Asian stocks had a mixed start Monday, with investors continuing to assess the outlook for trade discussions and geopolitical tensions. Equity benchmarks rose in Sydney, while those in Tokyo and Seoul were little changed.

The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, fell 0.5 percent to 10,551 as of 6:50 a.m.

Short on time? Well, then listen to this podcast for a quick summary of the article!

BQ Live

Here's a quick look at all that could influence equities on Monday.

Global Cues

- U.S. stocks stumbled into the weekend, as renewed selling in technology shares overshadowed what has so far been a solid earnings season.

- The yield on 10-year Treasuries climbed five basis points to 2.9583 percent, reaching the highest in eight weeks.

Europe Check

European stocks posted their fourth straight week of gains, with miners surging on rising metal prices, as investor attention shifted to earnings releases.

- The euro declined 0.5 percent to $1.2287, the weakest in two weeks.

- The British pound dipped 0.4 percent to $1.4035, the weakest in more than two weeks.

- Germany's 10-year yield fell one basis point to 0.59 percent.

Asian Cues

- Japan's Topix index rose 0.3 percent.

- Australia's S&P/ASX 200 Index rose 0.2 percent.

- Futures on Hong Kong's Hang Seng Index slid 0.3 percent.

- Futures on the S&P 500 Index gained 0.2 percent.

- Australia's 10-year bond yield jumped five basis points to 2.86 percent.

- Yen slipped 0.2 percent to 107.82 per dollar.

Here are some key events coming up this week:

- Japan manufacturing flash PMI data.

- French President Emmanuel Macron begins a three-day visit to the U.S. Monday

- U.S. manufacturing and services sector PMIs. Later this week's GDP and jobless claims.

- Earnings season continues. Among those reporting: Alphabet/Google,Microsoft, Amazon.com, Twitter, Samsung, Facebook,SAP,Sony, Caterpillar,Halliburton, Airbus, Daimler, Honda, Deutsche Bank, Barclays, Credit Suisse, UBS, Visa, Nomura, Bank of China, Vale, Statoil, Royal Dutch Shell,Barrick Gold, Total, Exxon Mobil and Chevron.

- European Central Bank rate decision on Thursday. While no change to interest rates or the pace of asset purchases is expected, investors will watch for any sign that officials are preparing a shift in stimulus plans for their June meeting.

- Bank of Japan announces its latest policy decision Friday and releases a quarterly outlook report.

Prime Minister Modi to visit China on April 27-28 for summit talks with President Xi.https://t.co/iUMowoN0Ii pic.twitter.com/lFch0QEVdi

Commodity Check

- West Texas Intermediate crude dropped 0.2 percent to $68.24 a barrel.

- Gold lost 0.3 percent to $1,332.82 an ounce.

- Base metals index climbed for fourth consecutive week on LME.

- Aluminum and nickel surged as global supply chains disrupted.

- Nickel posts biggest weekly gain since Feb, ended 1.6 percent lower on Friday.

- Copper gained 2.4 percent last week, most in last two months.

- Lead and tin closed 1 percent higher.

Stories You Might've Missed

- The weight of plastic waste in the world has topped that of 1 billion African bush elephants.

- An experiment conducted in Kenya sparks debate over long-term benefits of lump-sum cash transfers.

- Indian farmers must diversify their income sources beyond agriculture, says report.

- Ola's co-founder makes it to Time's list of 100 most influential people across the globe.

- Union Cabinet clears the ordinance that imposes a death penalty on convicted child rapists.

- Cabinet approves the ordinance to seize assets of economic offenders for paring debt.

- Here's the worth of papers of the shareholders of insolvent companies.

- This is what's needed to break Siddaramaiah's spell in upcoming Karnataka polls.

- Arsene Wenger's retirement leaves Arsenal in search of a new leader at a critical time both on and off the pitch.

- Here's why Flipkart needs Walmart to contend with Amazon.

