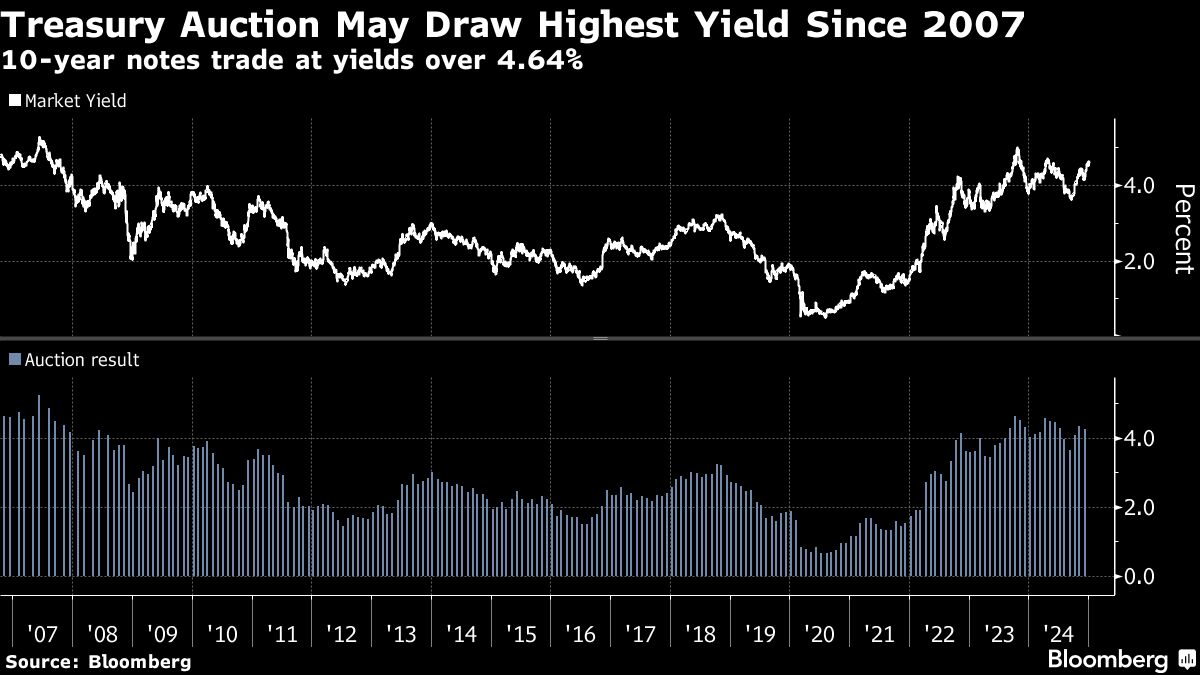

The bond market selloff that's lifted long-maturity Treasury yields to the highest levels in months stands to reward buyers at Tuesday's auction of 10-year notes with the juiciest yield in 17 years.

While the yield on 10-year notes hit as much as 5% in late 2023, the current yield of 4.64% — if it holds through the 1 p.m. sale — would be the highest for newly auctioned securities since August 2007. In the post-pandemic period, 10-year auctions drew yields under 1%.

While Treasury yields were little changed in early US trading Tuesday, the 10-year note's briefly topped 4.64%, the highest level since May, while the 30-year bond's exceeded 4.87% for the first time in more than a year. Barring a big rally in the meantime, a 30-year bond auction on Wednesday stands to draw the highest yield since 2007 as well.

Treasury yields are rising — the 10-year note's was under 4.2% a month ago — amid signs of economic resilience and sticky inflation after three Federal Reserve interest-rate cuts last year, as well as projected growth in borrowing needs. It's part of a global trend that drove UK 30-year yields to the highest level since 1998 on Tuesday.

“There's still concern about elevated inflation risks that has created more of a term premium, there's concern about these budget deficits needing to be financed, and there's been a shift from last year that's leading to more of a focus now on a soft landing — or no landing — as opposed to a hard landing,” said Michael Cloherty, head of US rates strategy at UBS Securities.

The US 10-year auction is a reopening, meaning it creates more of a 10-year note that came into existence in November and has a fixed interest rate of 4.25%. The highest fixed interest rate for 10-year notes in recent years was 4.5%.

Still, the auction result will be noteworthy because it suggests that the next new 10-year note — which will debut in February — could wind up with the highest fixed rate in nearly two decades.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.