Bharat Electronics Ltd. saw its share price decline over 5% on Wednesday after the company missed its fiscal 2025 order inflow guidance. It secured orders worth Rs 18,715 crore, falling short of its projected Rs 25,000 crore, achieving only 74.86% of the target.

Despite this shortfall, BEL reported a 16% rise in revenue, reaching Rs 23,000 crore, compared to Rs 19,820 crore the previous year.

The company has secured orders worth Rs 1,385 crore since March 12, bringing the total value of accumulated orders to Rs 18,415 crore for the current financial year, according to an exchange filing on Thursday.

BEL, a public sector undertaking, has been a key player in India's defence electronics sector. The company's major orders include radar spares, radar upgradation, electronic voting machines, simulators, advanced land navigation systems and stabilisers for tanks, fire control systems for ship-based decoys, and communication equipment. These orders highlight BEL's diverse portfolio and its strategic importance in the defence sector.

Near-term order announcements could act as a catalyst for the company's stock, according to Jefferies. In fiscal 2023, BEL secured 83% of its orders in March and still met its annual guidance. Rising global defence spending could also be a positive factor for BEL's future prospects, the brokerage said.

On Wednesday, Bharat Electronics saw 20.4 lakh shares traded in two block deals.

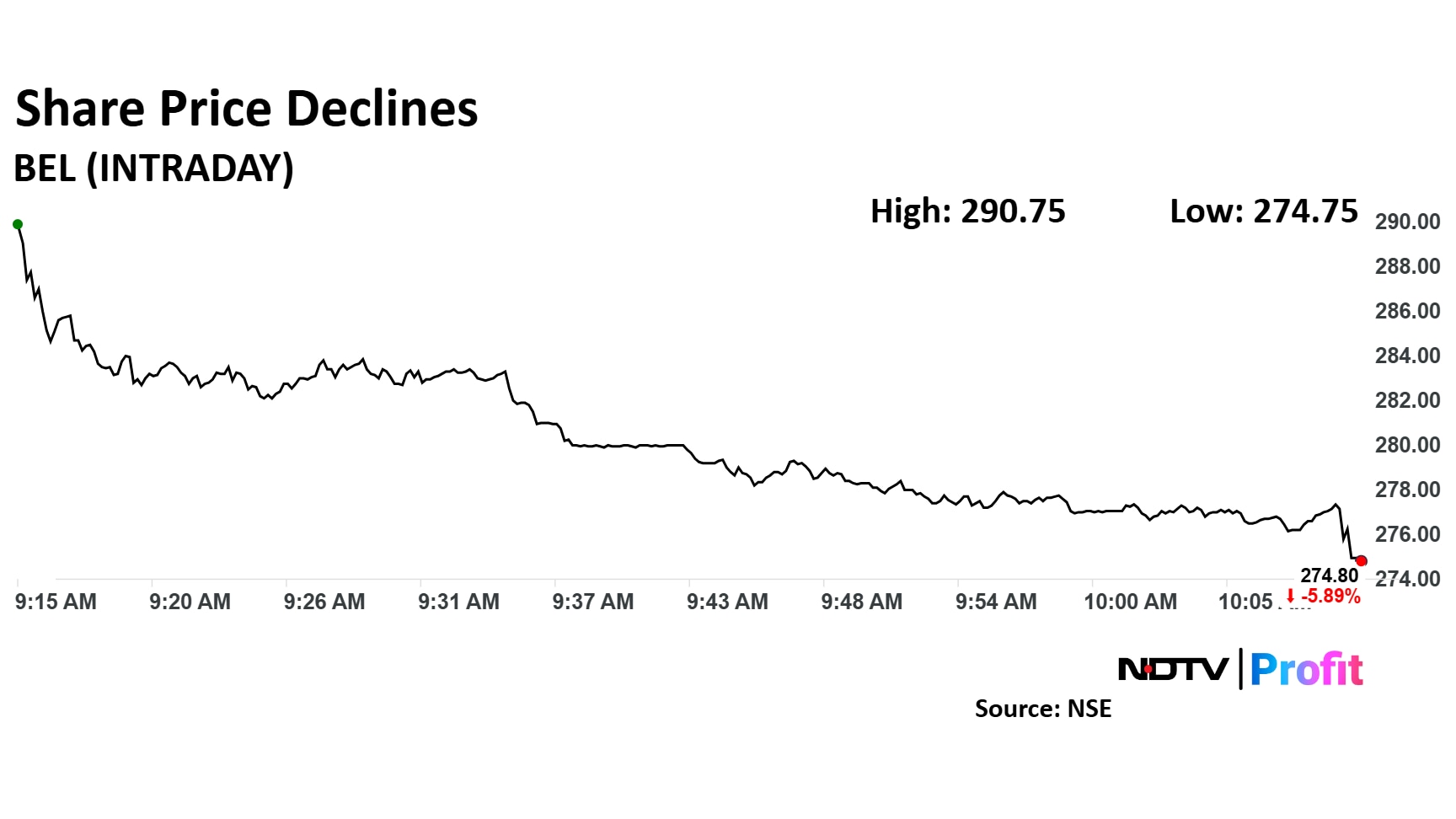

Bharat Electronics Share Price Today

Shares of BEL fell as much as 5.43% to Rs 276.15 apiece. They pared some losses to trade 5.41% lower at Rs 276.20 apiece, as of 10:09 a.m. This compares to a 0.33% advance in the NSE Nifty 50.

The stock has risen 24.98% in the last 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 45.

Out of 28 analysts tracking the company, 25 maintain a 'buy' rating, one recommends a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 23.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.