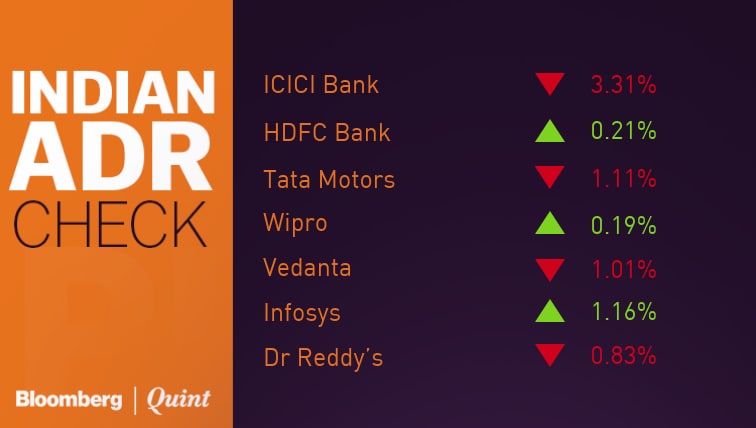

Indian ADRs

Nifty Earnings To Watch

- Bharti Infratel

Other Earnings To Watch

- Bharat Financial Inclusion

- Cholamandalam Investment

- Delta Corp

- GNFC

- Indiabulls Ventures

- LIC Housing Finance

- Reliance Infrastructure

- Reliance Naval And Engineering

- 3i Infotech

- Foseco India

- Kewal Kiran Clothing

- Swaraj Engines

SEBI may seek forensic probe of ICICI Bank books, disclosures.https://t.co/bYZg07SQv4 pic.twitter.com/x0p5KZb8XV

Earnings Reactions To Watch

HDFC Bank (Q4, YoY)

- NII up 17.7 percent to Rs 10,658 crore.

- Net Profit rose 20.3 percent to Rs 4,799 crore.

- GNPA at 1.30 percent versus 1.29 percent in Q3.

- NNPA at 0.40 percent versus 0.44 percent in Q3.

Indiabulls Housing Finance (Q4, YoY)

- NII up 22.2 percent to Rs 1,661 crore.

- Net Profit rose 22.6 percent to Rs 1,030 crore.

- Provisions at Rs 326 crore versus Rs 262 crore in Q3.

- Gross NPA unchanged at 0.77 percent.

Sasken Technologies (Q4, QoQ)

- Revenues down 2.4 percent to Rs 128.7 crore.

- Net profit rose 27.5 percent to Rs 26 crore.

- EBIT up 31 percent to Rs 21.5 crore.

- Margins at 16.7 percent versus 12.4 percent.

CDSL (Q4, YoY)

- Revenues up 35.1 percent to Rs 51.8 crore.

- Net profit rose 10.2 percent to Rs 25.9 crore.

- EBITDA up 54 percent to Rs 29.5 crore.

- Margins at 57 percent versus 50 percent.

Stocks To Watch

- Cipla's Pithampur plant gets three observations from U.S. FDA.

- U.S. FDA concludes the inspection of Unichem Labs' Ghaziabad facility with no observations.

- Coal India plans 41.5 million tons forward coal auctions in the current financial year (Bloomberg)

- Axis Bank commenced succession process for a new chief executive officer and managing director and appoints Egon Zehnder to succession conduct process

- SJVN signs accord with power ministry and aims to achieve 9,200 million units in financial year 2019

- RIL says it is not aware of any further investigation undertaken by the I-T department regarding the Rs 6,500-crore foreign direct investment by Biometrix in the company's group entities.

- Adani Enterprises forms a joint venture with Prakash Asphaltings for Bilaspur Pathrapali Road Private Ltd. in the ratio of 74:26.

- Indian Hume Pipe Company secures Rs 578.50 crore order from Madhya Pradesh Jal Nigam Maryadit.

- Kitex Garments Board to meet on April 25, 2018 to consider proposal for further investments.

- India Ratings upgrades HEG Limited's Long-Term Issuer Rating to 'IND AA' from 'IND A+'. The Outlook is Stable

- Orchid Pharma says committee of creditors have rejected all three bids for the company.

- Morepen Labs appeals to NCLAT against the order passed by NCLT, Chandigarh bench.

- Electrosteel Steels says steering committee was set up as per resolution plan

- Lenders of Nagarjuna Oil Corporation decide that the company should go for liquidation.

The world's best-performing department store chain is in India.https://t.co/sXflhqshvC pic.twitter.com/kMCQ0tO2Db

Trading Tweaks

- Avenue Supermarts, CL Educate and Shankara Building Products dropped from S&P BSE IPO Index.

- Omkar Speciality Chemicals is placed under Additional Surveillance Measure

- Monnet Ispat & Energy circuit filter revised to 5 percent

- Phillips Carbon Black FII / MF limit increases to 8 lakh shares versus 1.6 lakh shares earlier

- Mangalam Organics buy back from 23 April to 8 May

- Sona Koyo Steering Systems Ltd.'s name has been changed to JTEKT India Ltd.

Bulk Deals

- L&T Infotech: L&T sells 10 lakh shares or 0.58 percent equity at Rs 1,399 each.

- Ajmera Realty: Promoter Rajnikant Ajmera sold 5 lakh shares, or 1.4 percent equity at Rs 277.2 each.

- Moldtek Technologies: AKG Finvest sold 3 lakh shares, or 1.1 percent equity at Rs 49.87 each.

