Cantor Fitzgerald initiated coverage on Adani Power Ltd. with an 'overweight' rating and a target price of Rs 595 apiece. The current target price implied 16.21% upside from Thursday's closing price.

Adani Power's risk-reward is attractive due to its reasonable valuation, better balance sheet, according to the brokerage.

The Adani group company is the largest thermal power producer in India; it accounts for 8% of total coal generation in India compared to 4% back in financial year 2022. The company has more thermal power capacity than Tata Power Co., NTPC Ltd., and Reliance Power Ltd.

Thermal power generation is still core to India, despite efforts for increased renewable energy capacity. Thermal power will continue to be a mainstay of India's grid. The Chief Economic Advisor of India expects thermal power generation to decline to 32% from 49% in financial year 2024. This is despite total thermal power generation increasing by 17% or nearly 35 gigawatt by the end of decade, Cantor Fitzgerald said.

Adani Power has super critical technology among private players in India, which improves the efficiency of coal, resulting in maximised power generation while reducing emissions. The company pioneered the technology which gave it a head start against other thermal power generations, the brokerage said.

Adani Power's borrowings fell to Rs 37,427 crore in first half of financial year 2025, from Rs 52,368 crore in FY20. During that period, Ebitda has grown to Rs 22,024 crore on trailing 12-month basis as of first half of financial year 2025. "Thus, we believe APL has significant balance sheet flexibility to fund additional capacity expansion, both organically and inorganically."

The company will continue to acquire underperforming thermal power plants aggressively because of its balance sheet flexibility, according to Cantor Fitzgerald.

Adani Power has one of the better balance sheet across the industry and an unmatched growth profile. Its shares should trade at least at an in line multiple to its peer group in India, if not at premium, the brokerage said.

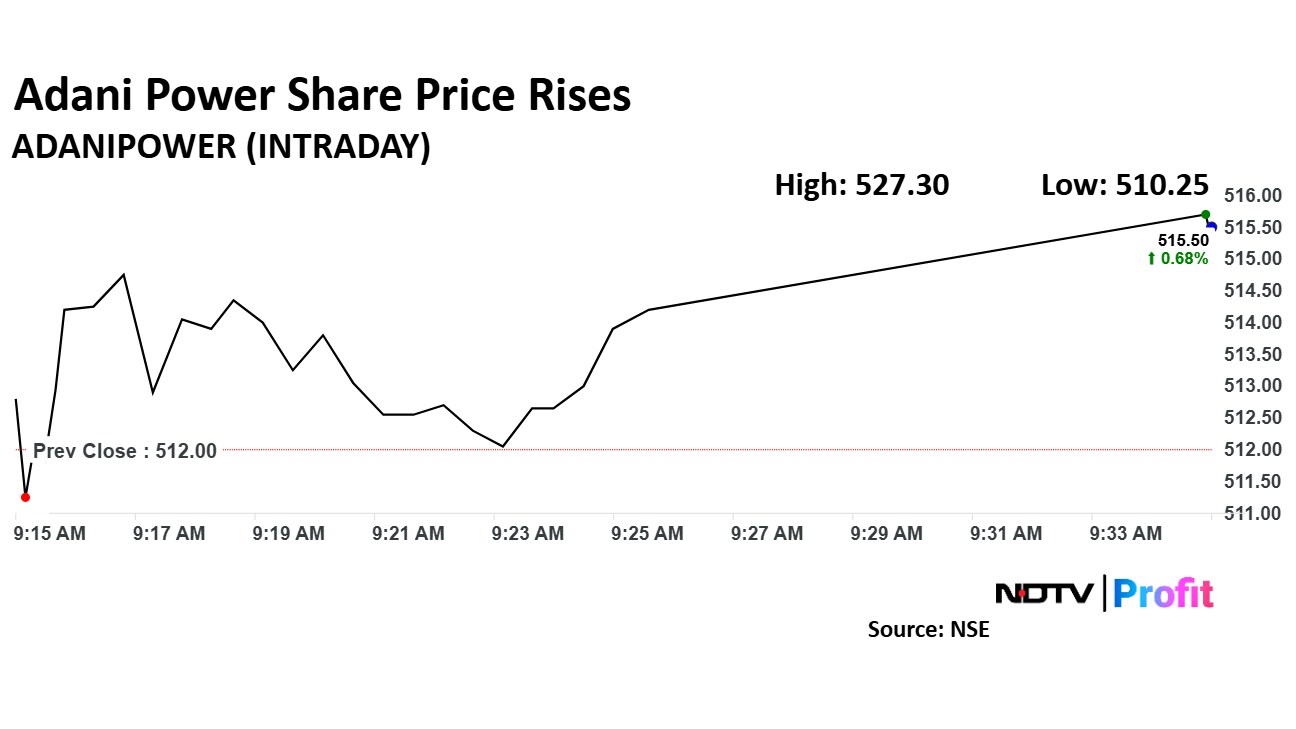

Adani Power Share Price

Adani Power shares rose 0.84% to Rs 516.30 apiece. They were trading 0.68% higher at Rs 515.50 apiece as of 9:36 a.m., as compared to a 0.68% advance in the NSE Nifty 50.

The stock declined 2.63% in 12 months, and 2.98% on year-to-date basis. The relative strength index was at 57.86.

Four analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 20.7%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.