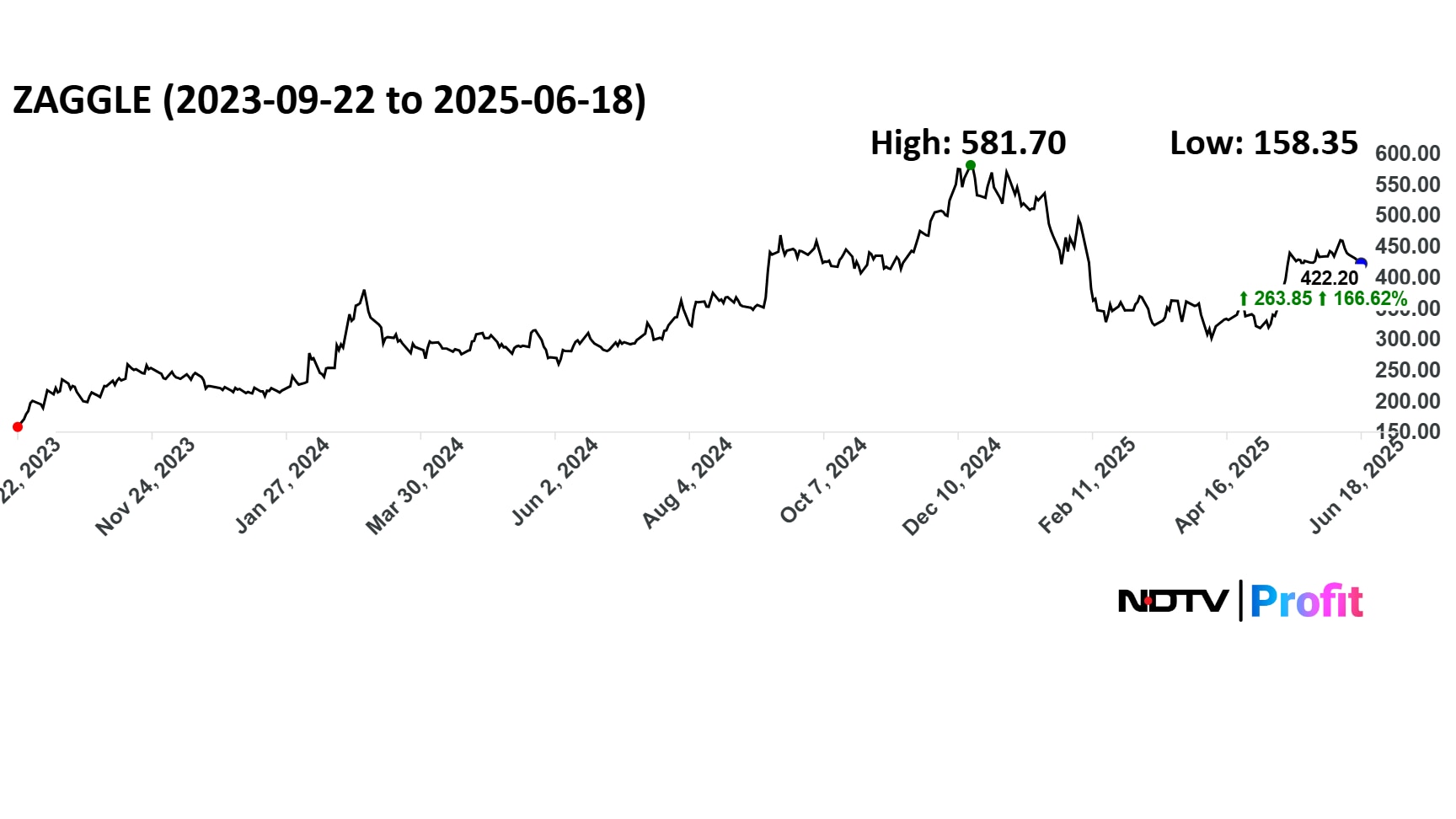

Ace investor Ashish Kacholia-backed Zaggle Prepaid Ltd. is now a multibagger stock as the scrip rallied over 200% after its listing on Sept. 22, 2023.

