Kotak Institutional Securities on Thursday put out a note upgrading Cello World Ltd. to a ‘buy' rating and a target price of Rs 717 apiece. Following this, shares of the company rose as much as 7.37% intraday.

The brokerage said the recent 35% correction in the stock was overdone, attributing the decline to weak growth trends, delays in commissioning its glass furnace, and rising discounts pressuring margins. It cut its revenue and margin estimates, resulting in a 12% earnings per share compound annual growth rate forecast for the financial years ending March 2025 to March 2027, down from 16% earlier.

Kotak noted Cello's management has guided for 12–14% revenue growth in the financial year ending March 2026, supported by Rs 1,000 crore in incremental revenue from its new glassware facility. While the ramp-up is expected to weigh on Ebitda margins by 50–100 basis points in the near term, the unit could break even at the earnings before interest and tax level in the same year.

The brokerage also flagged rising competition in the opalware segment, with Milton expected to enter the market after Diwali. However, it believes volume growth should cushion the impact on realisations.

Kotak said risks include persistent weakness in houseware and writing instruments, as well as intensified competition in the opalware segment.

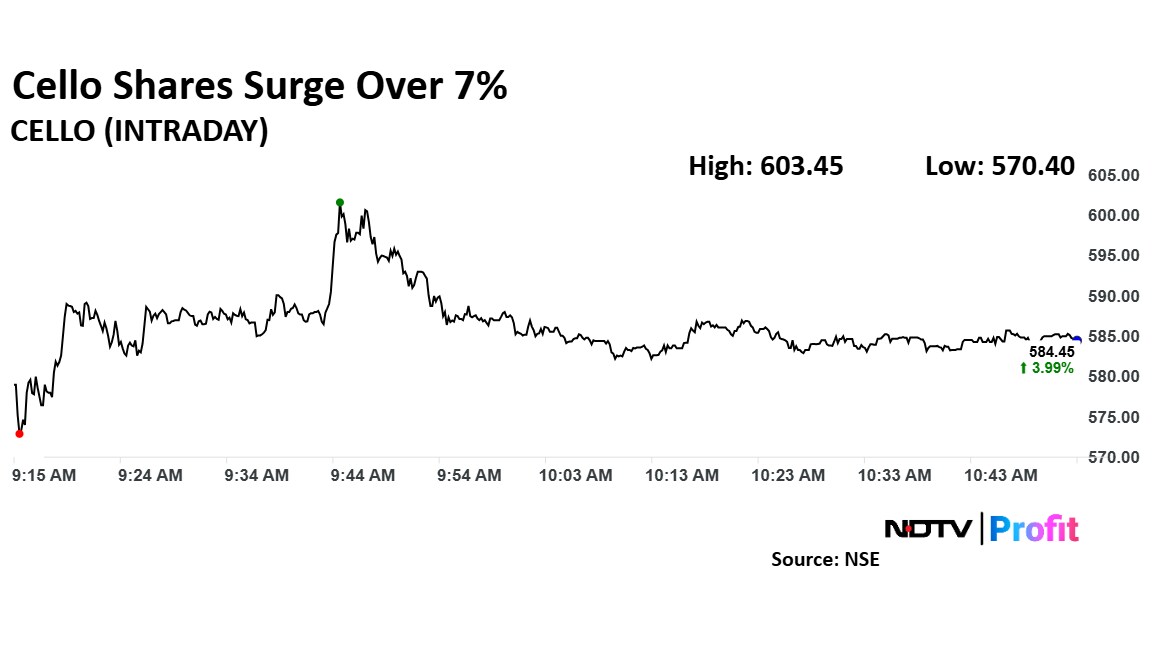

Cello Share Price Today

Cello World stock rose as much as 7.37% during the day to Rs 603.45 apiece on the NSE. It was trading 4.08% higher at Rs 585 apiece, compared to an 0.01% decline in the benchmark Nifty 50 as of 10:52 a.m.

It has fallen 31.8% in the last 12 months and 22.78% on a year-to-date basis. The total traded volume so far in the day stood at 7.8 times its 30-day average. The relative strength index was at 60.91.

Seven out of the nine analysts tracking the consumerware brand have a 'buy' rating on the stock and two recommend a 'hold', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 710.5, implying an upside of 21.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.