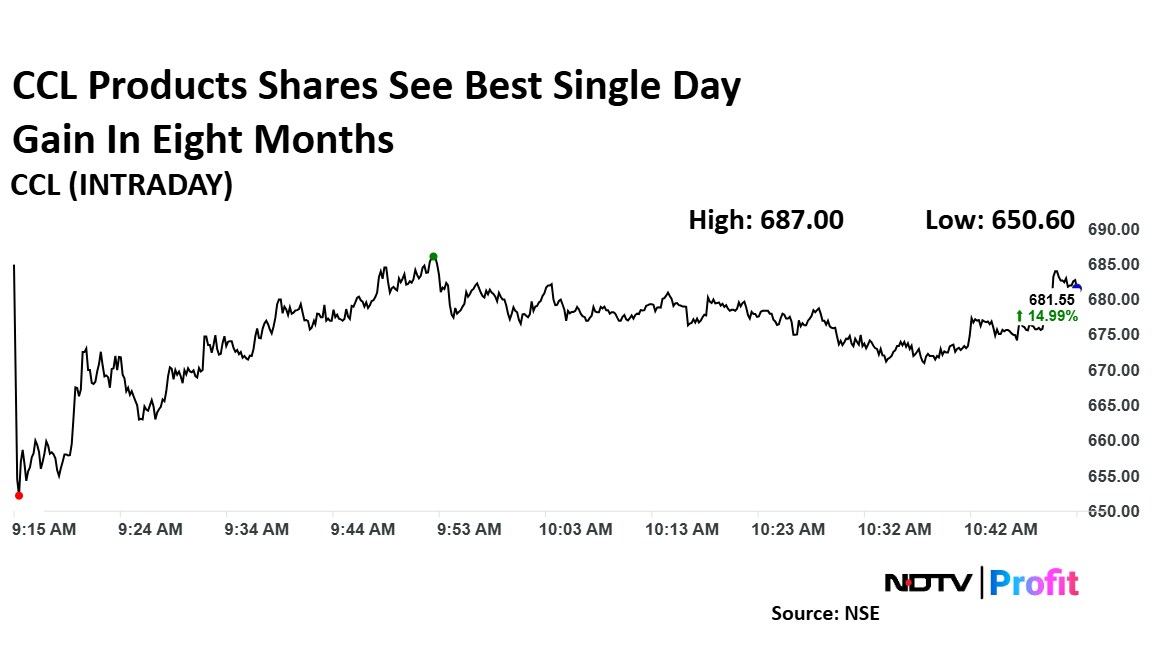

Shares of CCL Products Ltd. rose nearly 16% on Tuesday, hitting nearly one-month high after it reported its fourth-quarter earnings. This is also the best single day gain in nearly eight months.

The producer and distributor of granulated and powdered coffee reported a 56% year-on-year rise in the net profit for the fourth quarter of this financial year to Rs 102 crore. The profit stood at Rs 65.2 crore in the same quarter of the previous fiscal year, according to its stock exchange notification. This was above Bloomberg's estimate of Rs 68 crore.

Revenue increased by 15% year-on-year for the three months ended March, reaching Rs 836 crore. This was above Bloomberg's estimate of Rs 827 crore. Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose 38.2% year-on-year to Rs 163 crore. The Ebitda margin expanded 330 basis points to 19.5% from 16.2% in the same quarter of the previous year. Bloomberg analysts expected the Ebidta at Rs 130 crore and the margin was at 15.7%.

The board of CCL Products recommended a final dividend of Rs 5 per equity share at a face value of Rs 2 each for the year ended March 31, 2025. This payment of the proposed dividend is subject to the approval of members of the company at their annual general meeting.

CCL Products Share Price Rises

The shares of CCL Products rose as much as 15.91% to Rs 687 apiece, the highest level since April 9. It pared gains to trade 14.32% higher at Rs 677.55 apiece, as of 10:51 p.m. This compares to a 0.29% advance in the NSE Nifty 50 Index.

It has risen 16.67% in the last 12 months and fallen 8.31% year-to-date. Total traded volume so far in the day stood at 167 times its 30-day average. The relative strength index was at 68.

Out of 11 analysts tracking the company, eight maintain a 'buy' rating and three recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.