending a Bloomberg Intelligence index of developer shares up by nearly 10%. Policymakers are showing a sense of urgency as official data Friday showed that home prices in April had the steepest month-on-month drops in a decade.

Analysts did express some skepticism about the efficacy of the measures. Also, since the flows data aren't intraday, it can't be determined how much of the buying came when the announcement was made. And some of the initiatives — like urging local governments to buy unsold homes — were introduced after the close Friday and wouldn't have been a factor in the flows data.

The Bloomberg China developers index dropped as much as 2.9% on Monday.

Still, the gauge rose 22% in the previous three trading sessions and is hovering around its highest levels since November. With a broader rally in Chinese stocks continuing, optimism from foreign investors appears to be coming back after a long stretch of hesitation.

This story was produced with the assistance of Bloomberg Automation.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.