Shares of Aptus Value Housing Finance India Ltd. fell over 9% on Tuesday following multiple block deals worth Rs 1,950 crore.

On Tuesday, 6.33 crore equity shares changed hands through three block deals. The buyers and sellers were not known. However, according to the term sheet accessed by NDTV Profit, promoter Westbridge Crossover Fund is looking to offload stake worth Rs 1,922.3 crore.

Westbridge Crossover Fund plans to sell 12.61% equity in Aptus Value Housing Finance. The floor price for the offer was set at Rs 305, indicating a 9.41% discount to Rs 336.5, the close on NSE on Monday.

As of March 2025, Westbridge held 28.6% equity in Aptus Value Housing Finance, according to data on BSE.

The home loan company recorded a consolidated profit of Rs 207.02 crore for the January–March 2025 quarter, in comparison to Rs 164.03 crore in the year-ago period.

The consolidated total income during the quarter under review grew to Rs 499.23 crore, compared to Rs 387.20 crore registered in the same period of the last financial year.

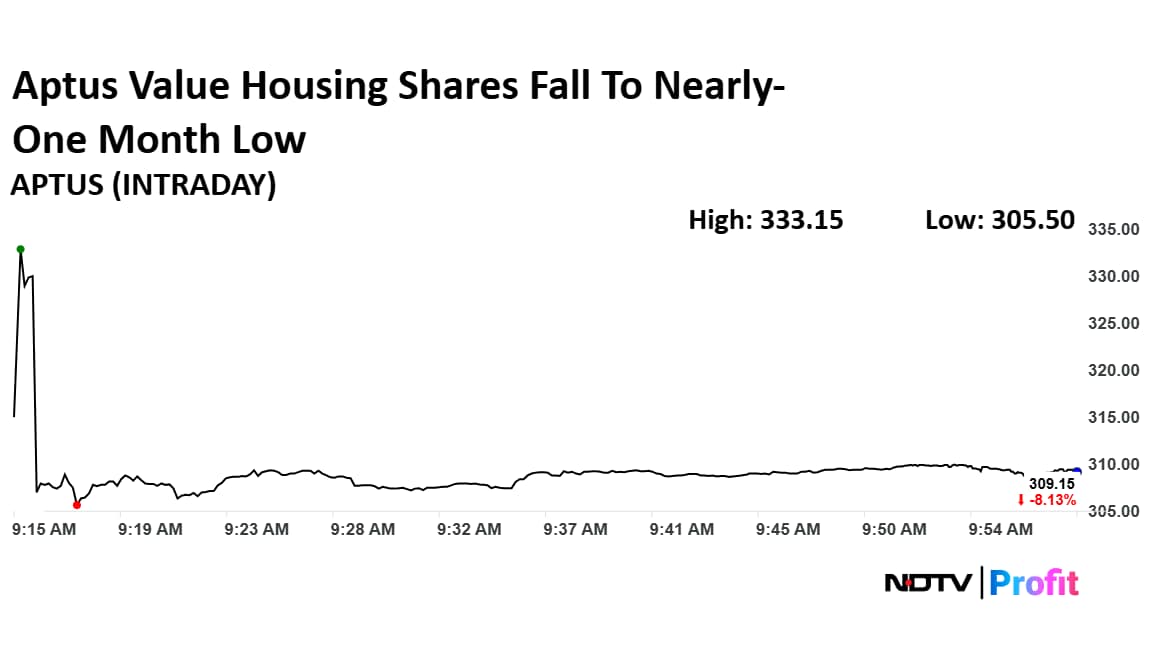

Aptus Value Housing Share Price Declines

Shares of Aptus Value Housing fell as much as 9.21% to Rs 305.50 apiece, the lowest level since April 15. It pared gains to trade 8.62% lower at Rs 307.50 apiece, as of 9:53 a.m. This compares to a 0.18% decline in the NSE Nifty 50.

The stock has fallen 0.55% in the last 12 months and risen 7.07% year-to-date. Total traded volume so far in the day stood at 0.67 times its 30-day average. The relative strength index was at 65.19.

Out of 17 analysts tracking the company, 14 maintain a 'buy' rating, one recommends a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 26.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.