230523 RBI's Rs 2,000 currency exchange facility opens..jpeg?downsize=773:435)

Bank of Baroda Ltd.'s standalone net profit during the quarter ended March rose 3.3% to Rs 5,048 crore, compared to Rs 4,886 crore in the year-ago period.

The net interest income—the difference of interest earned and interest paid— for the quarter fell 7% to Rs 11,020 crore. This compares to Rs 11,793 crore reported in the corresponding quarter of the previous fiscal. It is below Bloomberg's estimate of Rs 11,689 crore.

Bank of Baroda's asset quality improved during the quarter under review, with the gross non-performing assets ratio declining to 2.26% from 2.43% in the October-December period. In absolute terms, the gross NPA slipped to Rs 27,834.88 crore from Rs 28,471.22 crore in the previous quarter.

The net NPA ratio contracted 10 basis points to 0.58% from 0.59% in the preceding quarter. In absolute terms, the net NPA advanced to Rs 6,994.24 crore from Rs 6,825.06 crore.

Operating profit rose 0.3% to Rs 8,132 crore in comparison to Rs 8,106 crore in the same quarter last year. Provisions rose 43.4% to Rs 1,552 crore in comparison to Rs 1,082 crore reported in the previous quarter.

Return on assets remains above 1% and stands at 1.16% for financial year 2025, the bank said in its press release. Return on equity stands at 16.96% for fiscal year 2025.

The board of directors also approved the final dividend of Rs 8.35 per share. The bank has set June 6 as the record date for the purpose of dividend payment.

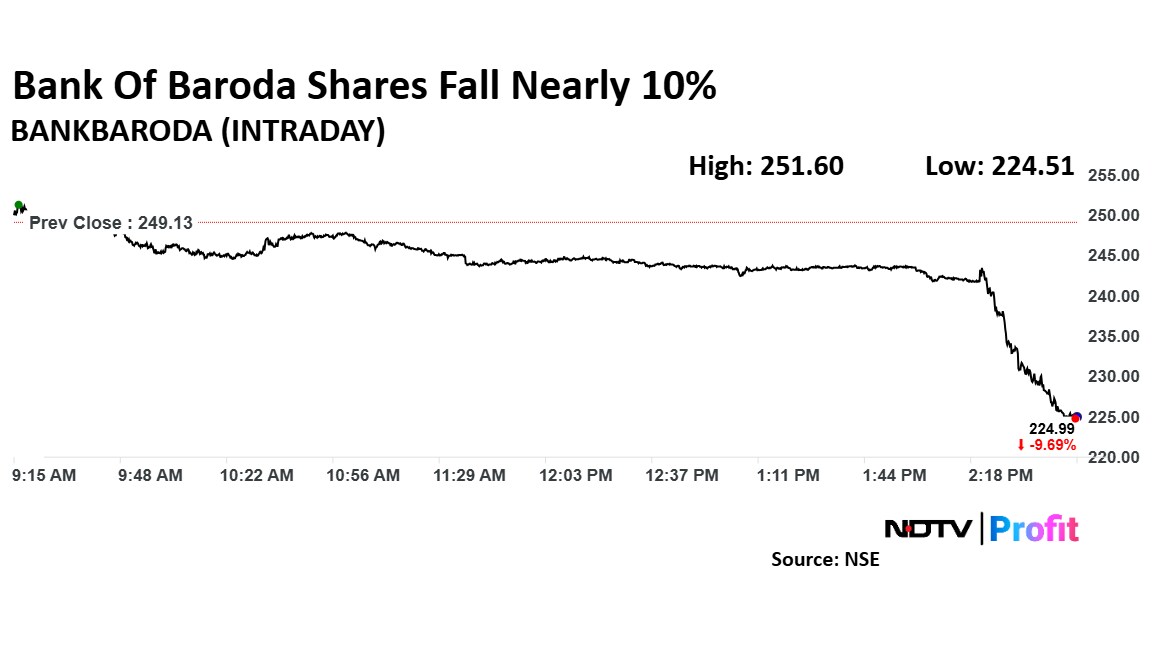

Bank of Baroda Shares Decline

After the quarterly results were declared, shares of Bank of Baroda fell as much as 9.88% to Rs 224.51 apiece, the lowest level since April 15. It pared losses to trade 9.73% lower at Rs 224.88 apiece, as of 3:08 p.m. This compares to a 0.29% decline in the NSE Nifty 50 Index.

The stock has fallen 15.51% in the last 12 months and 6.68% year-to-date. Total traded volume so far in the day stood at 1.2 times its 30-day average. The relative strength index was at 52.38.

Out of 37 analysts tracking the company, 29 maintain a 'buy' rating, six recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.