.png?downsize=773:435)

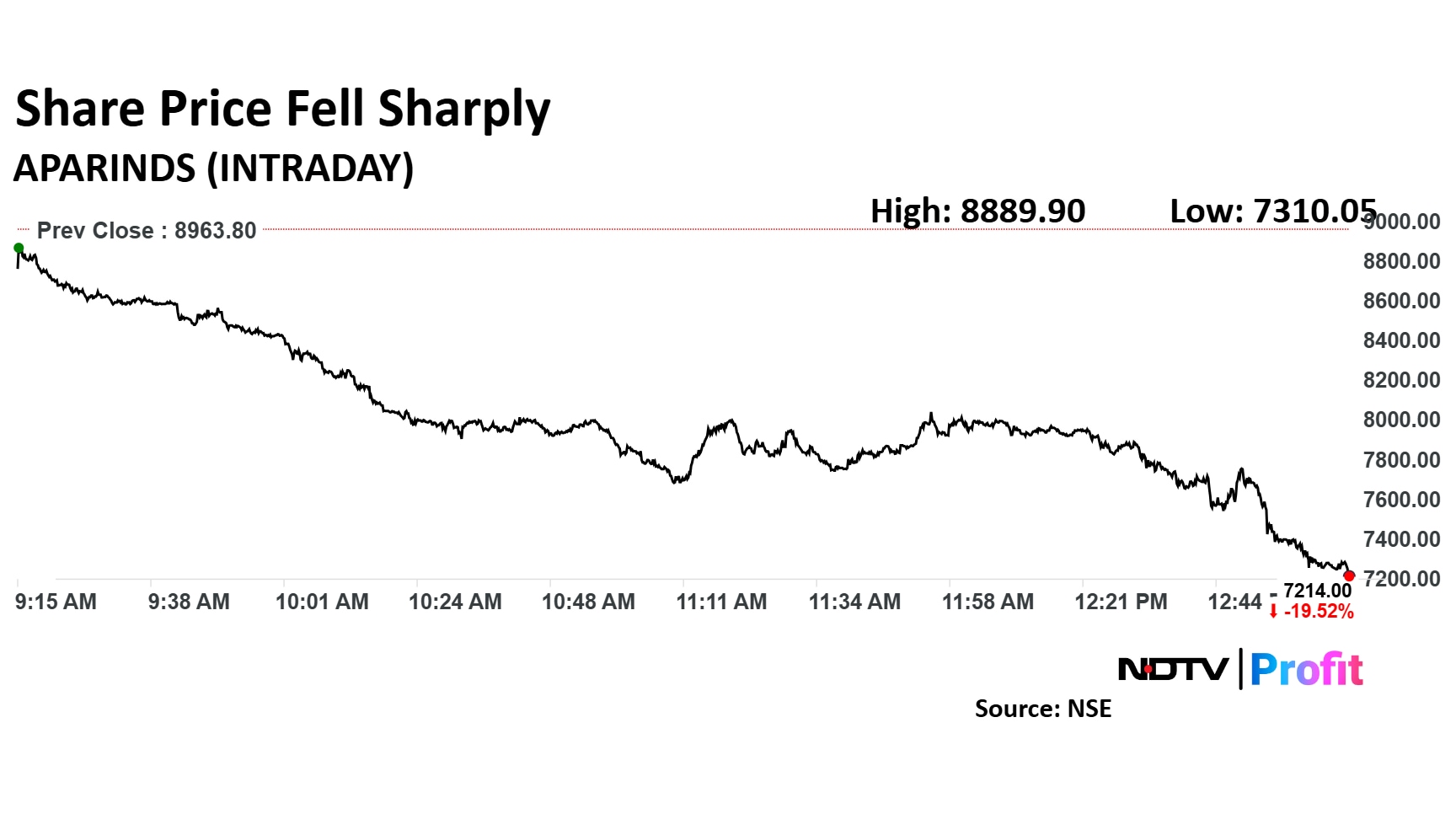

Shares of Apar Industries saw a sharp decline of over 19% on Tuesday after the company reported disappointing earnings for the third quarter of the financial year. The stock fell over seven-month low.

The decline came as investors reacted to weaker-than-expected profit figures and a decline in margins, which dampened market sentiment.

For the third quarter of FY25, Apar Industries posted a 19.6% drop in net profit, which fell to Rs 175 crore compared to Rs 218 crore in the same quarter last year.

While the company reported a rise in revenue, increasing by 17.7% to Rs 4,716 crore from Rs 4,009 crore in the previous year, the growth was not sufficient to offset the decline in profitability.

Apar Industries also saw a decline in Ebitda, which fell by 12.1% to Rs 356 crore from Rs 405 crore in the previous year. This drop in Ebitda was further compounded by a contraction in Ebitda margin, which stood at 7.6%, down from 10.1% in the same quarter last year.

The scrip fell as much as 19.26% to Rs 7,237.70 apiece. It pared losses to trade 18.87% lower at Rs 7,272.70 apiece, as of 01:05 p.m. This compares to a 0.95% advance in the NSE Nifty 50 Index.

It has risen 26.43% in the last 12 months. Total traded volume so far in the day stood at 4.48 times its 30-day average. The relative strength index was at 19.

Out of six analysts tracking the company, four maintain a 'buy' rating, one recommends a 'hold,' and one suggests a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 35.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.