Shares of Adani Green Energy Ltd. rose over 4% on Thursday after Macquarie Equity Research initiated an 'outperform' rating with the bull case implying a 200% upside from the current level.

However, it has set a scenario-weighted target price of Rs 1,200, and a bull-case target price of Rs 2,600 if the company successfully meets its targets.

The company's strong growth potential, robust cash flow generation, and ability to manage debt make it a compelling investment. With a solid renewable energy expansion plan, Adani Green Energy is well-positioned to lead India's energy transition, said the brokerage.

The rating comes on the back of the company's plan to expand its capacity from 12GW currently to 50GW by financial year 2030. This ambitious growth plan aligns with India's broader goal to triple its renewable energy capacity to 500GW by financial year 2030.

This follows an upgrade for two restricted group bonds of Adani Green Energy to 'overweight' from JPMorgan. The rating has been raised for Adani Renewable Energy RJ Ltd. bond maturing in 2039; and Adani Green Energy bond maturing in 2042. Before this upgrade, the two bonds were rated as neutral.

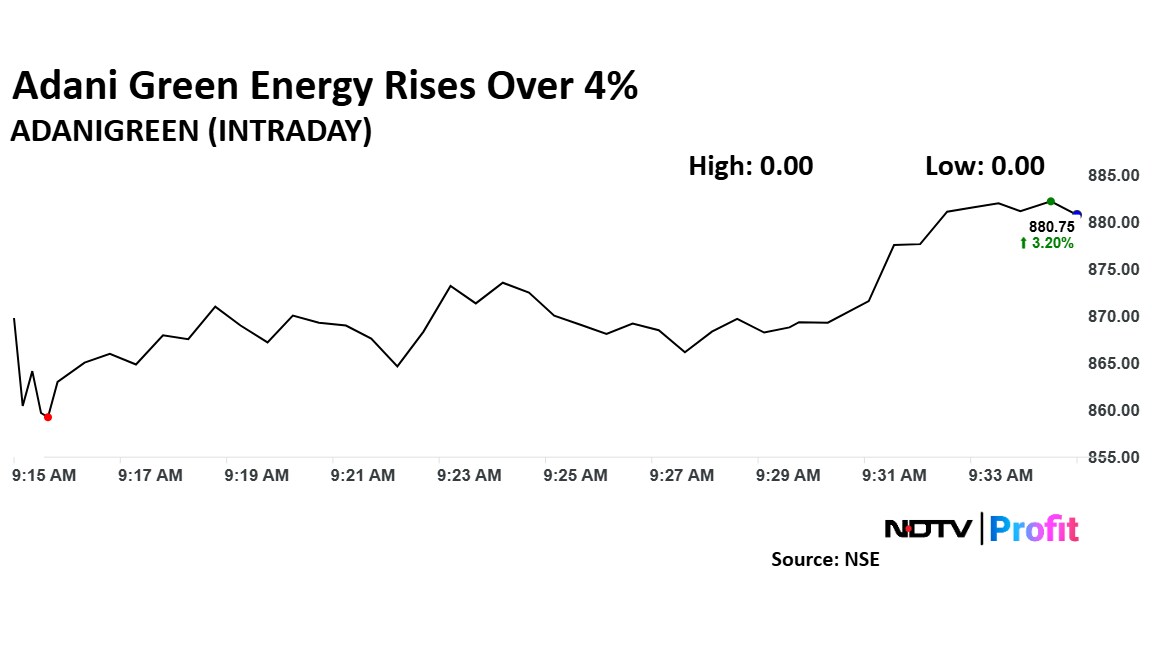

Adani Green Energy Share Price

The scrip rose as much as 4.35% to Rs 890.55 apiece, the highest level since Feb. 18. It pared gains to trade 3.38% higher at Rs 882.30 apiece, as of 10:09 a.m. This compares to a 0.32% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 52.

Out of five analysts tracking the company, four maintain a 'buy' rating, and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 44.1%.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.