Share price of Adani Power Ltd., Tata Power Co., and Torrent Power Ltd., surged on Friday after the companies applied to distribute electricity to various pockets of Maharashtra, as part of efforts to expand beyond the financial capital.

Tata Power Co. has filed for a license across key growth regions, including parts of Mumbai, Pune, Sambhaji Nagar and Nashik, according to an exchange filing.

In the application submitted before the Maharashtra Electricity Regulatory Commission, seeking the grant of a distribution license to serve key regions across the state, the Tata Group company has evinced interest in serving areas like Pune region, Chhatrapati Sambhaji Nagar, Badnapur, Jalna Taluka, Waluj MIDC, Nashik, Sinnar, Igatpuri, and Trimbak Talukas.

"It is also keen to serve the Municipal Corporation of Greater Mumbai, Thane Municipal Corporation, Navi Mumbai Municipal Corporation, Panvel Municipal Corporation, and the entire corridor from PMC to Jawaharlal Nehru Port Authority," officials told PTI.

Torrent Power and Adani Power have also undertaken similar efforts and the MERC is expected to hold hearings for their applications on July 22, PTI reported.

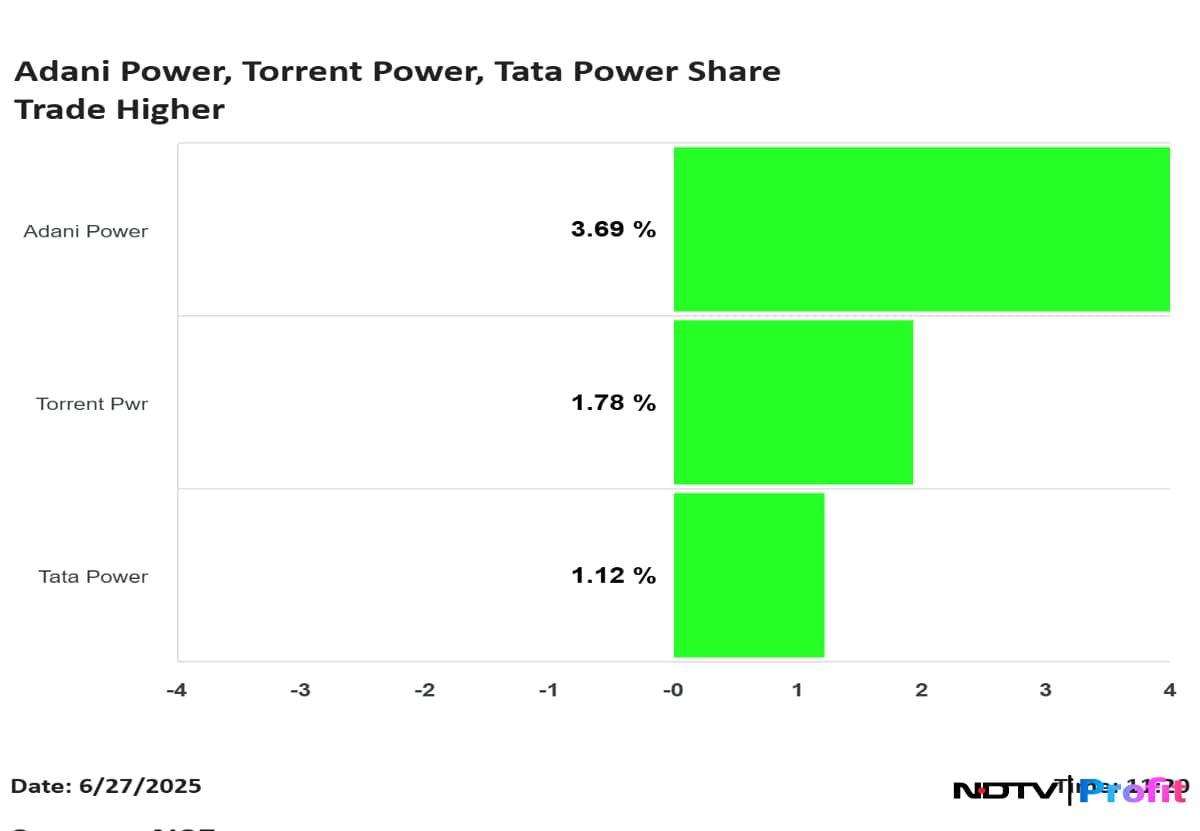

Tata Power, Adani Power, Torrent Power Share Prices

Of the three electricity distribution stocks, Adani Power was leading gains by rising as much as 4.96% at Rs 606.80 apiece. They pared gains to trade 3.69% higher at Rs 599.19 apiece as of 11:20 a.m. This compares to a 0.23% advance in the NSE Nifty 50. It has fallen 16.31% in the last 12 months and risen 13.16% on a year-to-date basis.

Torrent Power rose as much as 2.14% to Rs 1,492 apiece. The stock pared gains to trade 1.78% higher at Rs 1,486.70 apiece. It has fallen 2.46% in the last 12 months and 0.34% on a year-to-date basis.

Tata Power stock was up as much as 1.44% at Rs 411.50 apiece. It pared gains to trade 1.12% higher at Rs 410.20 apiece. It has fallen 6.79% in the last 12 months and risen 4.41% on a year-to-date basis.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.