Shares of CCL Products (India) Ltd. jumped to their highest in over a year on Thursday after its first quarter profit meet analysts' estimates.

The maker of Continental Coffee reported a 17.72% year-on-year increase in its net profit to Rs 71.47 crore, according to an exchange filing. That compares with Rs 69 crore consensus estimate of analysts polled by Bloomberg.

The company expects volume growth of 15-20% in the next 2-3 years, leading to an improvement in margins in the long term, the management told NDTV Profit.

However, for the next two years, they expect the margins to remain at the same level.

While the company does not have any capacity expansion plans, its management said it will focus on increasing capacity utilisation.

CCL Products Q1 Results: Key Highlights (Consolidated, YoY)

Revenue up 18.05% at Rs 773 crore. (Bloomberg estimate: Rs 774 crore).

Ebitda up 22.46% at Rs 130 crore. (Bloomberg estimate: Rs 128 crore).

Ebitda margin up 60 bps at 16.8%. (Bloomberg estimate: 16.5%).

Net profit up 17.72% at Rs 71.47 crore. (Bloomberg estimate: Rs 69 crore).

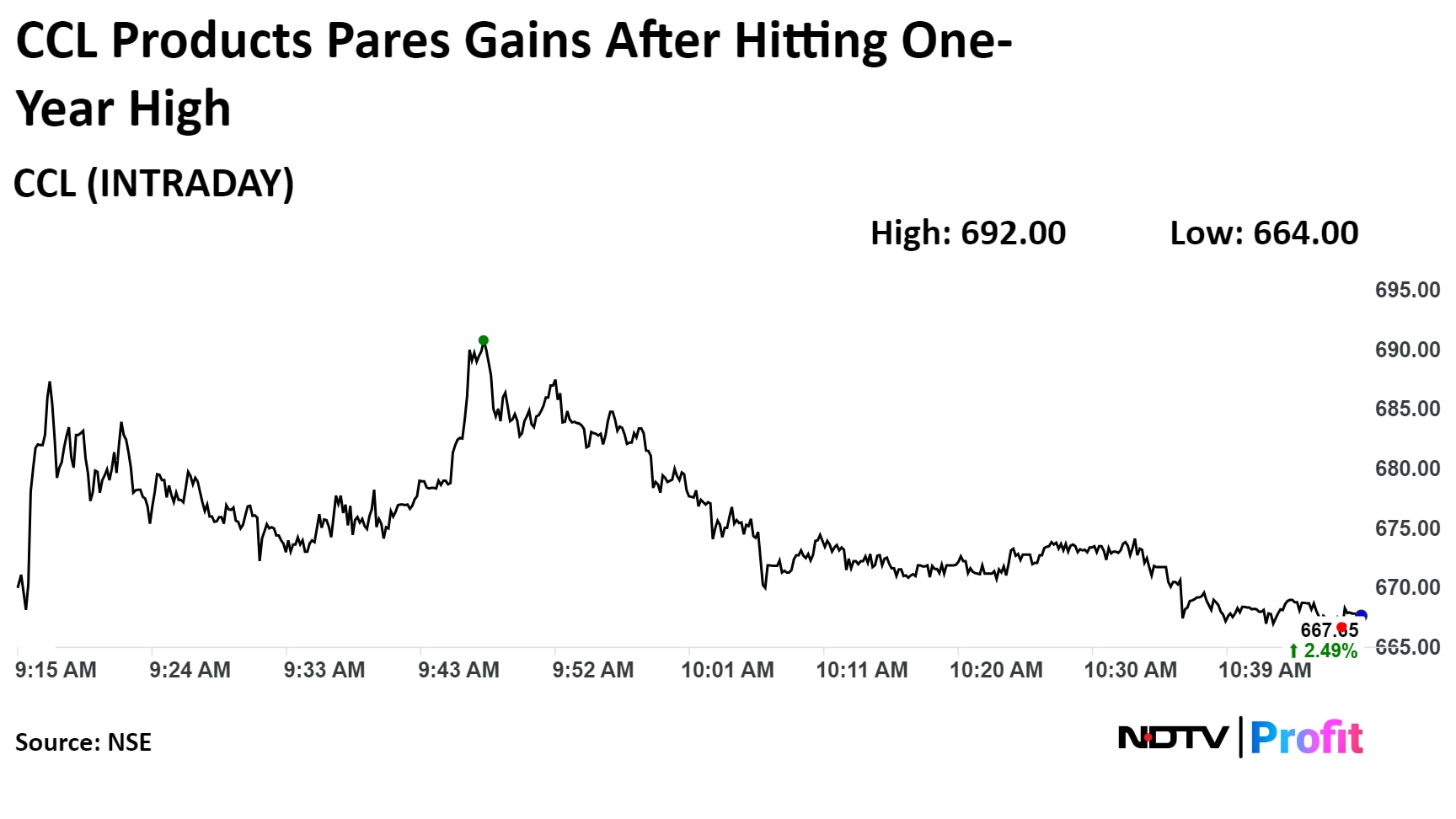

Shares of the company rose 6.22% to Rs 692, its highest level since July 17, 2023. It pared gains to trade 2.6% higher at Rs 667.95 as of 11:10 a.m., compared to a 0.4% decline in the Nifty. The stock has risen nearly 6% in three consecutive sessions of gains.

The stock has risen 3.67% on a year-to-date basis and 10% in the last 12 months. Total traded volume so far in the day stood at 2.61 times its 30-day average. The relative strength index was at 66.23

Out of the 10 analysts tracking the company, seven maintain a 'buy' rating and three recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.2%.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.