BSE Ltd.'s share price jumped 10% in early trade on Friday after market regulator SEBI proposed standardising expiry days for equity derivatives across exchanges, limiting them to either Tuesday or Thursday.

Each exchange must select one of the two days for all its derivatives contracts, including stock and index options and futures, according to a SEBI consultation paper issued on Thursday. The move aims to provide predictability for market participants, reduce concentration risk, and ensure market stability.

Jefferies noted that SEBI's proposal to spread out F&O expiry days could alleviate concerns for BSE. The proposal could lead to NSE reverting to Thursday expiries and BSE retaining Tuesday expiries.

This development may mitigate concerns about BSE losing market share and its estimated 12% impact on earnings per share. Although clarity on open interest limits is still pending, the brokerage expects impact on BSE is relatively lower.

With the stock having recovered most of its losses, reduced regulatory risks and improved market conditions could contribute to a re-rating, analysts said.

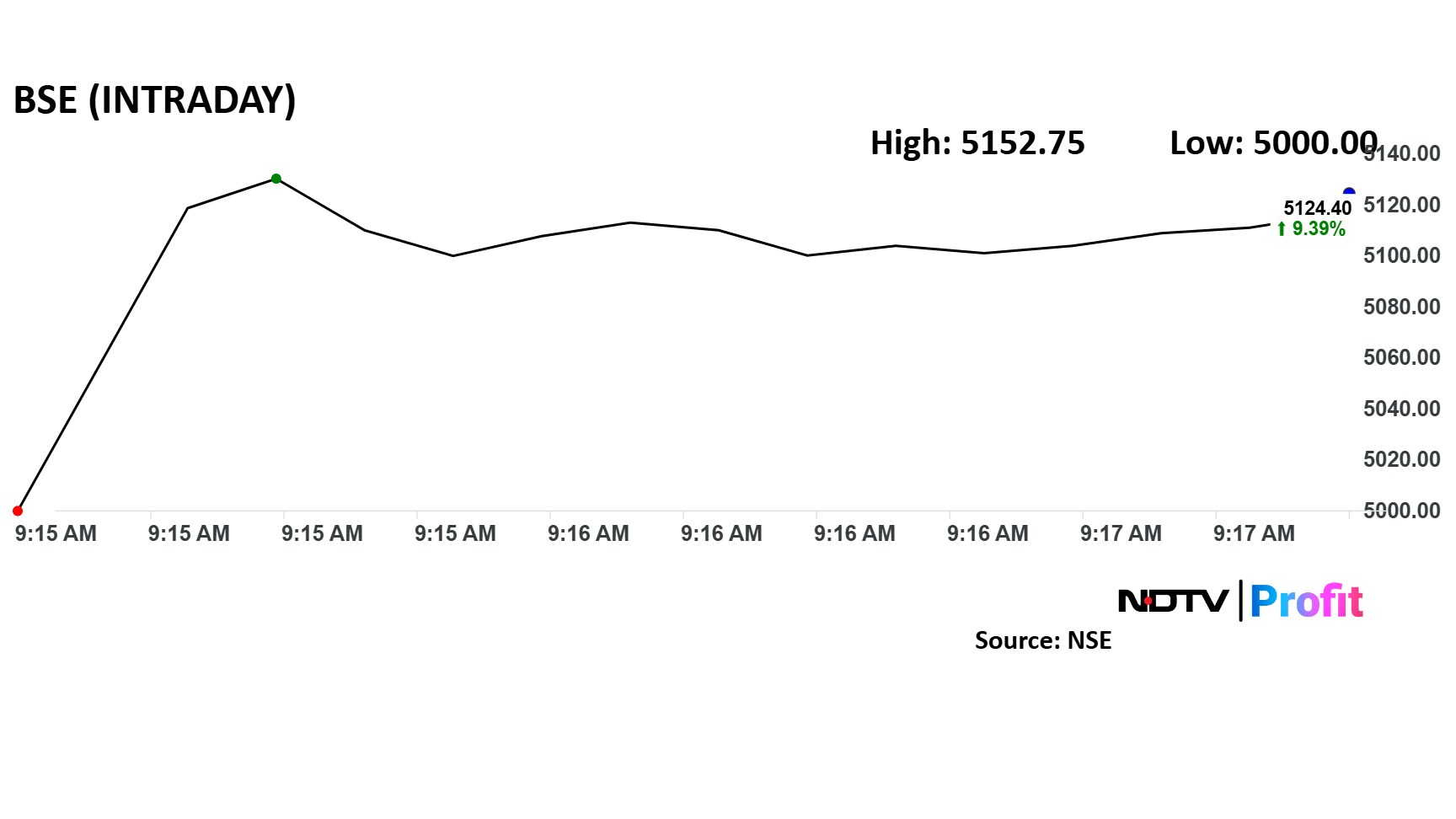

BSE Share Price Up

BSE share price advanced 10% intraday to Rs 5,152.75 apiece, to move above the 200-day daily moving average. The benchmark NSE Nifty 50 was down 0.1%.

The stock has risen 104% in the last 12 months and fallen 3% on a year-to-date basis. Total traded volume so far in the day stood at 5.5 times its 30-day average. The relative strength index was at 60.

Ten out of 13 analysts tracking BSE have a 'buy' rating on the stock, two recommend a 'hold' and one suggests a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 14%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.