Insider Trades

- Divi's Lab promoter Madhusudana Divi sold 13,200 shares from April 17-18.

- Adani Power promoter Pan Asia Trade and Investment acquired 75 lakh shares on April 19.

- Arcotech promoter Hiland Enclave sold 4 lakh shares from April 18-19.

- Astra Microwave promoter P A Chitrakar acquired 20,000 shares on April 19.

- Lumax Industries promoter Lumax Finance acquired 1,250 shares on April 16.

- Donear Industries promoter Ajay Agarwal HUF acquired 3,000 shares on April 19.

- Chaman Lal Setia promoter Ankit Setia sold 2,571 shares from April 17-18.

- Teamlease Services promoters sold 2.56 lakh shares on April 16.

- VIP Industries promoter Vibhuti Investments acquired 2 lakh shares on April 16.

- Liberty Shoes promoter Arpan Gupta sold 1,500 shares from April 18-19.

- Kwality Ltd. promoter Sanjay Dhingra sold 10 lakh shares on April 18.

Who's Meeting Whom

- NBCC non-deal road show in the U.S. from April 23 to April 27.

- JK Cement to meet investors and analysts from April 24-27 in Hong Kong and Singapore respectively, and from April 30 to May 4 in Mumbai and Chennai.

Rupee

- Rupee closed at Rs 66.11 per U.S. Dollar on Friday versus Rs 65.80 per U.S. Dollar on Thursday.