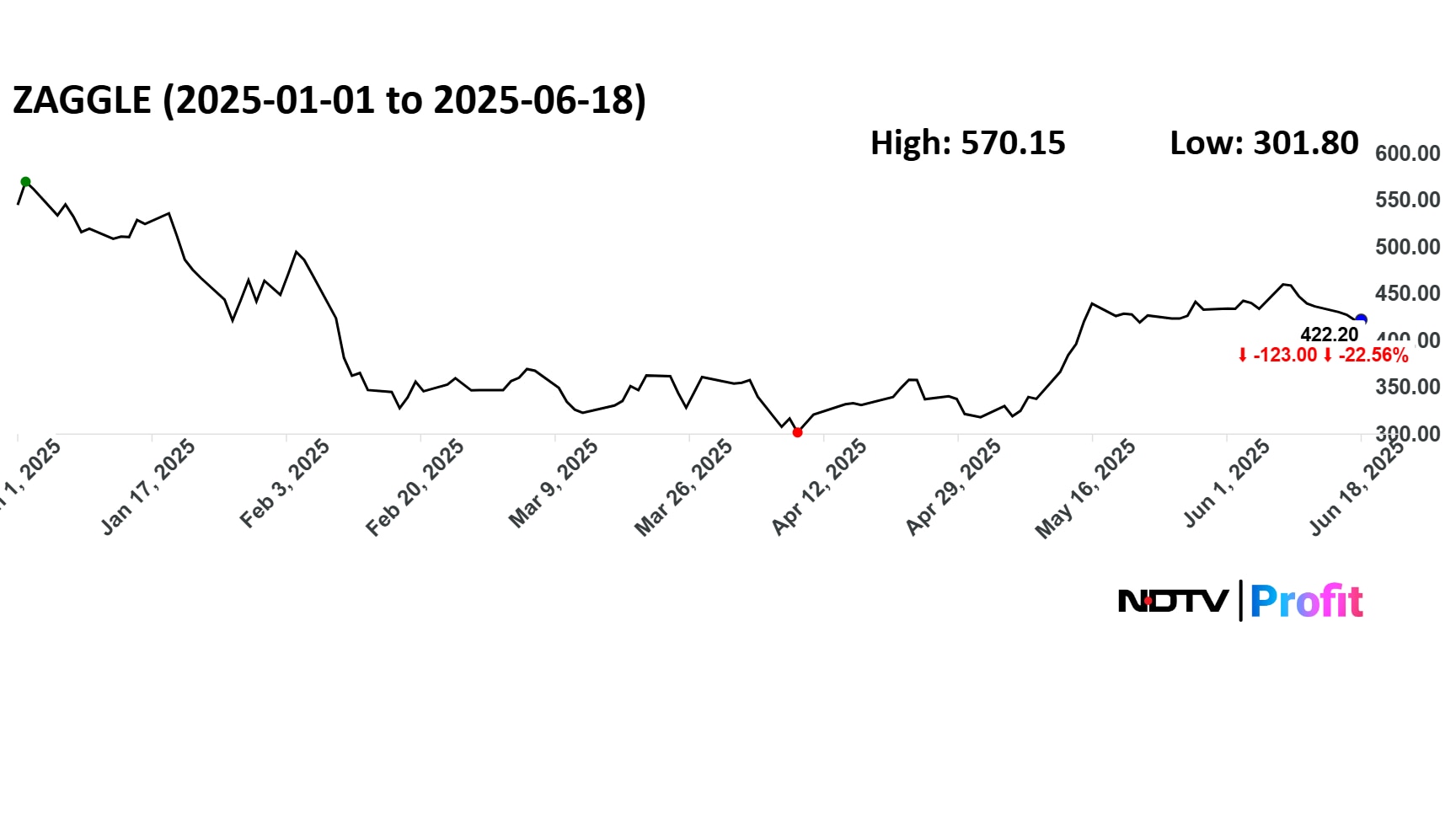

The scrip, however, has delivered a negative return of 18.69% on a year-to-date basis in 2025, while the return since listing stands at 263%. In the year so far, the share price recorded a high of Rs 570 on Jan. 2 and a low of Rs 301 on April 9.

Zaggle Prepaid Share Price Since Listing

The share price of Zaggle had risen to Rs 581 in December after listing. The analyst take on the counter is positive as the sole analyst tracking the space has a buy rating on the stock.

The target price on the scrip is set at Rs 550 while the counter sees an upside of 30.3% according to Bloomberg data.

Zaggle Share Price In The Year So Far

Outlook, Guidance From Zaggle

The IT-enabled services firm had given guidance of 58–63% growth for the last financial year and has crossed the 63% mark, he said during an earlier conversation with NDTV Profit.

"We are aiming in the next five to seven years to reach a billion-dollar revenue. That's our goal," Godkhindi said. "Assuming that the dollar-rupee ratio stays in a reasonable range, we are on track to do that."

With an annual churn rate below 1.5%, customer retention is one of the company's major strengths. Godkhindi attributed this to Zaggle's high-quality solutions, deep integrations with enterprise systems like enterprise resource planning, human resource management system and customer relationship management, along with competitive pricing.

Zaggle Prepaid's revenue jumped 68.9% year-on-year to Rs 336.4 crore during the December quarter against Rs 199.5 crore seen in the third quarter of financial year 2024. Net profit for the third quarter of financial year 2025 stood at Rs 19.74 crore from Rs 15.22 crore seen in the year-ago period, marking a 29.7% year on year rise.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.