Shares of Indian Railway transportation company, BEML Ltd., rose over 3% on Thursday after it bagged a contract worth Rs 3,658 crore from Chennai Metro Rail Ltd.

BEML secured a contract from Chennai metro for design, manufacture, supply, testing, commissioning and comprehensive maintenance contract for 15 years of standard gauge metro rolling stock and depot machinery and plant.

The company in its exchange filing on Thursday said that this order win is a normal course of business.

Last week it secured an order worth Rs 246.8 crore from Central Coalfields Ltd. for supplying 48 units of the BH60M rear dump trucks. The order also involves spares and consumables for a year and comprehensive after-sales support for four additional years.

BEML reported a marginal decline in its net profit for the second quarter of the financial year 2025. The bottom line fell by 1.5% to Rs 51 crore in the second quarter, compared to the same period last year. The revenue from operation during the quarter was down 6.2% to Rs 860 crore.

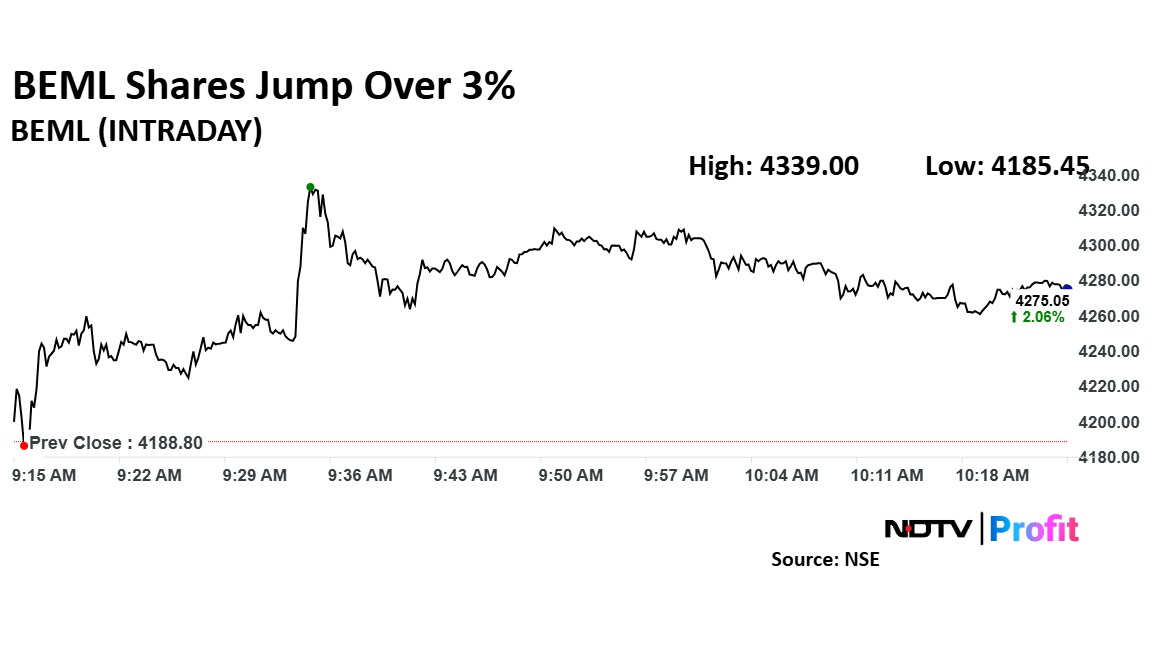

The company's scrip rose as much as 3.59% during the day to Rs 4,339 apiece on the NSE. It was trading 1.9% higher at Rs 4,269 apiece, compared to a 1.33% decline in the benchmark Nifty 50 as of 2:28 p.m.

It has risen 75% during the last 12 months and advanced by 51% on a year-to-date basis. The total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 64.

Three out of the seven analysts tracking the company have a 'buy' rating on the stock and one has a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 5.1%.

Note: The copy is updated with a new order value after a clarification was issued by the company on the stock exchanges.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.