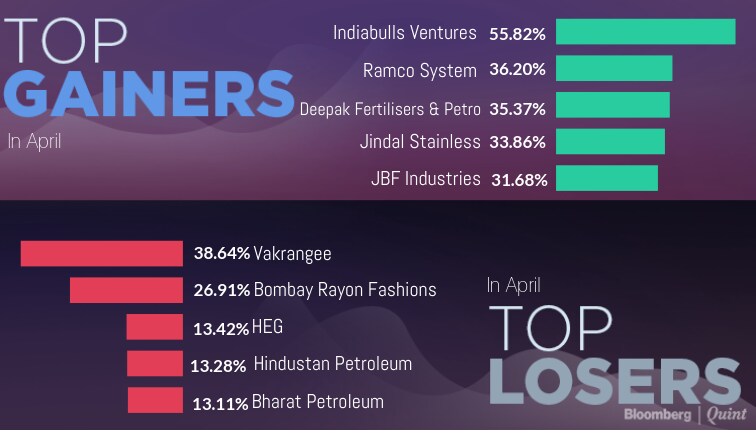

Top Gainers And Losers

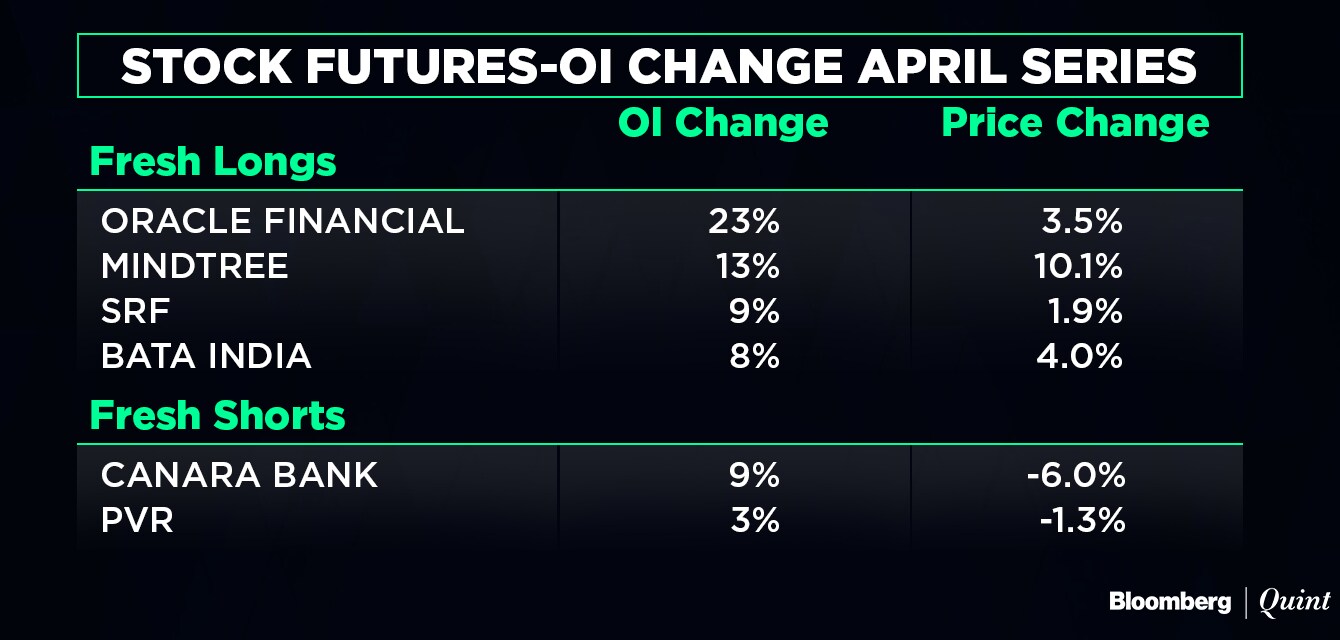

F&O Cues

- Nifty April Futures closed trading at 10,585.5 with a premium of 21.5 points versus 12.8 points.

- April series-Nifty Open Interest unchanged, Bank Nifty Open Interest up 1 percent.

- India VIX ended at 12.9, down 5.8 percent.

- Maximum Open Interest for April series at 10,700, Open Interest at 50 lakh, Open Interest down 1.3 percent.

- Maximum Open Interest for April series at 10,500, Open Interest at 54.9 lakh, up 1 percent.

F&O Ban

- In Ban: Balrampur Chini, Dewan Housing, Jet Airways, JP Associates, Reliance Communications, TV18 Broadcast

- New In Ban: Dewan Housing

- Out Of Ban: IRB Infrastructure

Alert: Only intraday positions can be taken in stocks under F&O ban. There is a penalty in case of rollover of these intraday positions.

Put-Call Ratio

- Nifty PCR at 1.61 from 1.63.

- Nifty Bank PCR at 1.38 from 1.49.

Stocks Seeing High Open Interest Change

Fund Flows

Brokerage Radar

Kotak Securities on Dilip Buildcon

- Initiated ‘Buy' with a price target of Rs 1,365.

- Well-placed to leverage growing EPC opportunity in roads and beyond.

- Expect compounded growth rate of 8 percent in order inflow over the fiscal 2018-2022.

- Bharatmala to offer EPC opportunity of Rs 3.3 lakh crore in the next few years.

- Market share in NHAI ordering to improve to 17 percent by March 2022, compared to 15 percent clocked in the previous financial year.

- Healthy backlog and reasonable cash flow to service debt.

- Expect revenue, operating income and net profit to compound at 26 percent, 27 percent and 28 percent respectively through the financial years till March 2022.

CLSA on Ashok Leyland

- Maintained ‘Buy'; raised price target to Rs 185 from Rs 145.

- Commendable market-share defence in crucial previous fiscal.

- Commercial vehicle cycle surprising positively; raise current fiscal's industry growth estimates to 13 percent.

- Expect strong 23 percent compounded growth rate in earnings per share over the next two years

- Expensive valuations justified.

CLSA on HDFC Bank

- Maintained ‘Buy'; raised price target to Rs 2,470 from Rs 2,340.

- Key positive: 25 percent growth in operating profit.

- Asset quality stable, but unsecured loans rising fast.

- Subsidiaries scaling up well.

- Expect 21 percent compounded growth rate in earnings over the fiscal 2018-2021.

MOSL on HDFC Bank

- Maintained ‘Buy' with a price target of Rs 2,400

- March quarter remained steady; fee growth surprises positively.

- Retail loan growth remains healthy.

- Asset quality stable; Provisions coverage ratio improved to 70 percent.

- Expect market share to increase and RoEs to remain best.

CLSA on Indiabulls Housing

- Maintained ‘Buy'; raised price target to Rs 1,650 from Rs 1,620.

- Tad disappointed by compression in spreads.

- Stability in spreads will be key.

- Housing segment drives loan growth.

- Asset quality stable.

- Expect 22 percent compounded growth rate in profits over the fiscal 2018-2021.

Macquarie on Indiabulls Housing Finance

- Maintained ‘Outperform' with a price target of Rs 1,599.

- Loan growth much ahead of peers.

- Loan growth led by home loans and corporate.

- Rate hikes, increased securitization to aid margins.

- Expect strong loan growth, steady spreads and high return ratios.

CLSA on India Strategy

- NPL resolution process well underway.

- Legal delays the possible risk in NPL resolution.

- Multi-pronged approach to improve farm incomes.

- Increase of above 10 percent in MSP appears to be a done deal now.

- Oil at a tipping point; remains the main worry.

- Legal issues restrict UID, but subsidy savings continue to rise.

World's plastic burden: Weight of a billion African elephants! #EarthDayhttps://t.co/D2vRtligQG pic.twitter.com/CWtxhos94A

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.