The shares of Ashoka Buildcon Ltd. rose nearly 6% on Tuesday after the company emerged as the lowest bidder for a Rs 568.86 crore construction order. The order is from the Central Railway.

The company is the lowest bidder for the construction of earthwork, major bridges, minor bridges, rubs, P-way work and miscellaneous civil works, the company said on Saturday. The engineering, procurement and construction project is to be completed in 30 calendar months.

The company in the third quarter posted a sevenfold rise in net profit at Rs 654.5 crore in comparison to Rs 96.2 crore in the year-ago period. The revenue, however, declined by 10.1% to Rs 2,387.9 crore as compared to 2,657.1 crore in the same quarter of the last fiscal.

The company's earnings before interest, taxes, depreciation and amortisation rose by 7% to Rs 638.9 crore during the quarter under review from Rs 597 crore in the year-ago period. The margin expanded to 26.7% from 22.5%.

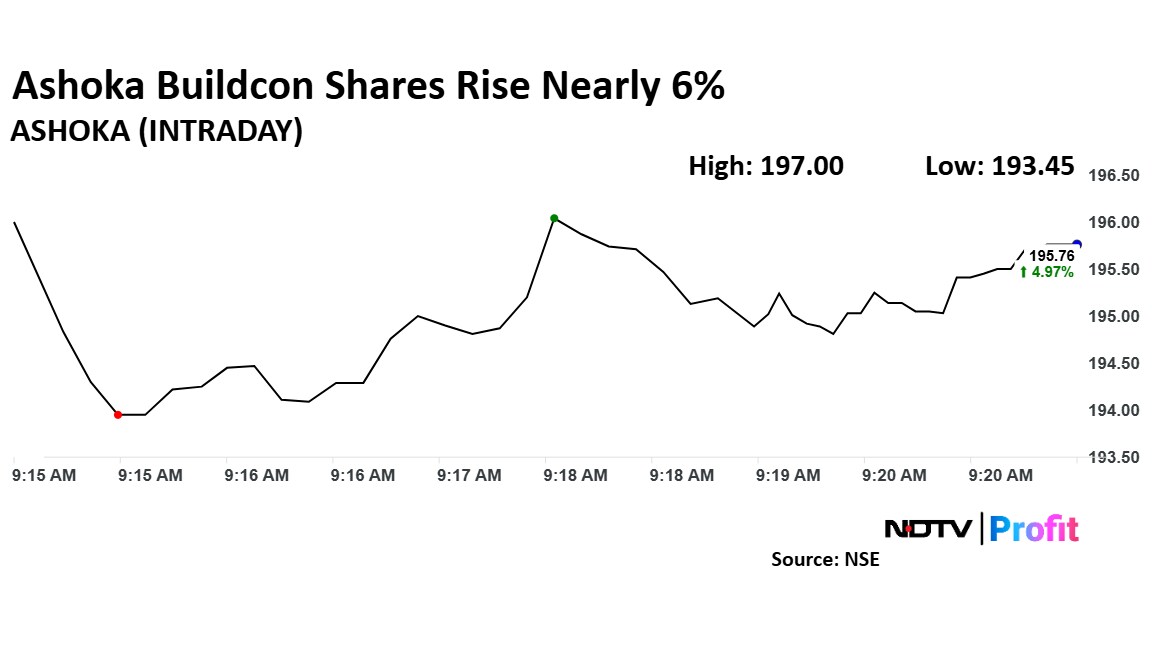

Ashoka Buildcon Share Price

The shares of Ashoka Buildcon rose as much as 5.64% to Rs 197 apiece, the highest level since April 4. It pared gains to trade 4.82% lower at Rs 195.44 apiece, as of 9:19 a.m. This compares to a 2% advance in the NSE Nifty 50 Index.

It has risen 15.67% in the last 12 months and fallen 37.14% year-to-date. Total traded volume so far in the day stood at 2.61 times its 30-day average. The relative strength index was at 51.

Out of 10 analysts tracking the company, five maintain a 'buy' rating, four recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 39.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.