Shares of Adani Wilmar Ltd., a consumer goods joint venture between Adani Group and Wilmar Group, rebounded after listing at a discount on market debut.

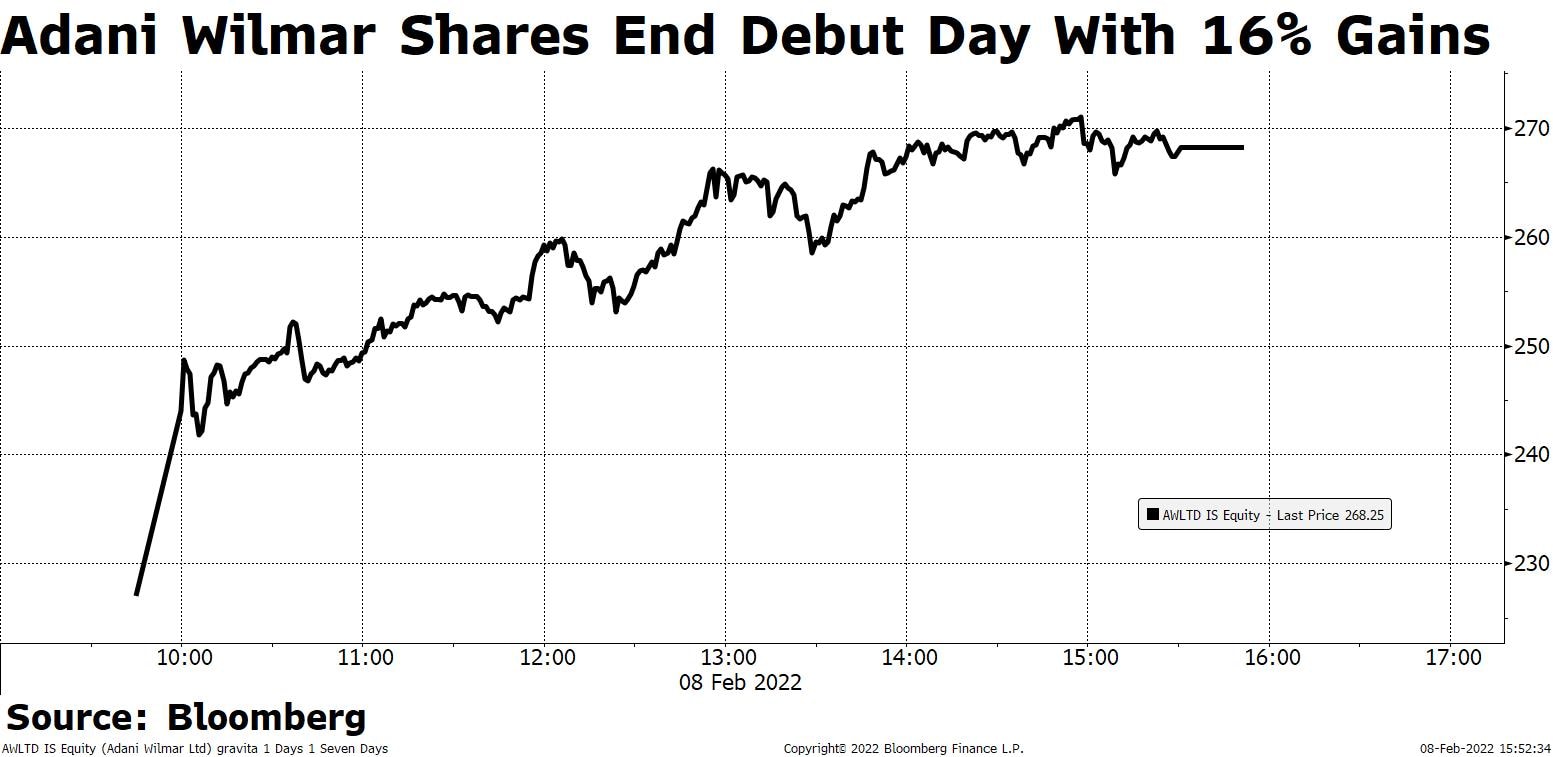

The stock listed at Rs 227 apiece, a 1.3% discount to its IPO price of Rs 230, on the National Stock Exchange. It then rose 17.93% to an intraday high of Rs 271.25 and closed with over 16.24% gains at Rs 267.35.

The Rs 3,600-crore IPO, a fresh issue, was subscribed 17.37 times. The company had scaled down the offering size from Rs 4,500 crore, at the time of filing the draft red herring prospectus.

Adani Wilmar's portfolio of products spans across three categories—edible oil, packaged food & FMCG products, and industry essentials. It sells most primary kitchen commodities such as edible oil, wheat flour, rice, pulses and sugar. Kitchen commodities account for 66% of primary kitchen spends in India.

The company, which claims to have the largest distribution network among all branded edible oil companies in India, has 22 plants across 10 states. Its refinery in Mundra is the largest single-location refinery in the country with a designed capacity of 5,000 MT per day.

Top Research Reports On Adani Wilmar IPO:

Watch BloombergQuint's IPO Adda With Adani Wilmar Management:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.